Ocuphire Corporate Presentation Mina Sooch CEO January 5, 2022 Exhibit 99.2

Disclosures And Forward-Looking Statements This presentation contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning Ocuphire Pharma, Inc.’s (“Ocuphire” or the “Company”) product candidates and future milestones,

including the potential for Nyxol to be a “best in class” presbyopia drop. These forward-looking statements are based upon the Company’s current expectations and involve assumptions that may never materialize or may prove to be incorrect.

Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation: (i) timing or ability for the company to

achieve its targeted milestones; (ii) the success and timing of regulatory submissions and pre-clinical and clinical trials; (iii) regulatory requirements or developments; (iv) changes to clinical trial designs and regulatory pathways; (v)

changes in capital resource requirements; (vi) risks related to the inability of the Company to obtain sufficient additional capital to continue to advance its product candidates and its preclinical programs; (vii) legislative, regulatory,

political and economic developments, and (viii) the effects of COVID-19 on clinical programs and business operations. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed

as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors detailed in documents that have been and may be filed by the Company from time to time with the SEC. All

forward-looking statements contained in this presentation speak only as of the date on which they were made. The Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date

on which they were made. The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained in or incorporated by reference into this presentation. Nothing contained in or

incorporated by reference into this presentation is, or shall be relied upon as, a promise or representation by the Company as to the past or future. The Company assumes no responsibility for the accuracy or completeness of any such

information. This presentation may not be reproduced or provided to any other person (other than your advisor) without our prior written consent. By accepting delivery of this presentation, you agree to the foregoing and agree to return this

presentation and any documents related thereto and any copies thereof to us or to destroy the same if you do not make an investment in any securities. The information contain within this presentation shall not, except as hereinafter provided,

without the prior written consent of the Company, be disclosed by you or your representatives in any manner whatsoever, in whole or in part, and shall not be used by you or your representatives other than for the purpose of evaluating the

transaction described herein. By accepting delivery of this presentation you further acknowledge and agree you are aware of the restrictions imposed by the United States securities laws on the purchase or sale of securities by any person who

has received material, nonpublic information from the issuer of the securities or any affiliate thereof and on the communication of such information to any other person when it is reasonably foreseeable that such other person is likely to

purchase or sell such securities in reliance on such information for so long as the information remains material and non-public. This presentation also contains estimates and other statistical data made by independent parties and by us relating

to market shares and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The trademarks included herein are the property of the owners

thereof and are used for reference purposes only. Such use should not be construed as an endorsement of such products. November 6, 2020

Differentiated, Late-Stage Pipeline Targeting Large Unmet Ophthalmic Markets Of The Front And Back Of

The EyeNyxol with > 330 patients treated across 9 trials (505(b)(2) regulatory pathway)APX3330 with > 340 patients treated across 11 trials (NCE development pathway)Nyxol and APX3330 achieved promising clinical data and favorable safety

profile across multiple Phase 1, 2, and 3 trialsPoised For Commercial SuccessAddressing 4 large markets with unmet needs: RM, Presbyopia, NVD and DR/DMESuccessful trial execution with 2 recent positive Phase 3 & Phase 2 data read-outs for

Nyxol in RM and Nyxol + LDP Presbyopia, respectivelyStable, small-molecule drugs with commercial scalabilityRobust and growing IP portfolio: US and global issued thru 2034 for both assets as well as new 2039 Nyxol patent issued for

presbyopiaMultiple Value Creation Opportunities With A Capital-efficient Plan$24.5 million cash reported at 12-31-21 sufficient for operations into 2Q 2023Lower-cost, fast-enrolling, shorter-duration clinical trialsFavorable, precedent

regulatory environment for ophthalmic drug approvalAnalyst coverage by Cantor, Canaccord, Jones Trading, Alliance Global, and HCW A Look Ahead Into 2022:Nyxol MIRA-3 trial for RM EARLY 2022Nyxol Pediatric trial for RM EARLY 2022Nyxol LYNX-1

trial for NVD EARLY 2022APX3330 ZETA-1 trial for DR/DME 2H22 Ocuphire PharmaNasdaq: OCUP RM = Reversal of Mydriasis NVD = Night Vision DisturbancesDR/DME = Diabetic Retinopathy/Diabetic Macular Edema 3

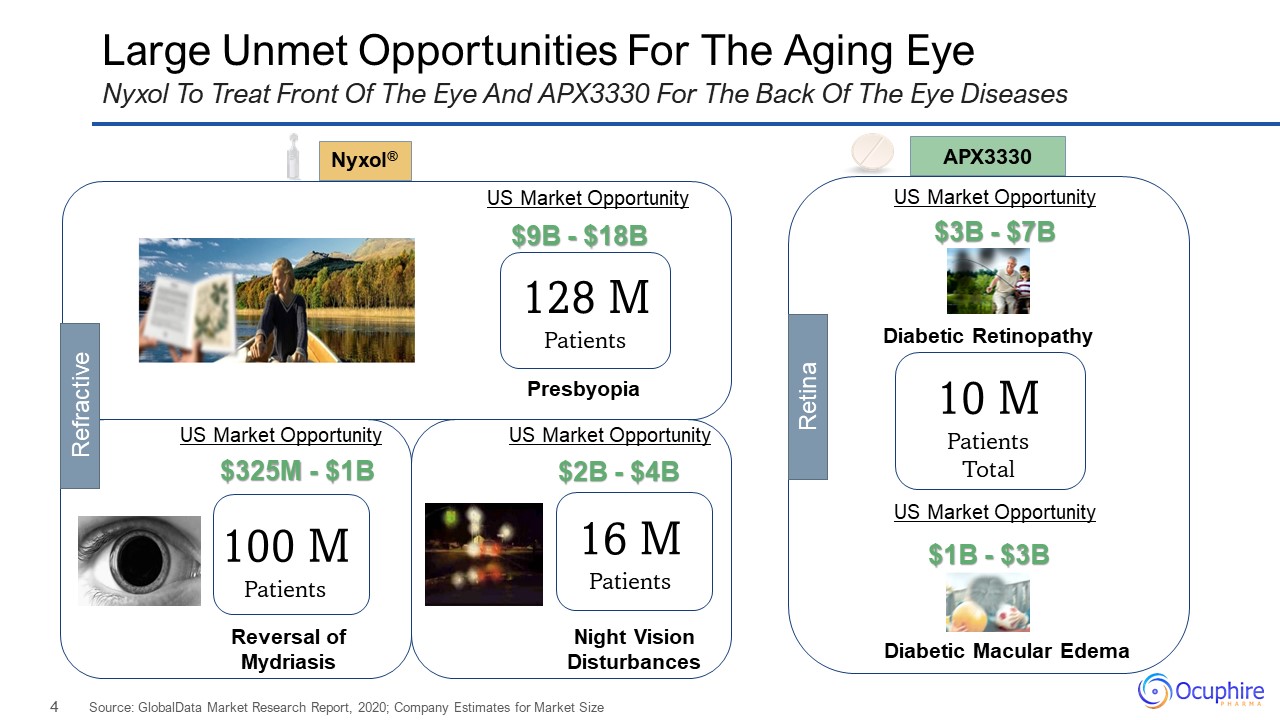

Large Unmet Opportunities For The Aging Eye Nyxol To Treat Front Of The Eye And APX3330 For The Back Of

The Eye Diseases Nyxol® $9B - $18B $325M - $1B $2B - $4B $3B - $7B $1B - $3B APX3330 128 MPatients 100 MPatients 16 MPatients Presbyopia Reversal of Mydriasis Night Vision Disturbances Diabetic Retinopathy Diabetic

Macular Edema Presbyopia 10 MPatientsTotal US Market Opportunity US Market Opportunity US Market Opportunity US Market Opportunity US Market Opportunity Refractive Retina Source: GlobalData Market Research Report, 2020; Company

Estimates for Market Size

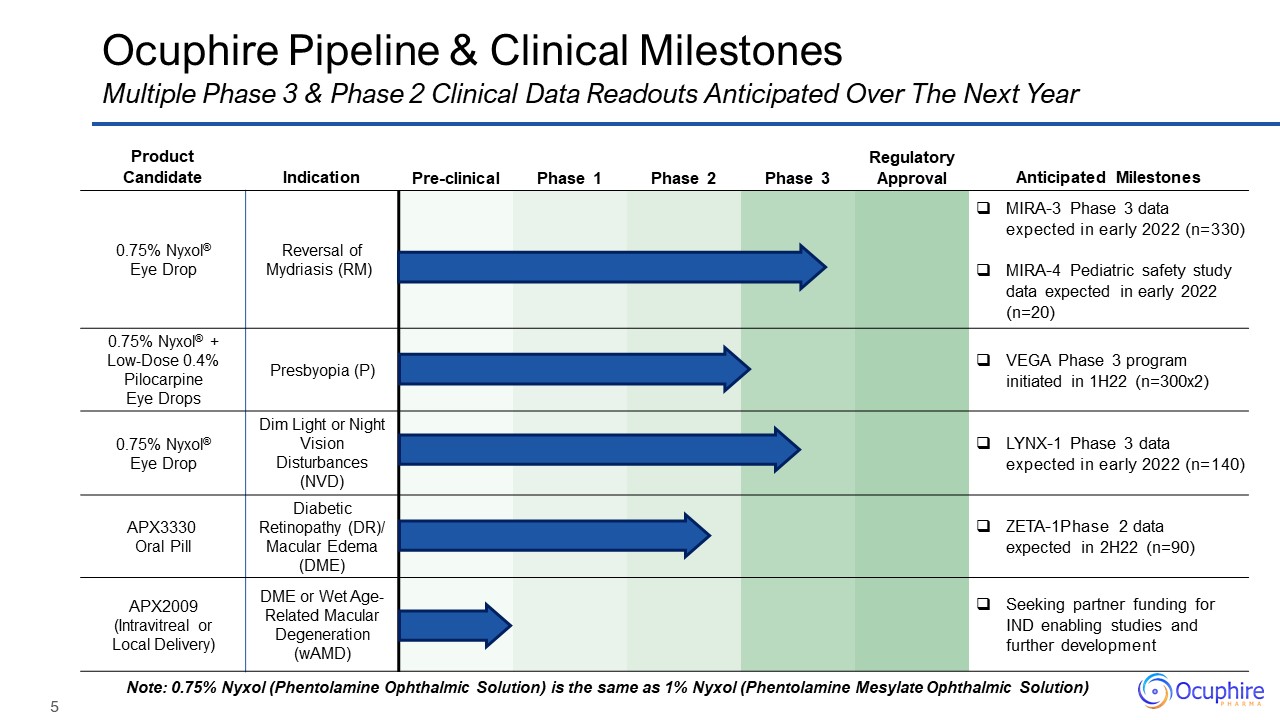

Ocuphire Pipeline & Clinical Milestones Note: 0.75% Nyxol (Phentolamine Ophthalmic Solution) is

the same as 1% Nyxol (Phentolamine Mesylate Ophthalmic Solution) Product Candidate Indication Pre-clinical Phase 1 Phase 2 Phase 3 RegulatoryApproval Anticipated Milestones 0.75% Nyxol®Eye Drop Reversal of Mydriasis

(RM) MIRA-3 Phase 3 data expected in early 2022 (n=330)MIRA-4 Pediatric safety study data expected in early 2022 (n=20) 0.75% Nyxol® + Low-Dose 0.4% Pilocarpine Eye Drops Presbyopia (P) VEGA Phase 3 program initiated in

1H22 (n=300x2) 0.75% Nyxol®Eye Drop Dim Light or Night Vision Disturbances (NVD) LYNX-1 Phase 3 data expected in early 2022 (n=140) APX3330 Oral Pill Diabetic Retinopathy (DR)/ Macular Edema (DME) ZETA-1Phase 2 data

expected in 2H22 (n=90) APX2009 (Intravitreal or Local Delivery) DME or Wet Age-Related Macular Degeneration (wAMD) Seeking partner funding for IND enabling studies and further development Multiple Phase 3 & Phase 2

Clinical Data Readouts Anticipated Over The Next Year

6 RM Reversal of Mydriasis P NVD Presbyopia Night Vision Disturbance 0.4%

+ Nyxol®Eye Drops

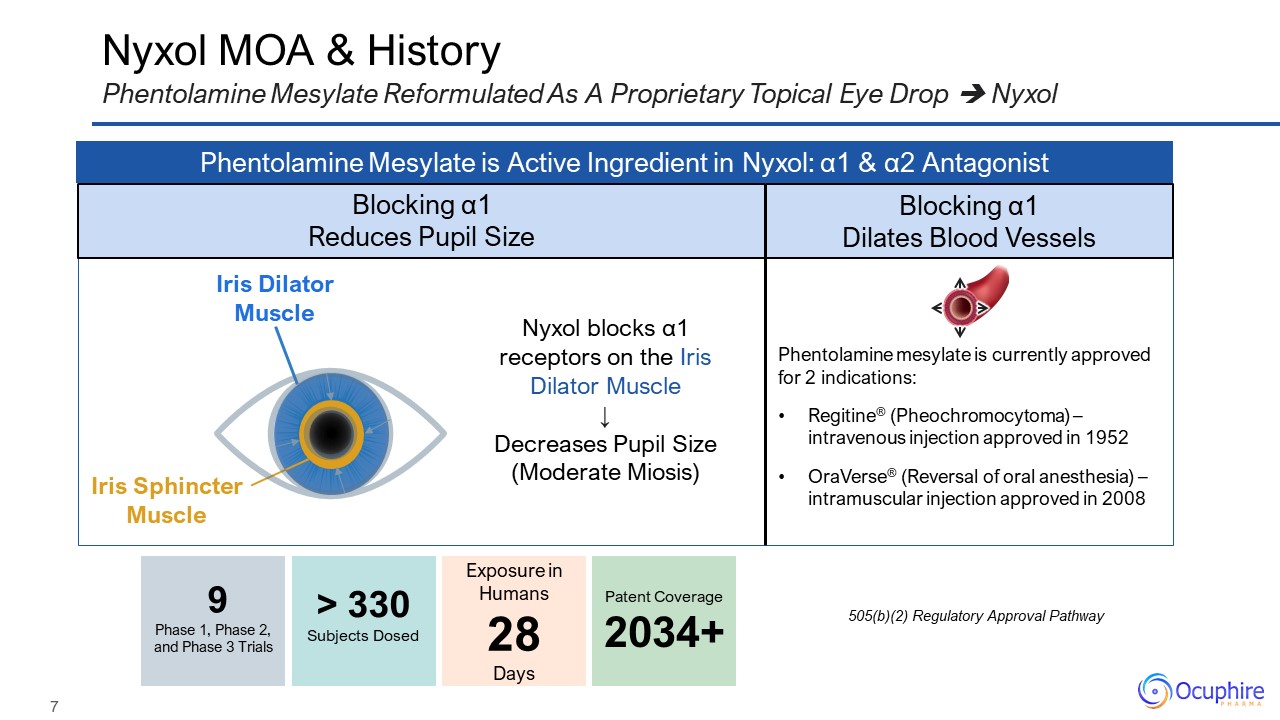

Nyxol MOA & History Phentolamine Mesylate Reformulated As A Proprietary Topical Eye Drop

Nyxol Phentolamine Mesylate is Active Ingredient in Nyxol: α1 & α2 Antagonist Blocking α1Reduces Pupil Size Blocking α1Dilates Blood Vessels Phentolamine mesylate is currently approved for 2 indications:Regitine® (Pheochromocytoma) –

intravenous injection approved in 1952OraVerse® (Reversal of oral anesthesia) – intramuscular injection approved in 2008 505(b)(2) Regulatory Approval Pathway Nyxol blocks α1 receptors on the Iris Dilator Muscle↓Decreases Pupil Size (Moderate

Miosis) Iris Dilator Muscle Iris Sphincter Muscle 9Phase 1, Phase 2, and Phase 3 Trials > 330Subjects Dosed Exposure in Humans28Days Patent Coverage2034+

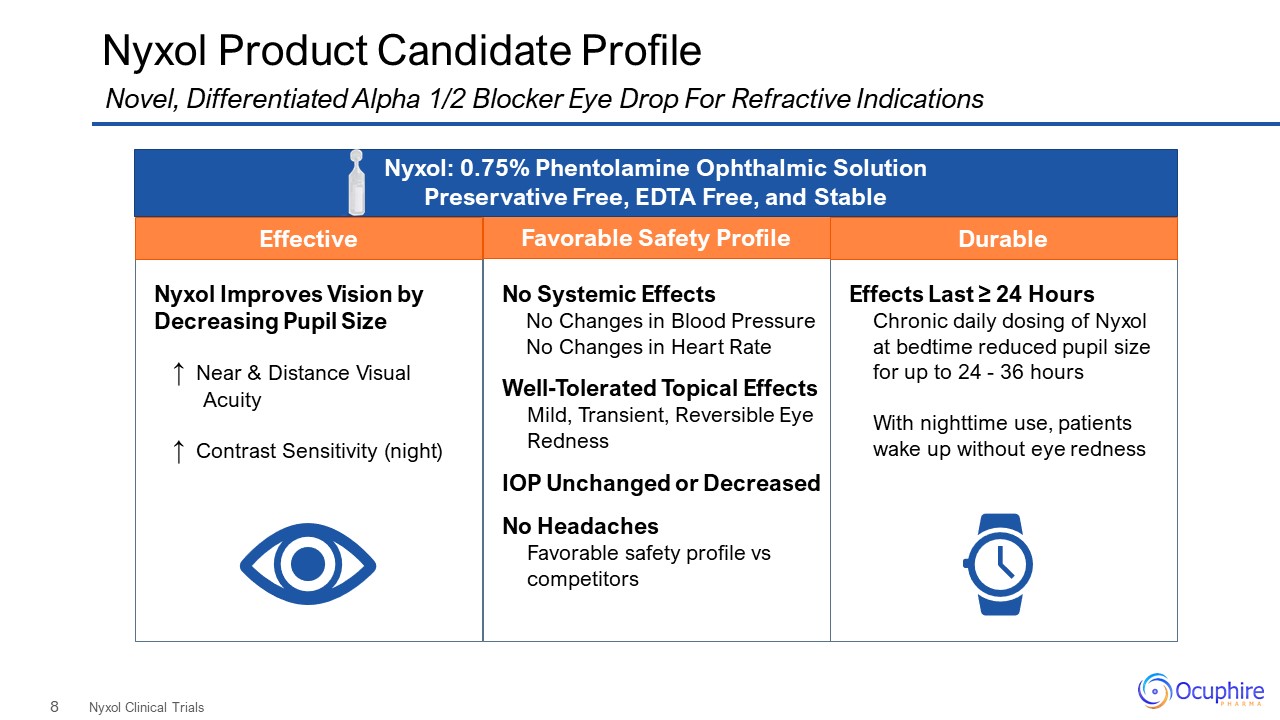

Nyxol Improves Vision by Decreasing Pupil Size↑ Near & Distance Visual Acuity↑ Contrast Sensitivity

(night) No Systemic EffectsNo Changes in Blood PressureNo Changes in Heart RateWell-Tolerated Topical EffectsMild, Transient, Reversible Eye RednessIOP Unchanged or DecreasedNo Headaches Favorable safety profile vs competitors Nyxol Product

Candidate Profile Nyxol Clinical Trials Novel, Differentiated Alpha 1/2 Blocker Eye Drop For Refractive Indications Favorable Safety Profile Effective Nyxol: 0.75% Phentolamine Ophthalmic SolutionPreservative Free, EDTA Free, and

Stable Effects Last ≥ 24 HoursChronic daily dosing of Nyxol at bedtime reduced pupil size for up to 24 - 36 hoursWith nighttime use, patients wake up without eye redness Durable

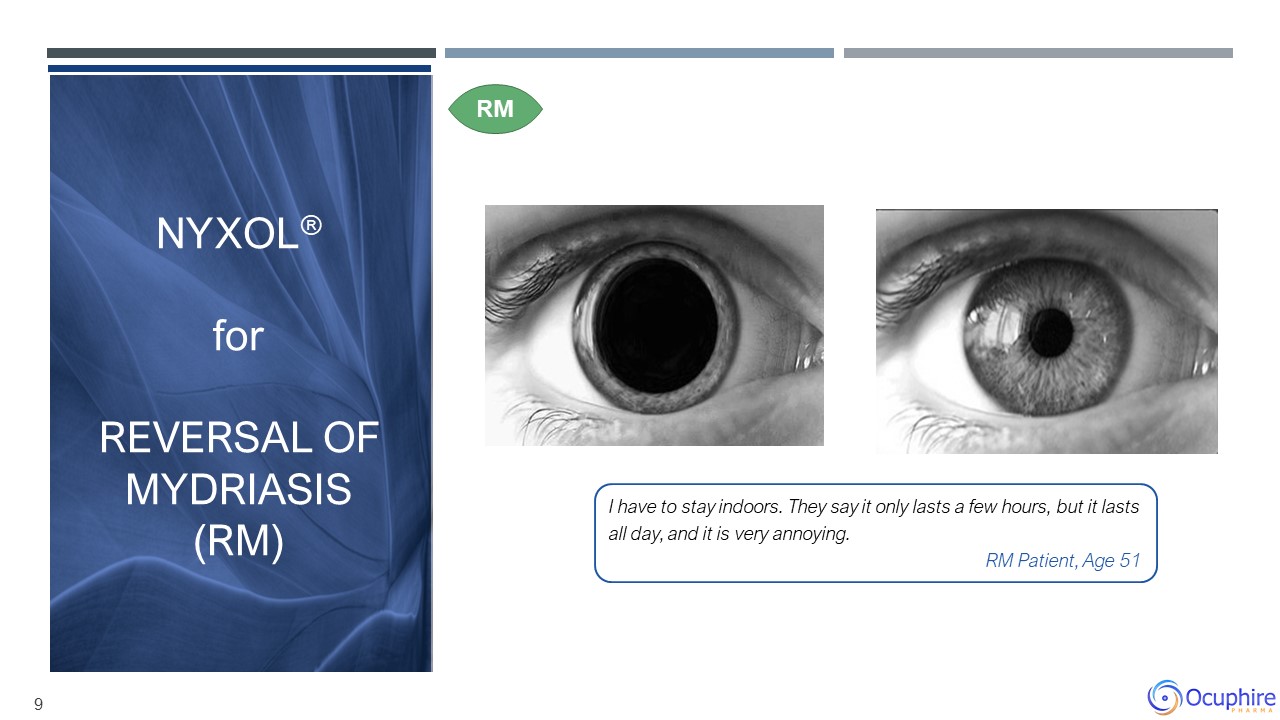

I have to stay indoors. They say it only lasts a few hours, but it lasts all day, and it is very

annoying.RM Patient, Age 51 RM 9 Nyxol®forReversal of Mydriasis (RM)

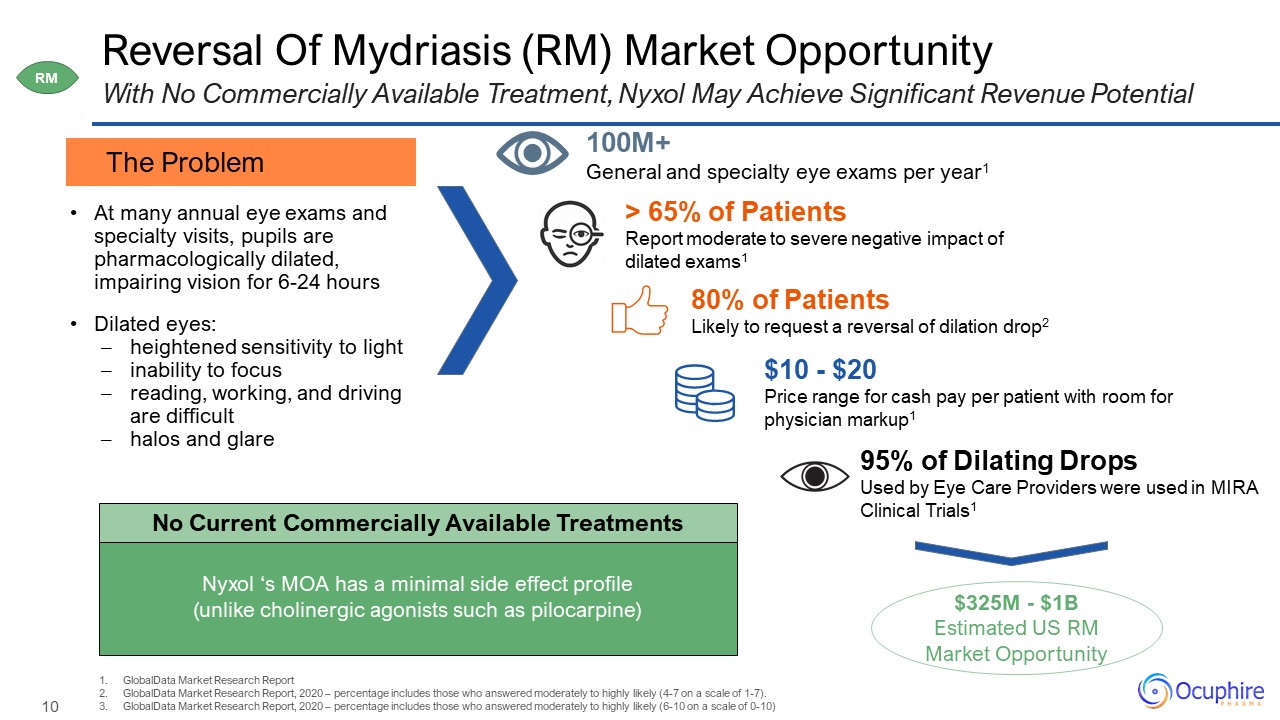

Reversal Of Mydriasis (RM) Market Opportunity With No Commercially Available Treatment, Nyxol May

Achieve Significant Revenue Potential > 65% of PatientsReport moderate to severe negative impact of dilated exams1 $10 - $20Price range for cash pay per patient with room for physician markup1 100M+General and specialty eye exams per

year1 GlobalData Market Research ReportGlobalData Market Research Report, 2020 – percentage includes those who answered moderately to highly likely (4-7 on a scale of 1-7).GlobalData Market Research Report, 2020 – percentage includes those who

answered moderately to highly likely (6-10 on a scale of 0-10) Nyxol ‘s MOA has a minimal side effect profile (unlike cholinergic agonists such as pilocarpine) $325M - $1BEstimated US RM Market Opportunity At many annual eye exams and

specialty visits, pupils are pharmacologically dilated, impairing vision for 6-24 hoursDilated eyes:heightened sensitivity to light inability to focus reading, working, and driving are difficult halos and glare 80% of PatientsLikely to request

a reversal of dilation drop2 The Problem 95% of Dilating DropsUsed by Eye Care Providers were used in MIRA Clinical Trials1 No Current Commercially Available Treatments RM

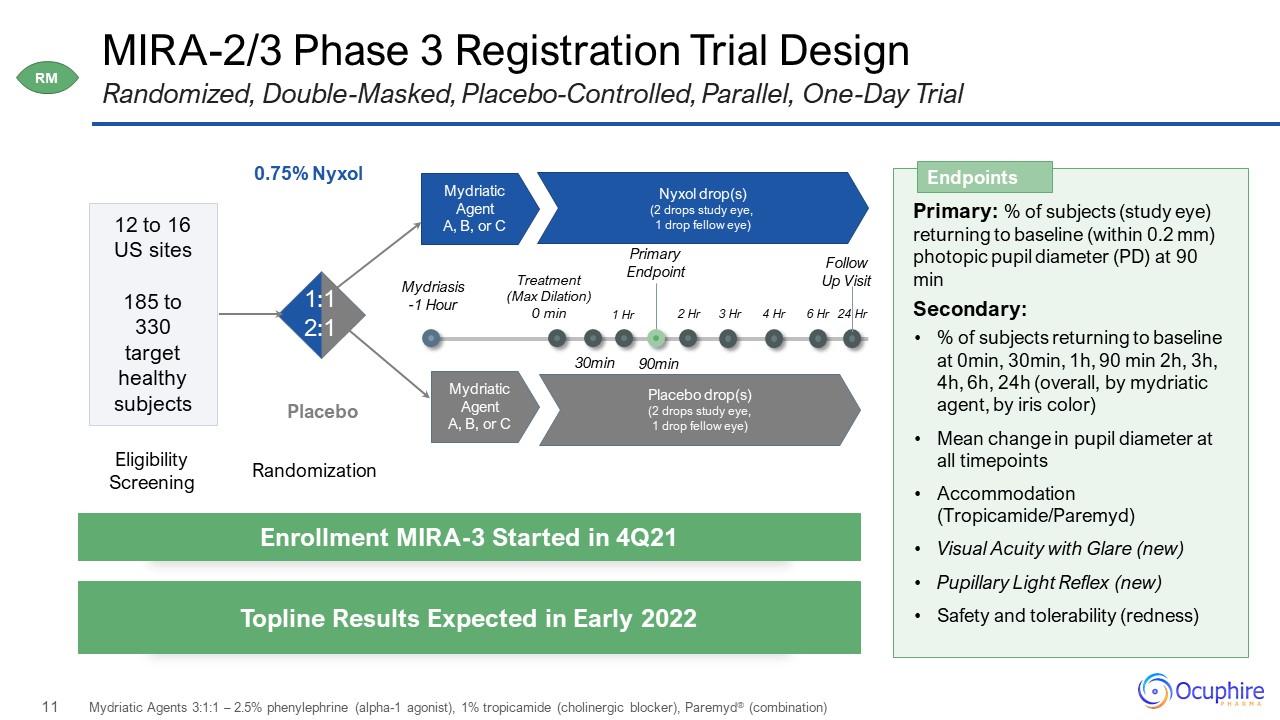

MIRA-2/3 Phase 3 Registration Trial Design Randomized, Double-Masked, Placebo-Controlled, Parallel,

One-Day Trial Mydriasis-1 Hour 1:1 Mydriatic Agent A, B, or C 0.75% Nyxol Placebo 12 to 16 US sites185 to 330target healthy subjects Nyxol drop(s)(2 drops study eye, 1 drop fellow eye) Mydriatic Agent A, B, or C Placebo drop(s)(2

drops study eye, 1 drop fellow eye) Primary: % of subjects (study eye) returning to baseline (within 0.2 mm) photopic pupil diameter (PD) at 90 minSecondary:% of subjects returning to baseline at 0min, 30min, 1h, 90 min 2h, 3h, 4h, 6h, 24h

(overall, by mydriatic agent, by iris color)Mean change in pupil diameter at all timepoints Accommodation (Tropicamide/Paremyd)Visual Acuity with Glare (new) Pupillary Light Reflex (new)Safety and tolerability (redness) Endpoints Enrollment

MIRA-3 Started in 4Q21 Topline Results Expected in Early 2022 Eligibility Screening Randomization 1:12:1 Treatment (Max Dilation)0 min 30min 1 Hr 90min 2 Hr 3 Hr 4 Hr 6 Hr 24 Hr Primary Endpoint Follow Up

Visit Mydriatic Agents 3:1:1 – 2.5% phenylephrine (alpha-1 agonist), 1% tropicamide (cholinergic blocker), Paremyd® (combination) RM

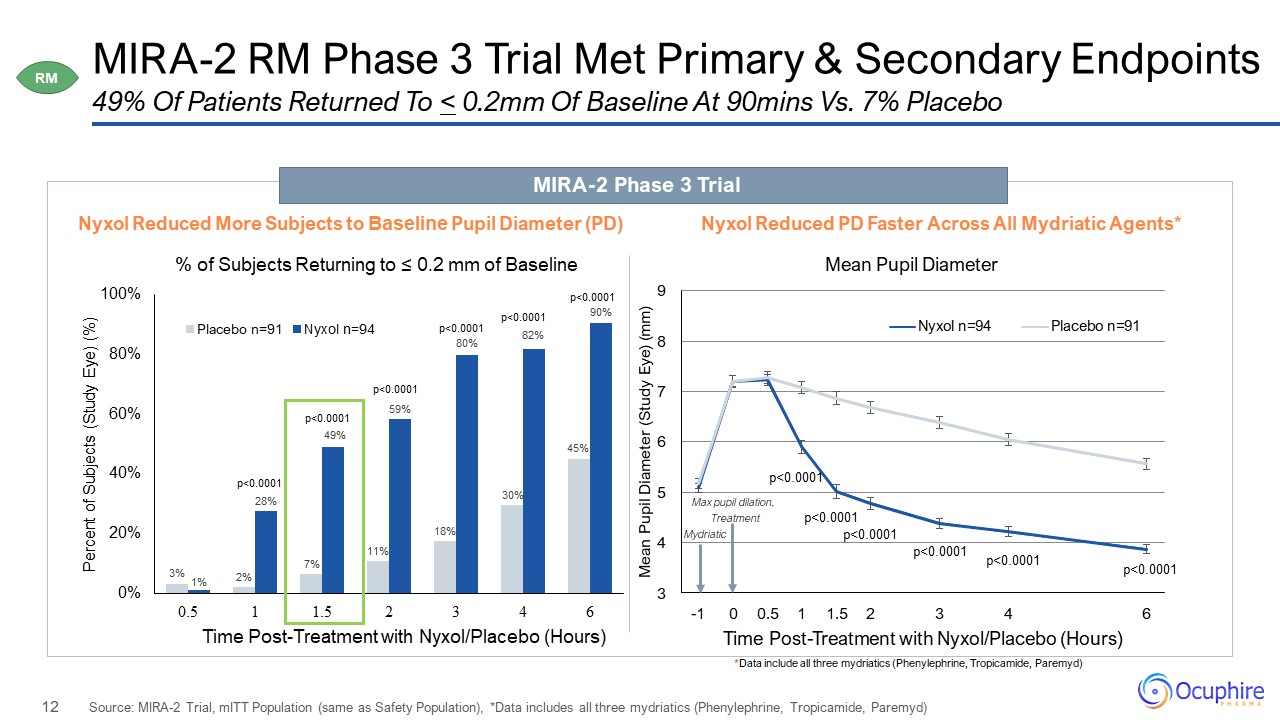

MIRA-2 RM Phase 3 Trial Met Primary & Secondary Endpoints Source: MIRA-2 Trial, mITT Population

(same as Safety Population), *Data includes all three mydriatics (Phenylephrine, Tropicamide, Paremyd) 49% Of Patients Returned To < 0.2mm Of Baseline At 90mins Vs. 7% Placebo Max pupil dilation,

Treatment Mydriatic p<0.0001 p<0.0001 p<0.0001 p<0.0001 p<0.0001 Nyxol Reduced More Subjects to Baseline Pupil Diameter (PD) Nyxol Reduced PD Faster Across All Mydriatic Agents* MIRA-2 Phase 3 Trial *Data include all

three mydriatics (Phenylephrine, Tropicamide, Paremyd) p<0.0001 RM

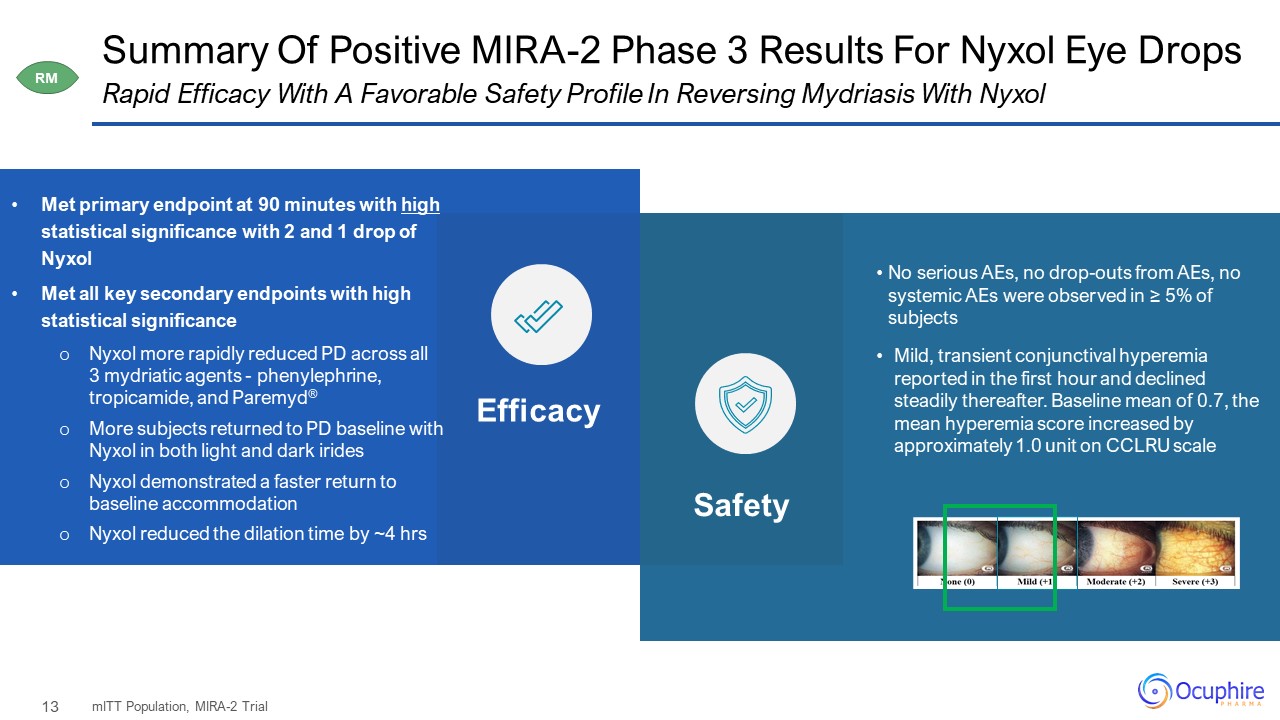

Summary Of Positive MIRA-2 Phase 3 Results For Nyxol Eye Drops mITT Population, MIRA-2 Trial Rapid

Efficacy With A Favorable Safety Profile In Reversing Mydriasis With Nyxol No serious AEs, no drop-outs from AEs, no systemic AEs were observed in ≥ 5% of subjectsMild, transient conjunctival hyperemia reported in the first hour and

declined steadily thereafter. Baseline mean of 0.7, the mean hyperemia score increased by approximately 1.0 unit on CCLRU scale Efficacy Safety Met primary endpoint at 90 minutes with high statistical significance with 2 and 1 drop

of NyxolMet all key secondary endpoints with high statistical significanceNyxol more rapidly reduced PD across all 3 mydriatic agents - phenylephrine, tropicamide, and Paremyd® More subjects returned to PD baseline with Nyxol in both light and

dark irides Nyxol demonstrated a faster return to baseline accommodationNyxol reduced the dilation time by ~4 hrs RM

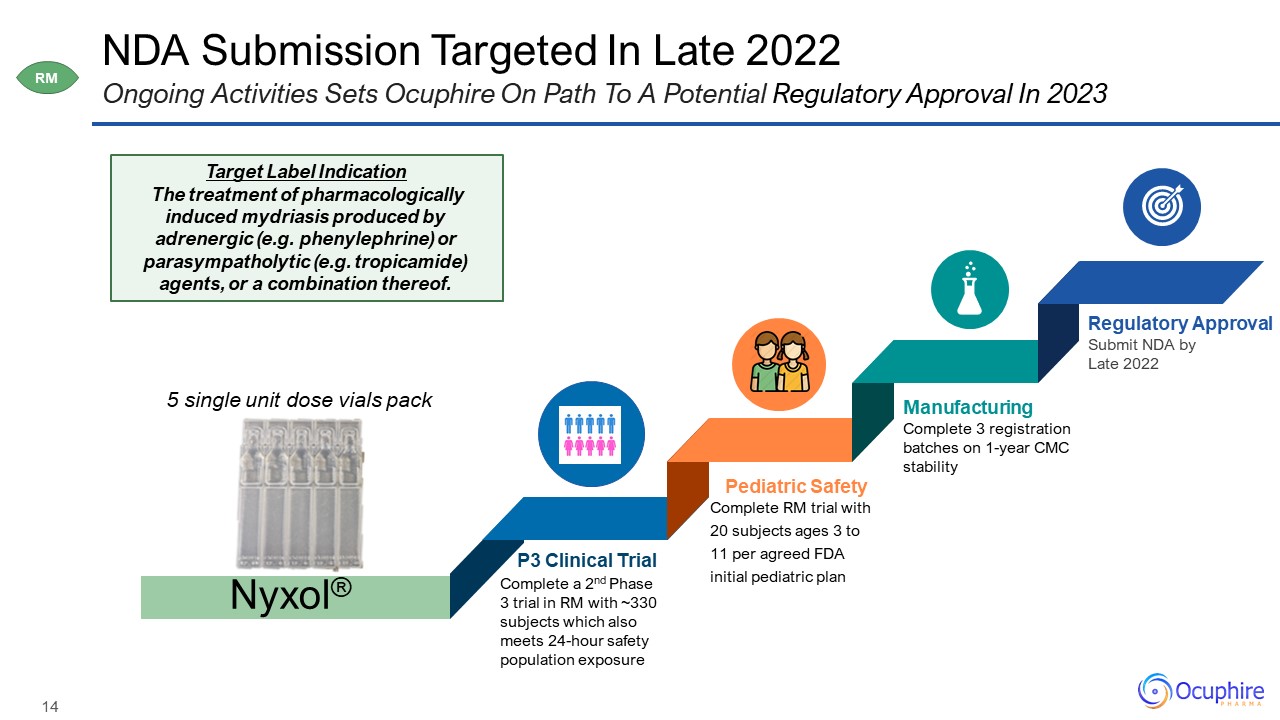

NDA Submission Targeted In Late 2022 Ongoing Activities Sets Ocuphire On Path To A Potential

Regulatory Approval In 2023 Complete RM trial with 20 subjects ages 3 to 11 per agreed FDA initial pediatric plan Pediatric Safety Complete a 2nd Phase 3 trial in RM with ~330 subjects which also meets 24-hour safety population

exposure P3 Clinical Trial Complete 3 registration batches on 1-year CMC stability Manufacturing Submit NDA by Late 2022 Regulatory Approval Nyxol® Target Label Indication The treatment of pharmacologically

induced mydriasis produced by adrenergic (e.g. phenylephrine) or parasympatholytic (e.g. tropicamide) agents, or a combination thereof. RM 5 single unit dose vials pack

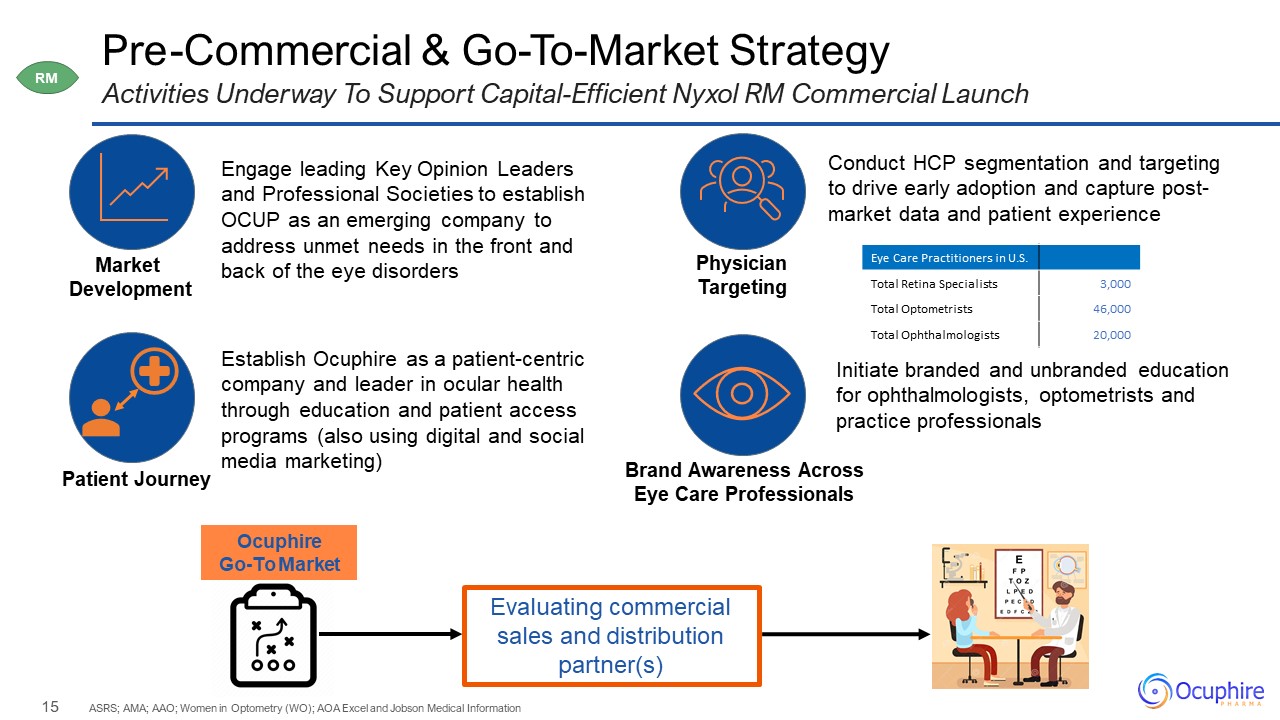

Pre-Commercial & Go-To-Market Strategy Activities Underway To Support Capital-Efficient Nyxol RM

Commercial Launch Brand Awareness Across Eye Care Professionals PhysicianTargeting Patient Journey Market Development Engage leading Key Opinion Leaders and Professional Societies to establish OCUP as an emerging company to

address unmet needs in the front and back of the eye disorders Establish Ocuphire as a patient-centric company and leader in ocular health through education and patient access programs (also using digital and social media marketing) Conduct

HCP segmentation and targeting to drive early adoption and capture post-market data and patient experience Initiate branded and unbranded education for ophthalmologists, optometrists and practice professionals Eye Care Practitioners in

U.S. Total Retina Specialists 3,000 Total Optometrists 46,000 Total Ophthalmologists 20,000 OcuphireGo-To Market Evaluating commercial sales and distribution partner(s) ASRS; AMA; AAO; Women in Optometry (WO); AOA Excel and

Jobson Medical Information RM

P 16 Nyxol® forPRESBYOPIA “By Age 45, 80% of Americans will struggle with Presbyopia, and by age

50, nearly everyone will.” NY Times

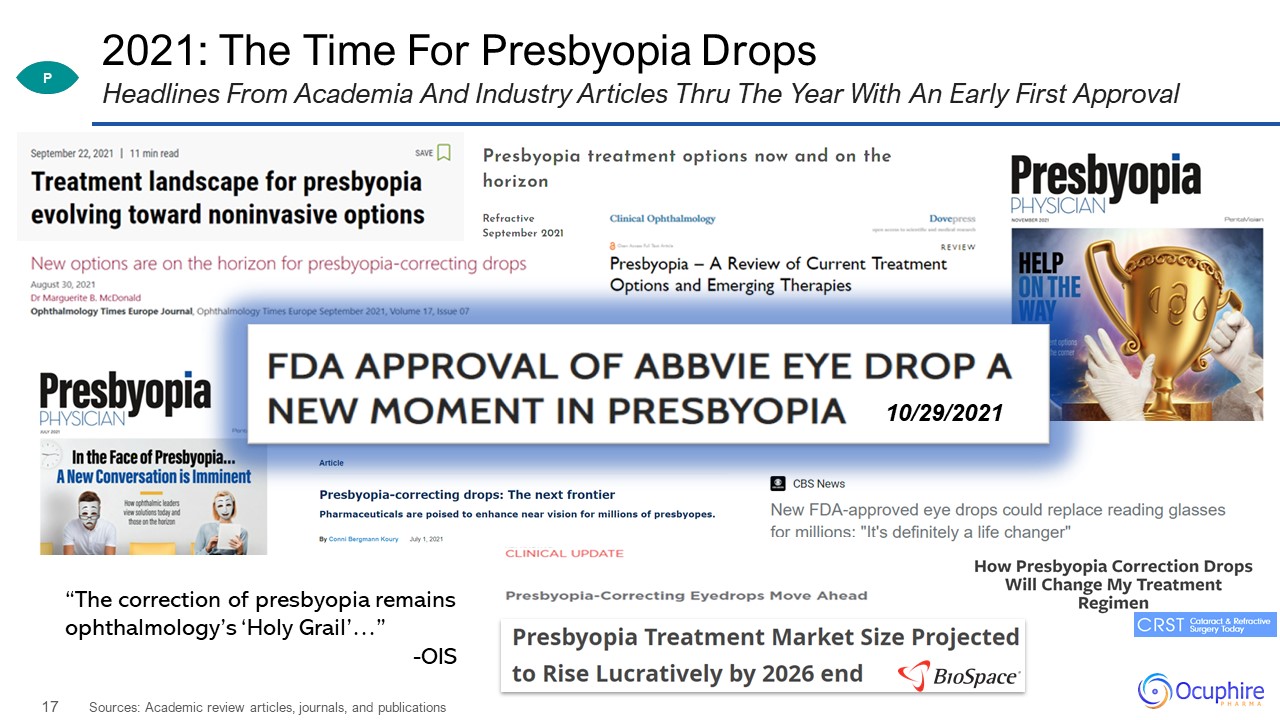

2021: The Time For Presbyopia Drops Sources: Academic review articles, journals, and

publications Headlines From Academia And Industry Articles Thru The Year With An Early First Approval “The correction of presbyopia remains ophthalmology’s ‘Holy Grail’…”-OIS 10/29/2021 P

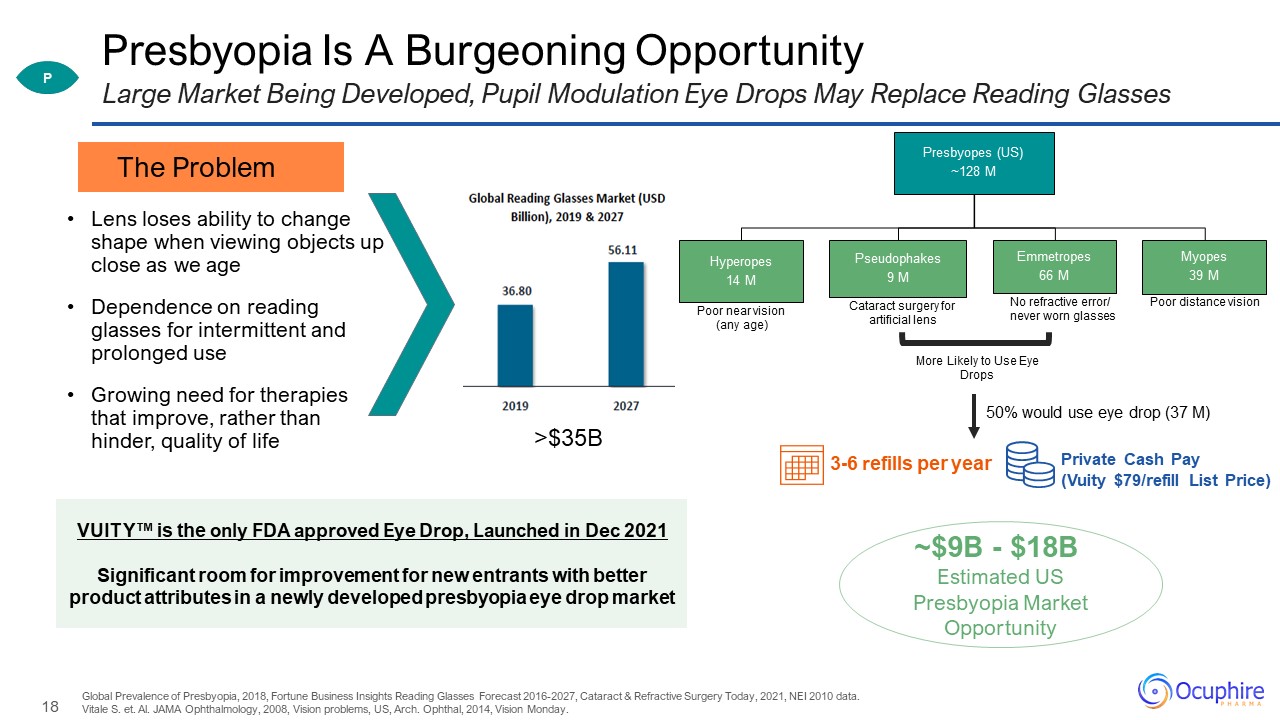

Presbyopia Is A Burgeoning Opportunity Global Prevalence of Presbyopia, 2018, Fortune Business Insights

Reading Glasses Forecast 2016-2027, Cataract & Refractive Surgery Today, 2021, NEI 2010 data.Vitale S. et. Al. JAMA Ophthalmology, 2008, Vision problems, US, Arch. Ophthal, 2014, Vision Monday. Large Market Being Developed, Pupil

Modulation Eye Drops May Replace Reading Glasses ~$9B - $18B Estimated US Presbyopia Market Opportunity VUITY™ is the only FDA approved Eye Drop, Launched in Dec 2021Significant room for improvement for new entrants with better product

attributes in a newly developed presbyopia eye drop market Lens loses ability to change shape when viewing objects up close as we ageDependence on reading glasses for intermittent and prolonged useGrowing need for therapies that improve,

rather than hinder, quality of life The Problem 3-6 refills per year Private Cash Pay(Vuity $79/refill List Price) More Likely to Use Eye Drops No refractive error/ never worn glasses Cataract surgery for artificial lens Poor near

vision (any age) Poor distance vision 50% would use eye drop (37 M) P >$35B

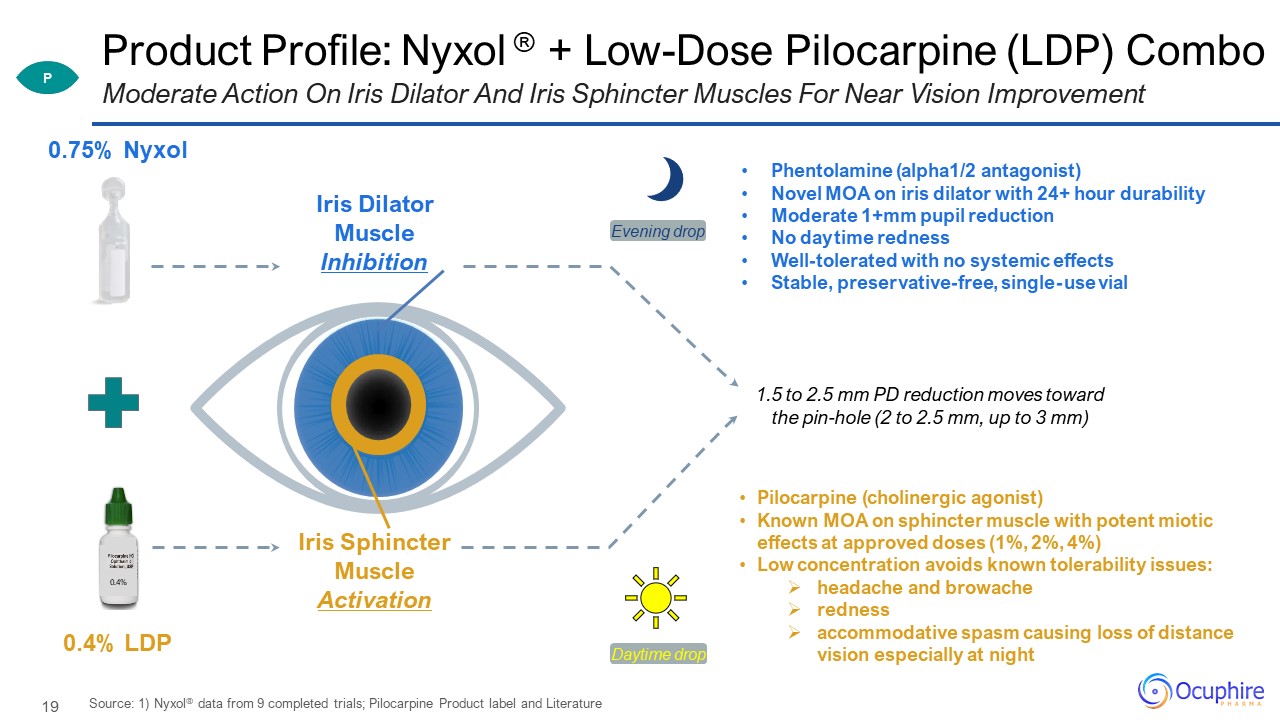

Product Profile: Nyxol ® + Low-Dose Pilocarpine (LDP) Combo Source: 1) Nyxol® data from 9 completed

trials; Pilocarpine Product label and Literature Moderate Action On Iris Dilator And Iris Sphincter Muscles For Near Vision Improvement 0.4% 0.75% Nyxol 0.4% LDP Iris Dilator Muscle Inhibition Iris Sphincter Muscle

Activation Phentolamine (alpha1/2 antagonist)Novel MOA on iris dilator with 24+ hour durabilityModerate 1+mm pupil reductionNo daytime redness Well-tolerated with no systemic effectsStable, preservative-free, single-use vial Pilocarpine

(cholinergic agonist)Known MOA on sphincter muscle with potent miotic effects at approved doses (1%, 2%, 4%)Low concentration avoids known tolerability issues:headache and browacherednessaccommodative spasm causing loss of distance vision

especially at night 1.5 to 2.5 mm PD reduction moves toward the pin-hole (2 to 2.5 mm, up to 3 mm) Daytime drop Evening drop P

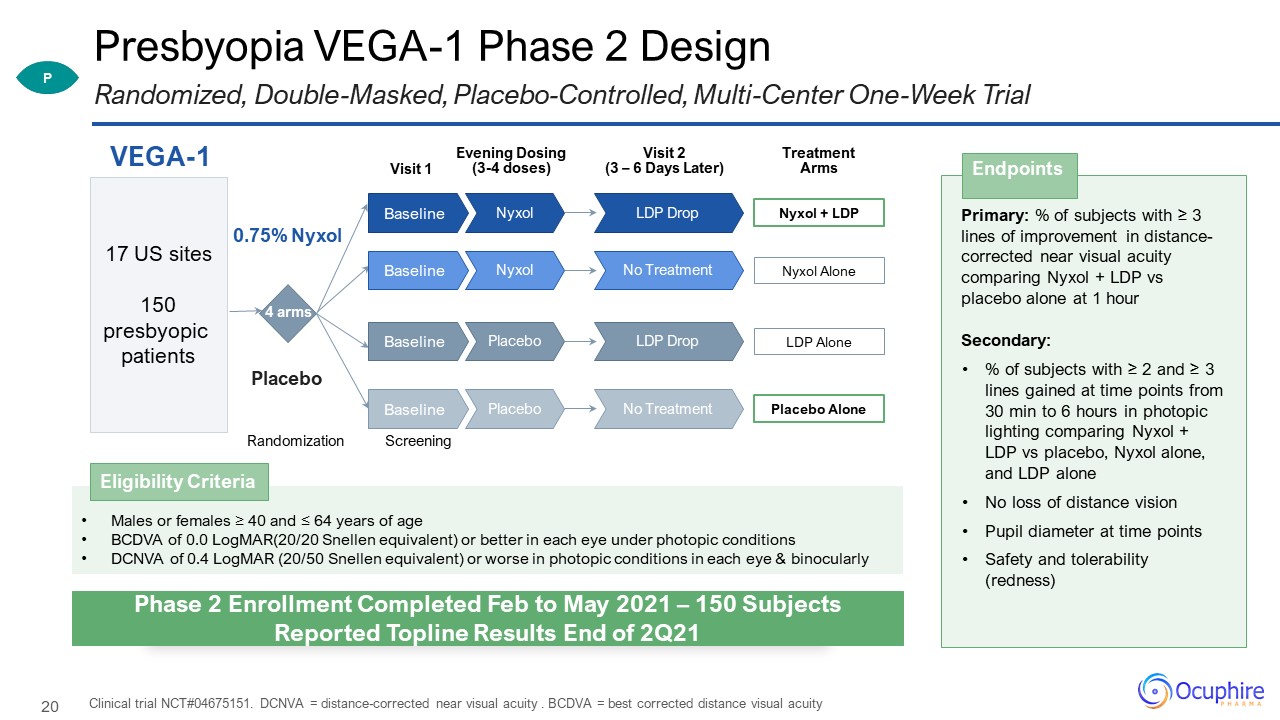

Presbyopia VEGA-1 Phase 2 Design Clinical trial NCT#04675151. DCNVA = distance-corrected near visual

acuity . BCDVA = best corrected distance visual acuity Randomized, Double-Masked, Placebo-Controlled, Multi-Center One-Week Trial Primary: % of subjects with ≥ 3 lines of improvement in distance-corrected near visual acuity comparing Nyxol +

LDP vs placebo alone at 1 hourSecondary:% of subjects with ≥ 2 and ≥ 3 lines gained at time points from 30 min to 6 hours in photopic lighting comparing Nyxol + LDP vs placebo, Nyxol alone, and LDP aloneNo loss of distance vision Pupil diameter

at time pointsSafety and tolerability (redness) Endpoints Visit 1 VEGA-1 Randomization 4 arms 0.75% Nyxol Placebo 17 US sites150 presbyopic patients Visit 2 (3 – 6 Days Later) Screening Treatment Arms Nyxol + LDP LDP

Drop Nyxol Baseline Nyxol Alone No Treatment Nyxol Baseline LDP Alone LDP Drop Placebo Baseline Placebo Alone No Treatment Placebo Baseline Evening Dosing(3-4 doses) Males or females ≥ 40 and ≤ 64 years of ageBCDVA of 0.0

LogMAR(20/20 Snellen equivalent) or better in each eye under photopic conditionsDCNVA of 0.4 LogMAR (20/50 Snellen equivalent) or worse in photopic conditions in each eye & binocularly Eligibility Criteria P Phase 2 Enrollment Completed

Feb to May 2021 – 150 Subjects Reported Topline Results End of 2Q21

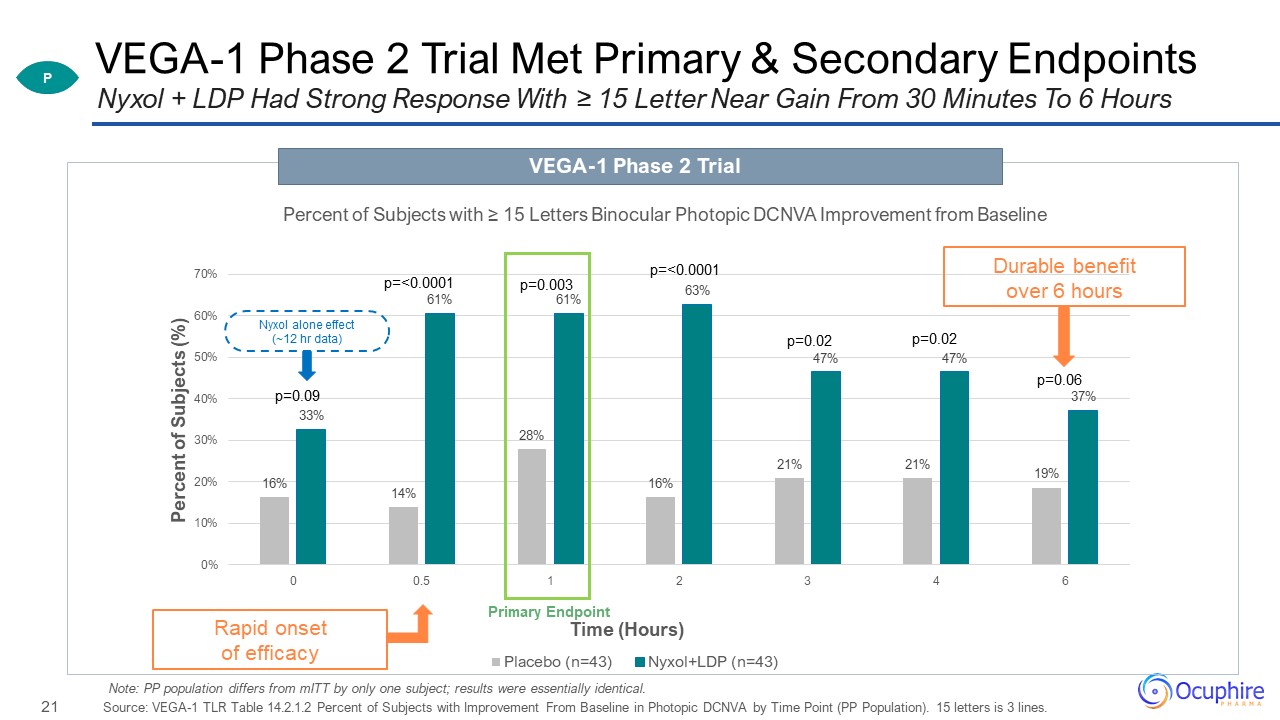

VEGA-1 Phase 2 Trial Met Primary & Secondary Endpoints Source: VEGA-1 TLR Table 14.2.1.2 Percent of

Subjects with Improvement From Baseline in Photopic DCNVA by Time Point (PP Population). 15 letters is 3 lines. Nyxol + LDP Had Strong Response With ≥ 15 Letter Near Gain From 30 Minutes To 6 Hours VEGA-1 Phase 2 Trial Durable benefit over

6 hours Rapid onset of efficacy Nyxol alone effect (~12 hr data) Primary Endpoint P Note: PP population differs from mITT by only one subject; results were essentially identical.

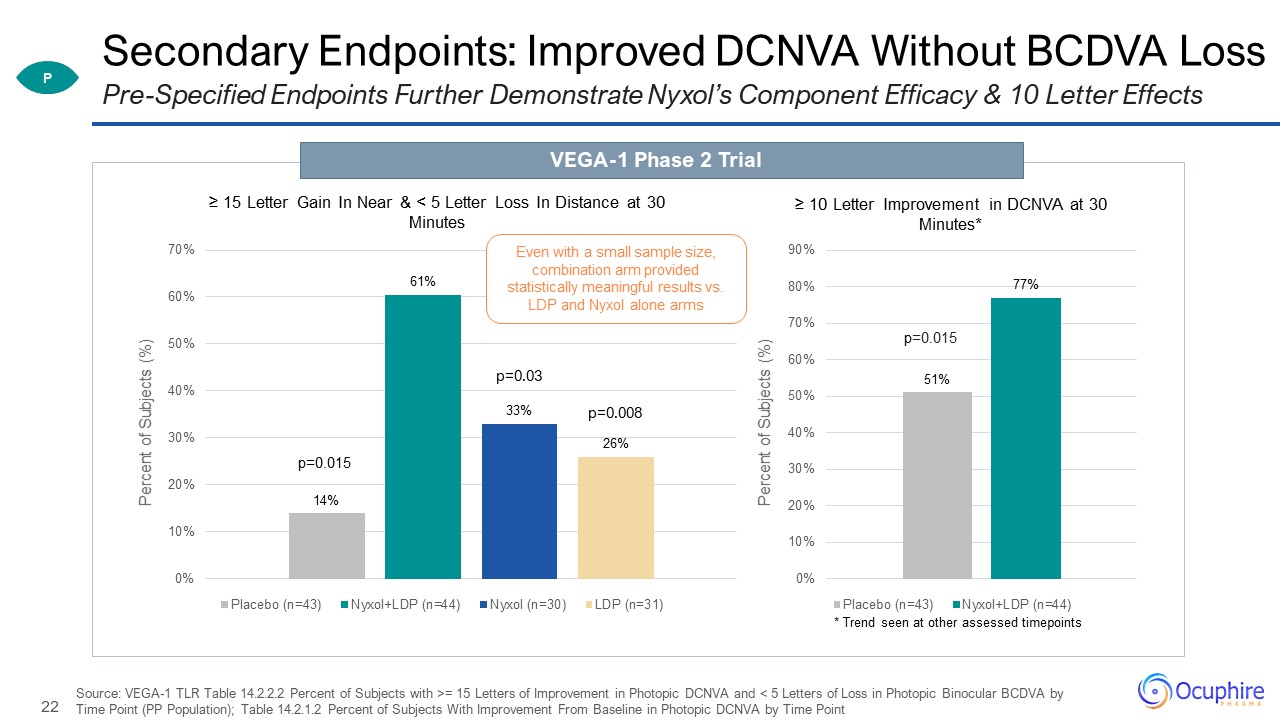

Secondary Endpoints: Improved DCNVA Without BCDVA Loss Source: VEGA-1 TLR Table 14.2.2.2 Percent of

Subjects with >= 15 Letters of Improvement in Photopic DCNVA and < 5 Letters of Loss in Photopic Binocular BCDVA by Time Point (PP Population); Table 14.2.1.2 Percent of Subjects With Improvement From Baseline in Photopic DCNVA by Time

Point Pre-Specified Endpoints Further Demonstrate Nyxol’s Component Efficacy & 10 Letter Effects VEGA-1 Phase 2 Trial P p=0.015 p=0.015 p=0.03 p=0.008 Even with a small sample size, combination arm provided statistically meaningful

results vs. LDP and Nyxol alone arms * Trend seen at other assessed timepoints

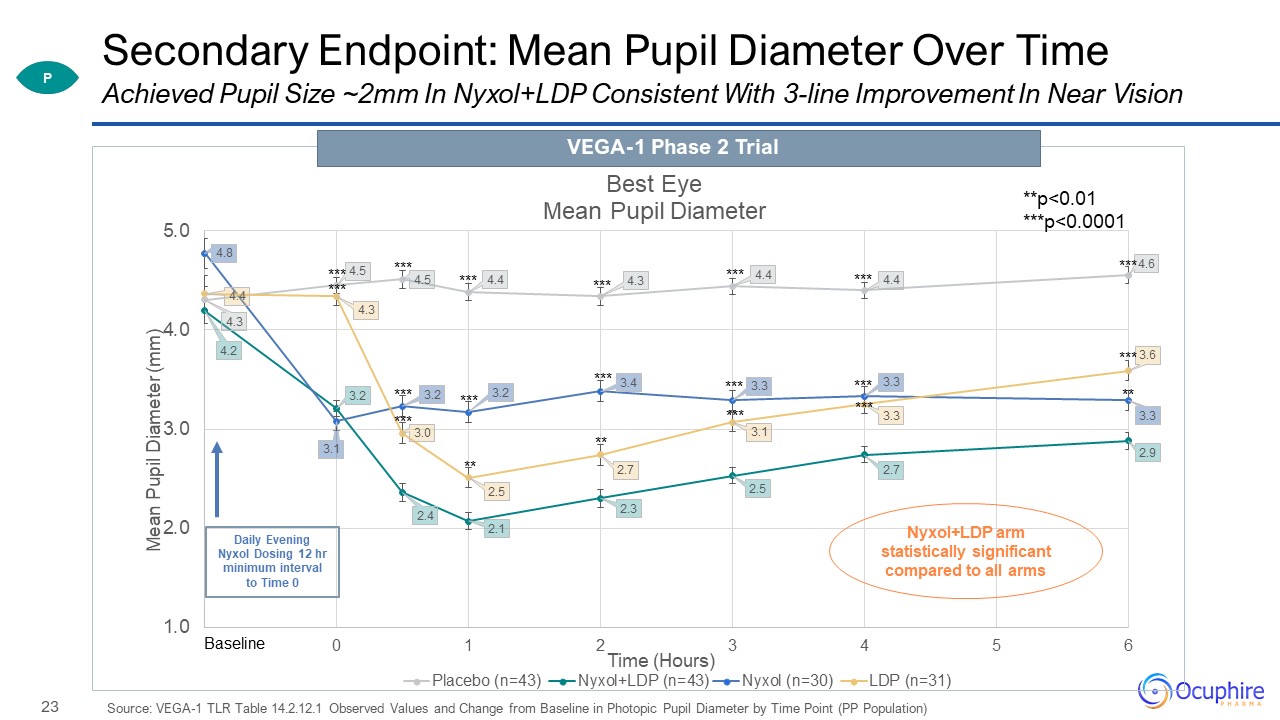

Secondary Endpoint: Mean Pupil Diameter Over Time Source: VEGA-1 TLR Table 14.2.12.1 Observed Values and

Change from Baseline in Photopic Pupil Diameter by Time Point (PP Population) Achieved Pupil Size ~2mm In Nyxol+LDP Consistent With 3-line Improvement In Near Vision Nyxol+LDP arm statistically significant compared to all arms

**p<0.01***p<0.0001 VEGA-1 Phase 2 Trial P

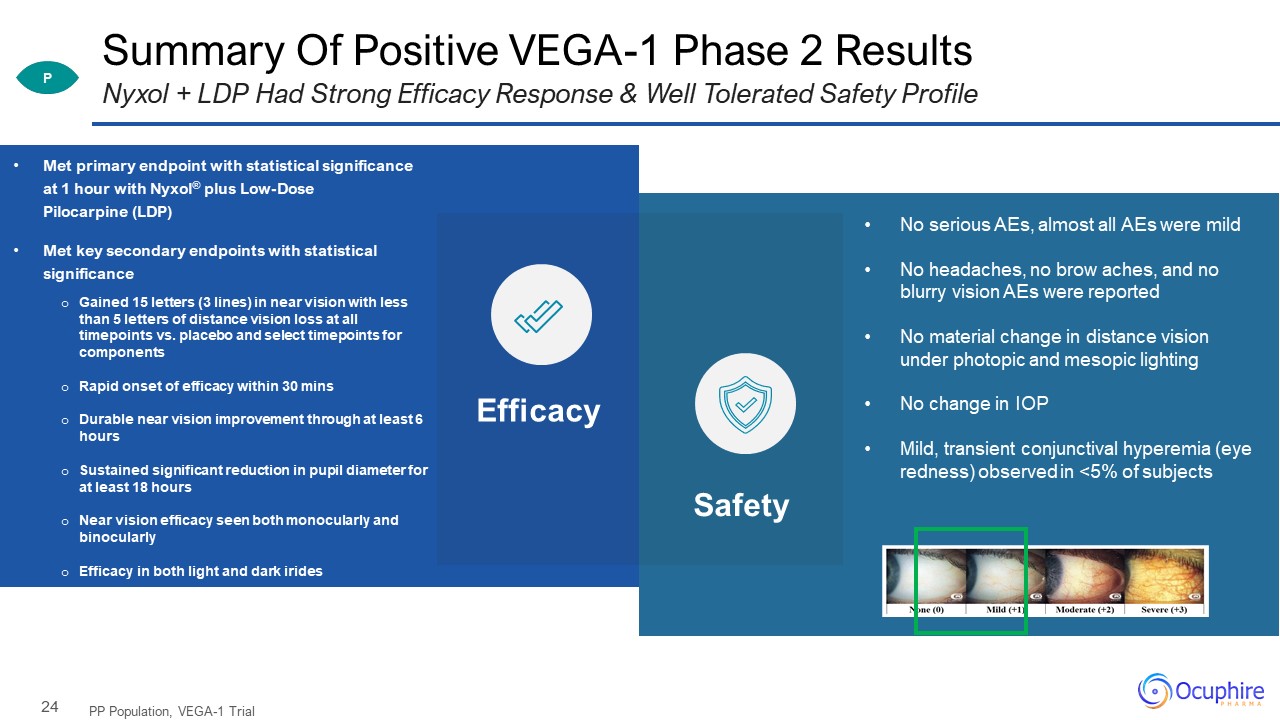

Summary Of Positive VEGA-1 Phase 2 Results PP Population, VEGA-1 Trial Nyxol + LDP Had Strong Efficacy

Response & Well Tolerated Safety Profile Efficacy Safety Met primary endpoint with statistical significance at 1 hour with Nyxol® plus Low-Dose Pilocarpine (LDP)Met key secondary endpoints with statistical significanceGained

15 letters (3 lines) in near vision with less than 5 letters of distance vision loss at all timepoints vs. placebo and select timepoints for componentsRapid onset of efficacy within 30 minsDurable near vision improvement through at least 6

hoursSustained significant reduction in pupil diameter for at least 18 hoursNear vision efficacy seen both monocularly and binocularlyEfficacy in both light and dark irides P No serious AEs, almost all AEs were mildNo headaches, no

brow aches, and no blurry vision AEs were reportedNo material change in distance vision under photopic and mesopic lightingNo change in IOPMild, transient conjunctival hyperemia (eye redness) observed in <5% of subjects

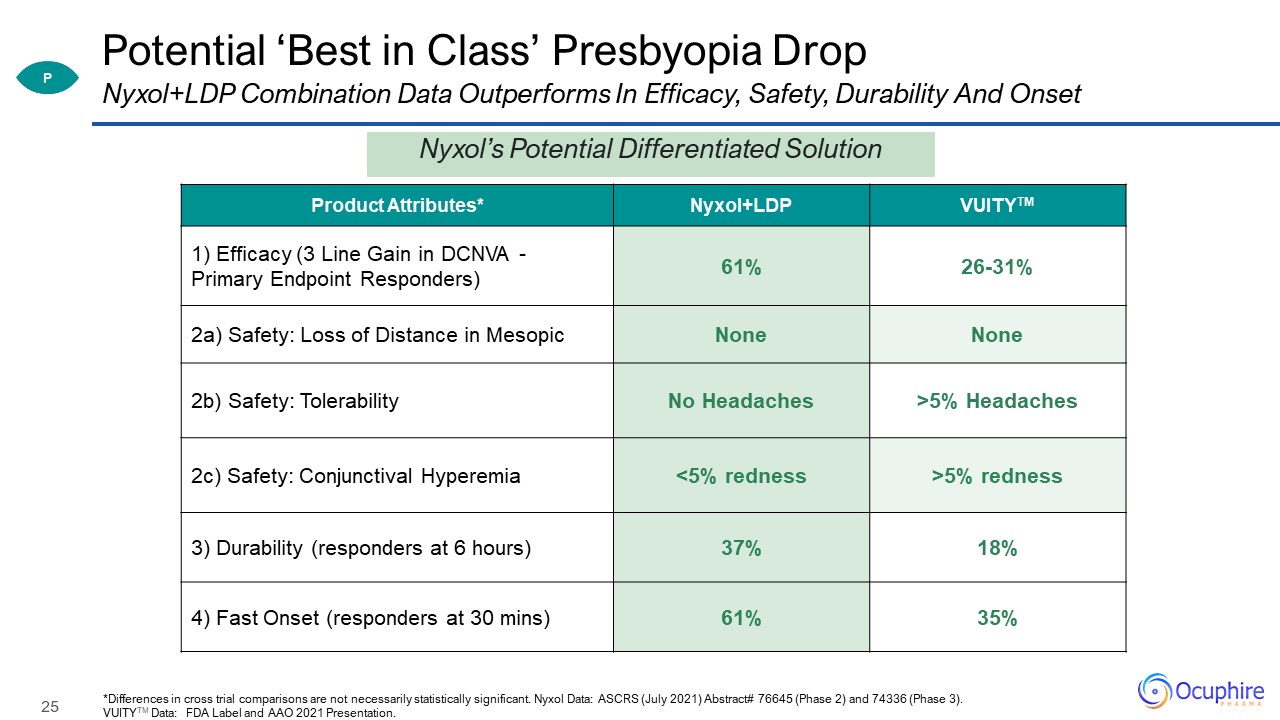

Potential ‘Best in Class’ Presbyopia Drop Product Attributes* Nyxol+LDP VUITYTM 1) Efficacy (3 Line

Gain in DCNVA - Primary Endpoint Responders) 61% 26-31% 2a) Safety: Loss of Distance in Mesopic None None 2b) Safety: Tolerability No Headaches >5% Headaches 2c) Safety: Conjunctival Hyperemia <5% redness >5% redness 3)

Durability (responders at 6 hours) 37% 18% 4) Fast Onset (responders at 30 mins) 61% 35% *Differences in cross trial comparisons are not necessarily statistically significant. Nyxol Data: ASCRS (July 2021) Abstract# 76645 (Phase 2) and

74336 (Phase 3). VUITYTM Data: FDA Label and AAO 2021 Presentation. Nyxol+LDP Combination Data Outperforms In Efficacy, Safety, Durability And Onset P Nyxol’s Potential Differentiated Solution

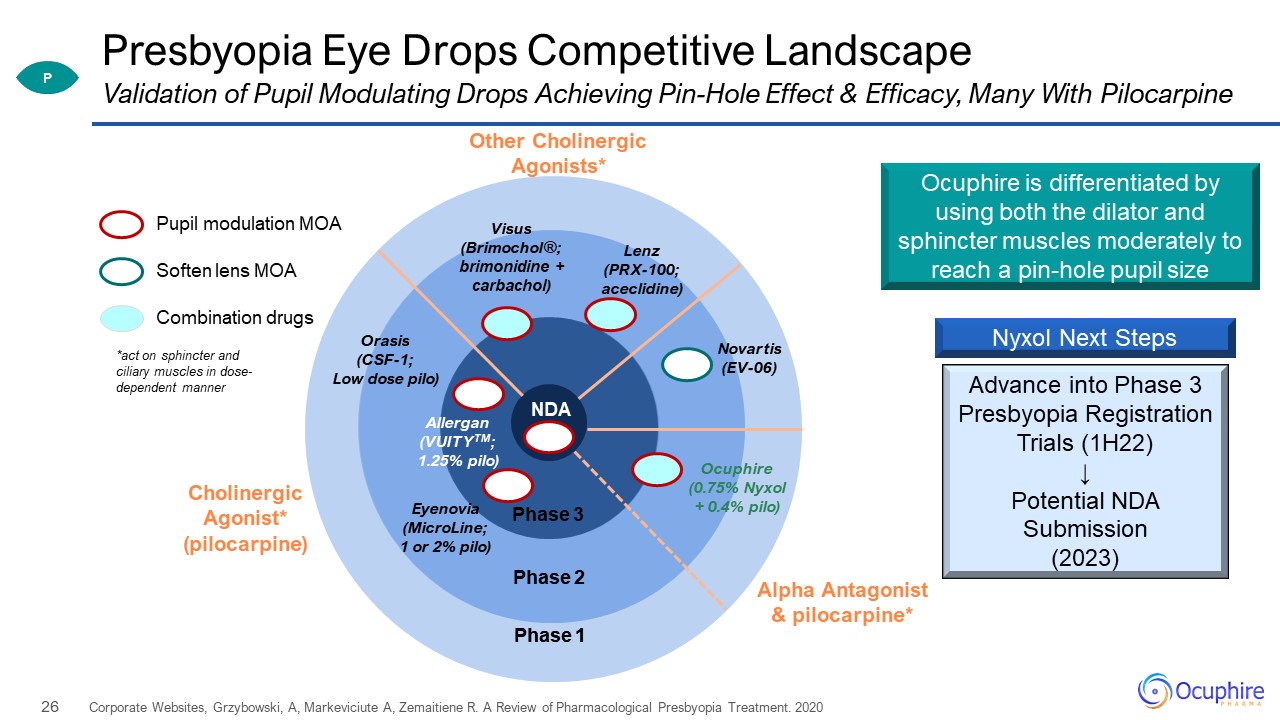

Phase 2 Phase 1 Presbyopia Eye Drops Competitive Landscape Corporate Websites, Grzybowski,

A, Markeviciute A, Zemaitiene R. A Review of Pharmacological Presbyopia Treatment. 2020 Pupil modulation MOA Combination drugs Soften lens MOA Phase 3 Phase 2 Phase 1 Allergan(VUITYTM;1.25% pilo) Orasis(CSF-1; Low dose

pilo) Ocuphire(0.75% Nyxol + 0.4% pilo) Visus(Brimochol®; brimonidine + carbachol) Other Cholinergic Agonists* CholinergicAgonist* (pilocarpine) Lenz(PRX-100; aceclidine) Eyenovia(MicroLine;1 or 2% pilo) Novartis(EV-06) Alpha

Antagonist& pilocarpine* NDA *act on sphincter and ciliary muscles in dose-dependent manner Ocuphire is differentiated by using both the dilator and sphincter muscles moderately to reach a pin-hole pupil size Nyxol Next

Steps Validation of Pupil Modulating Drops Achieving Pin-Hole Effect & Efficacy, Many With Pilocarpine Advance into Phase 3 Presbyopia Registration Trials (1H22)↓Potential NDA Submission(2023) P

I’m no longer comfortable driving at night, especially with my son in the car. I have a hard time

playing beach volleyball in the evenings due to the bright lights at the courts. Post-LASIK, Age 42 Nyxol® forDim Light or Night Vision Disturbances 27 NVD

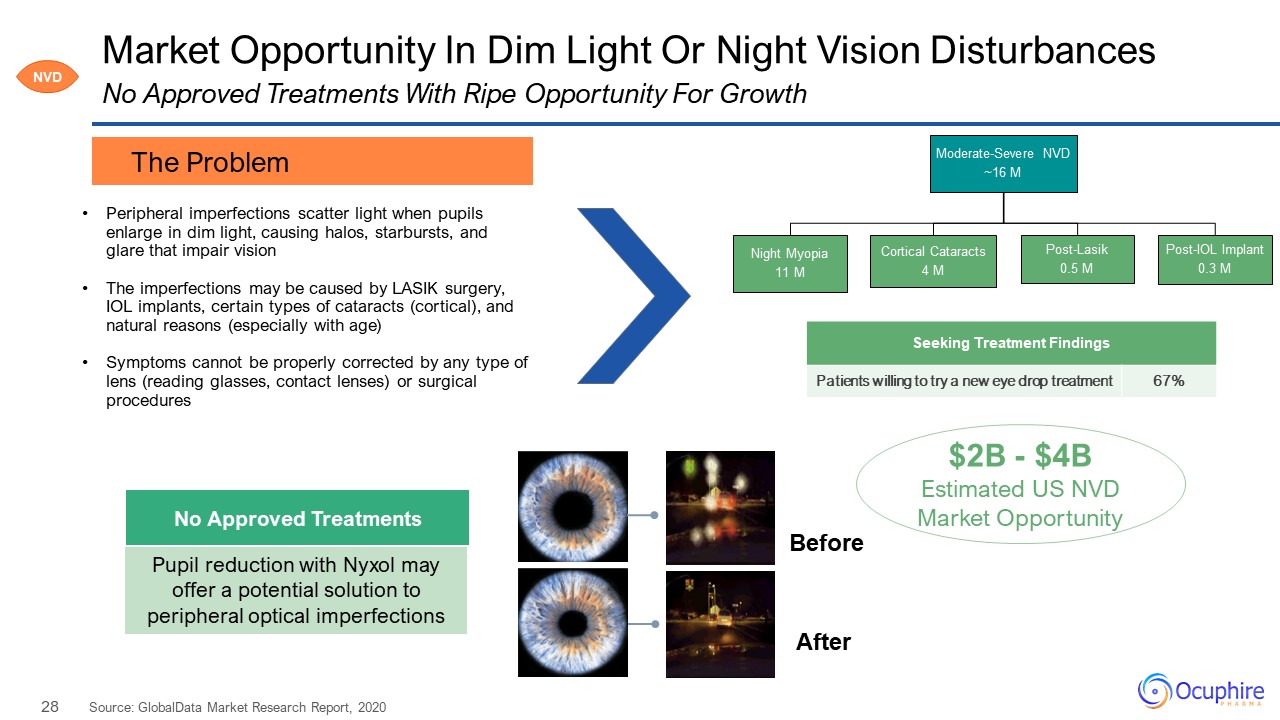

Market Opportunity In Dim Light Or Night Vision Disturbances No Approved Treatments With Ripe

Opportunity For Growth No Approved Treatments $2B - $4BEstimated US NVD Market Opportunity Peripheral imperfections scatter light when pupils enlarge in dim light, causing halos, starbursts, and glare that impair visionThe imperfections may

be caused by LASIK surgery, IOL implants, certain types of cataracts (cortical), and natural reasons (especially with age) Symptoms cannot be properly corrected by any type of lens (reading glasses, contact lenses) or surgical procedures The

Problem Seeking Treatment Findings Patients willing to try a new eye drop treatment 67% NVD Pupil reduction with Nyxol may offer a potential solution to peripheral optical imperfections After Before Source: GlobalData Market

Research Report, 2020

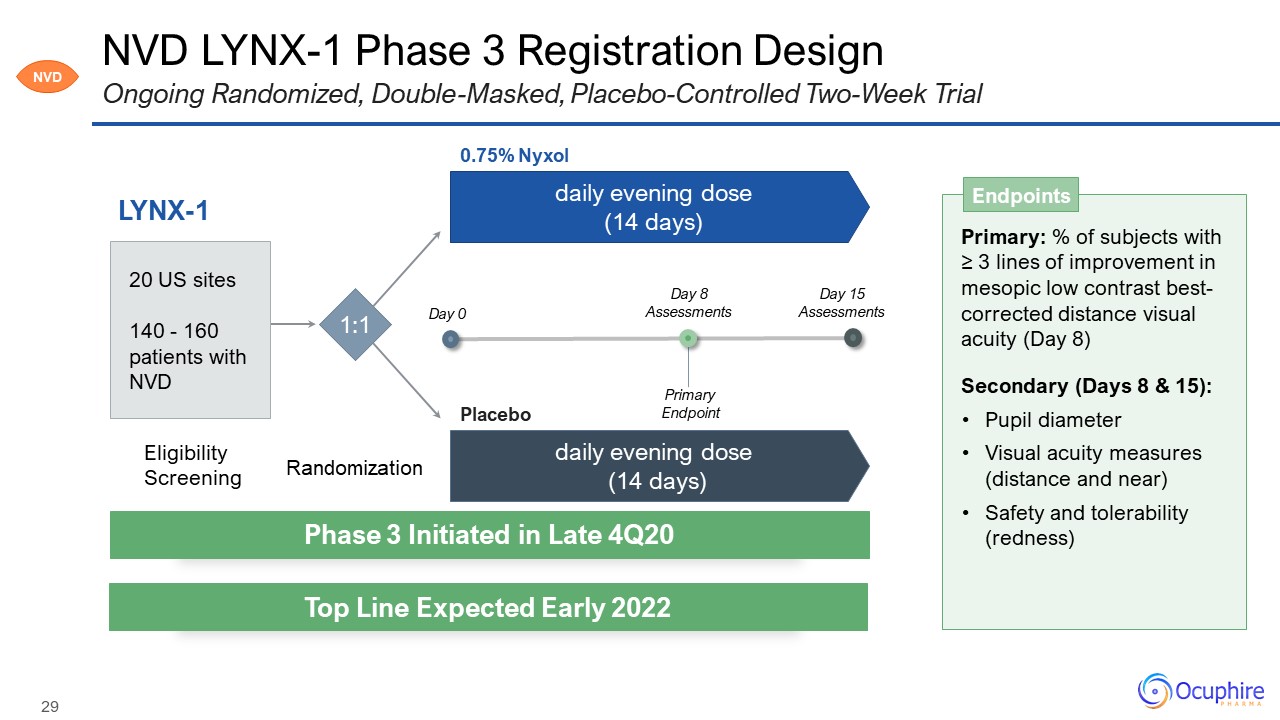

NVD LYNX-1 Phase 3 Registration Design Ongoing Randomized, Double-Masked, Placebo-Controlled

Two-Week Trial LYNX-1 Primary: % of subjects with ≥ 3 lines of improvement in mesopic low contrast best-corrected distance visual acuity (Day 8)Secondary (Days 8 & 15):Pupil diameterVisual acuity measures (distance and near)Safety and

tolerability (redness) Endpoints Eligibility Screening Randomization 1:1 daily evening dose(14 days) daily evening dose (14 days) 0.75% Nyxol Placebo 20 US sites140 - 160 patients with NVD Phase 3 Initiated in Late 4Q20 Top Line

Expected Early 2022 NVD Day 0 Day 8Assessments Primary Endpoint Day 15Assessments

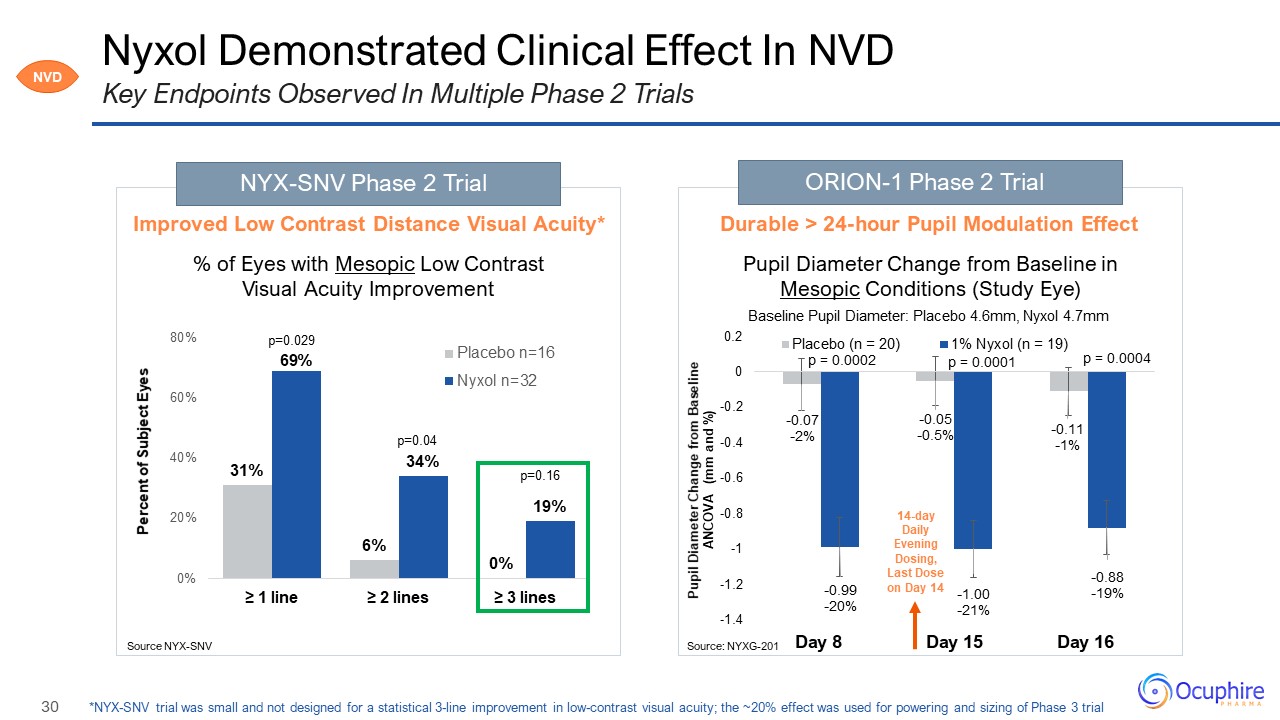

ORION-1 Phase 2 Trial NYX-SNV Phase 2 Trial Nyxol Demonstrated Clinical Effect In NVD *NYX-SNV

trial was small and not designed for a statistical 3-line improvement in low-contrast visual acuity; the ~20% effect was used for powering and sizing of Phase 3 trial Key Endpoints Observed In Multiple Phase 2 Trials Improved Low Contrast

Distance Visual Acuity* Source: NYXG-201 Durable > 24-hour Pupil Modulation Effect % of Eyes with Mesopic Low Contrast Visual Acuity Improvement Pupil Diameter Change from Baseline in Mesopic Conditions (Study Eye) Source

NYX-SNV Percent of Subject Eyes p=0.029 p=0.04 p=0.16 Baseline Pupil Diameter: Placebo 4.6mm, Nyxol 4.7mm p = 0.0002 p = 0.0001 p = 0.0004 NVD

DR DME 31 Diabetic Retinopathy Diabetic Macular Edema Apx3330tablets

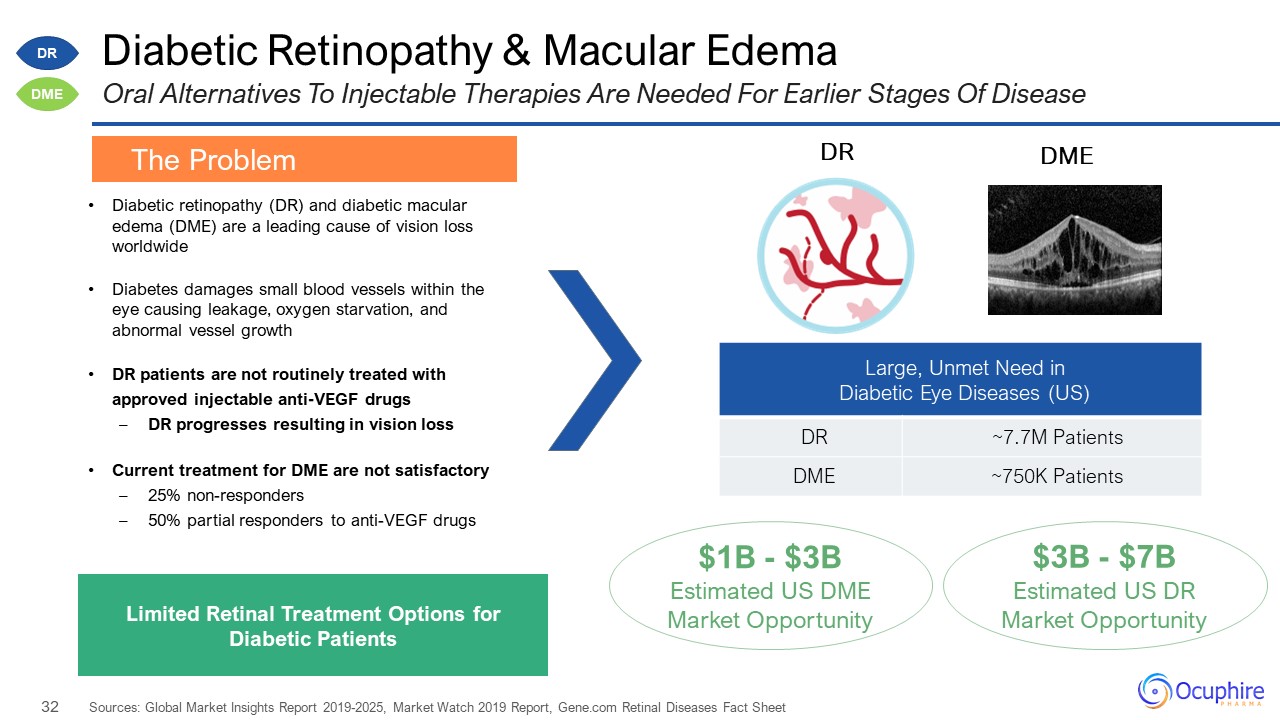

Large, Unmet Need in Diabetic Eye Diseases (US) DR ~7.7M Patients DME ~750K Patients Diabetic

Retinopathy & Macular Edema Diabetic retinopathy (DR) and diabetic macular edema (DME) are a leading cause of vision loss worldwideDiabetes damages small blood vessels within the eye causing leakage, oxygen starvation, and abnormal vessel

growthDR patients are not routinely treated with approved injectable anti-VEGF drugsDR progresses resulting in vision lossCurrent treatment for DME are not satisfactory 25% non-responders50% partial responders to anti-VEGF drugs Sources:

Global Market Insights Report 2019-2025, Market Watch 2019 Report, Gene.com Retinal Diseases Fact Sheet The Problem Oral Alternatives To Injectable Therapies Are Needed For Earlier Stages Of Disease DR DME DR DME $3B - $7BEstimated US DR

Market Opportunity $1B - $3BEstimated US DME Market Opportunity Limited Retinal Treatment Options for Diabetic Patients

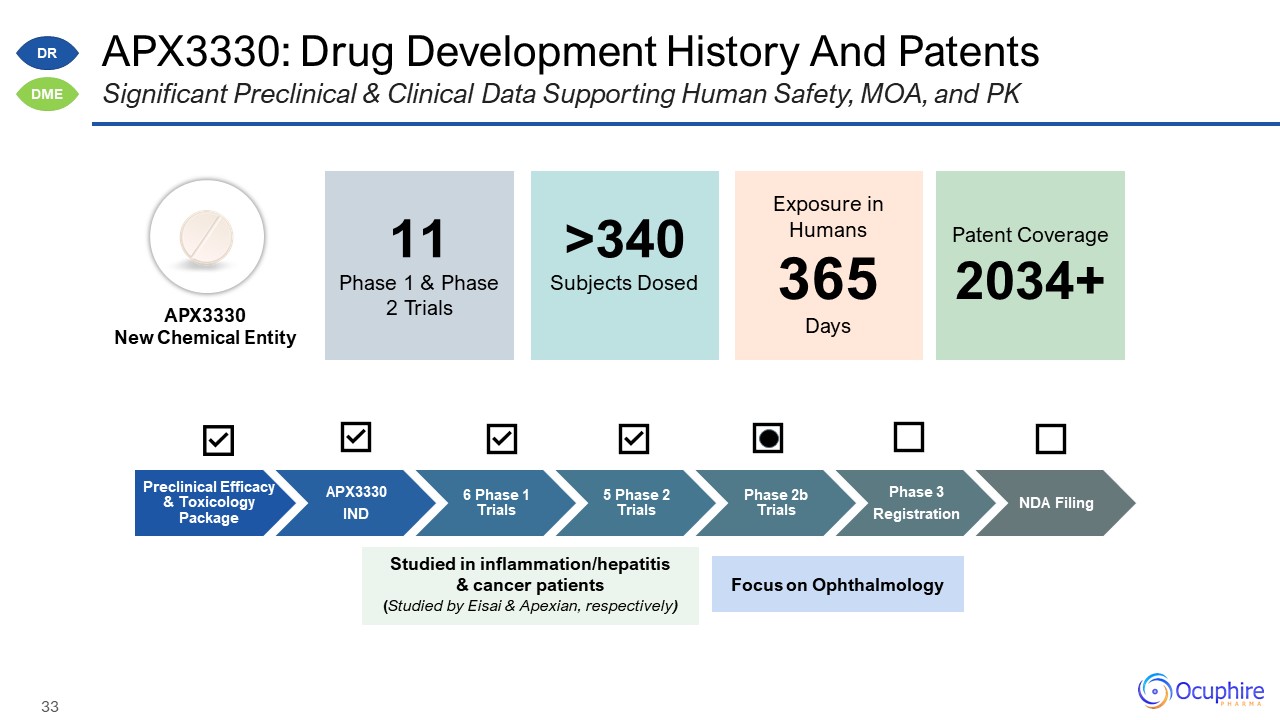

APX3330: Drug Development History And Patents Significant Preclinical & Clinical Data Supporting

Human Safety, MOA, and PK 11Phase 1 & Phase 2 Trials >340Subjects Dosed Exposure in Humans 365 Days Patent Coverage 2034+ Studied in inflammation/hepatitis & cancer patients (Studied by Eisai & Apexian,

respectively) APX3330New Chemical Entity Preclinical Efficacy & Toxicology Package APX3330IND 6 Phase 1 Trials 5 Phase 2 Trials Phase 2b Trials Phase 3Registration NDA Filing Focus on Ophthalmology DR DME

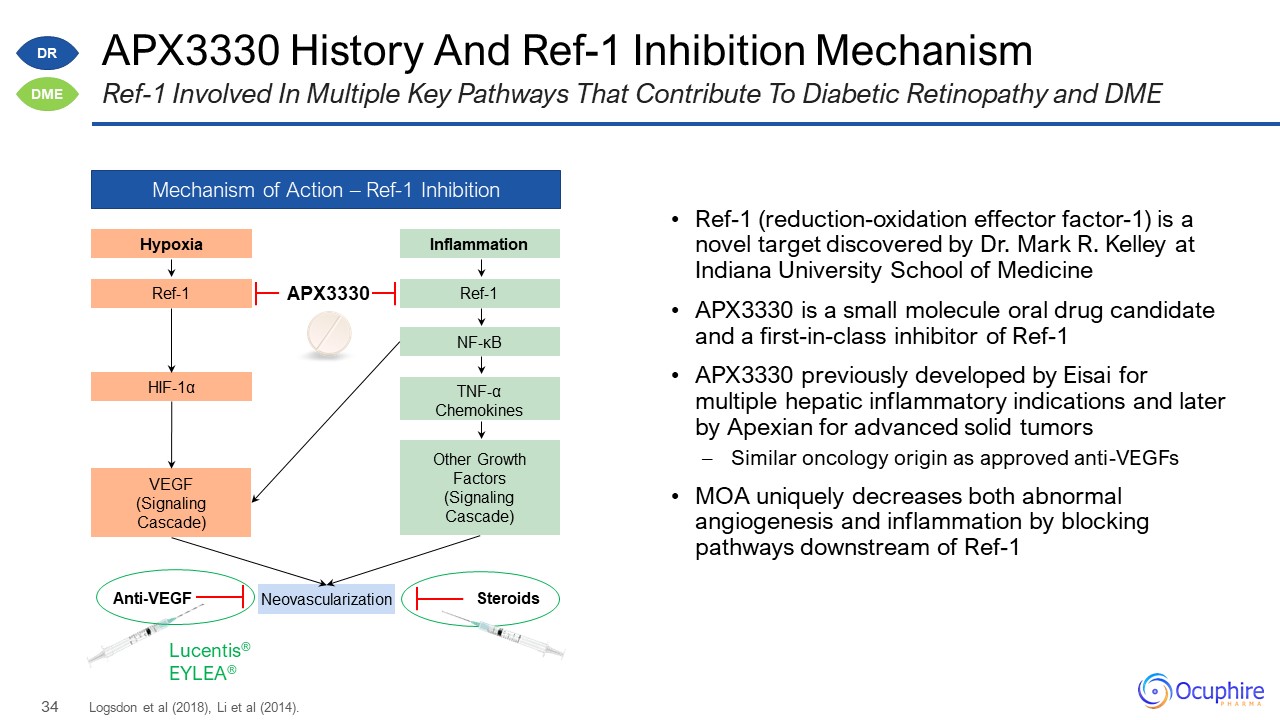

APX3330 History And Ref-1 Inhibition Mechanism Logsdon et al (2018), Li et al (2014). Ref-1 Involved

In Multiple Key Pathways That Contribute To Diabetic Retinopathy and DME Mechanism of Action – Ref-1 Inhibition Hypoxia Ref-1 HIF-1α VEGF(Signaling Cascade) Inflammation Ref-1 NF-κB Other Growth Factors(Signaling

Cascade) TNF-αChemokines Neovascularization Lucentis®EYLEA® Anti-VEGF Steroids APX3330 Ref-1 (reduction-oxidation effector factor-1) is a novel target discovered by Dr. Mark R. Kelley at Indiana University School of MedicineAPX3330

is a small molecule oral drug candidate and a first-in-class inhibitor of Ref-1APX3330 previously developed by Eisai for multiple hepatic inflammatory indications and later by Apexian for advanced solid tumorsSimilar oncology origin as approved

anti-VEGFsMOA uniquely decreases both abnormal angiogenesis and inflammation by blocking pathways downstream of Ref-1 DR DME

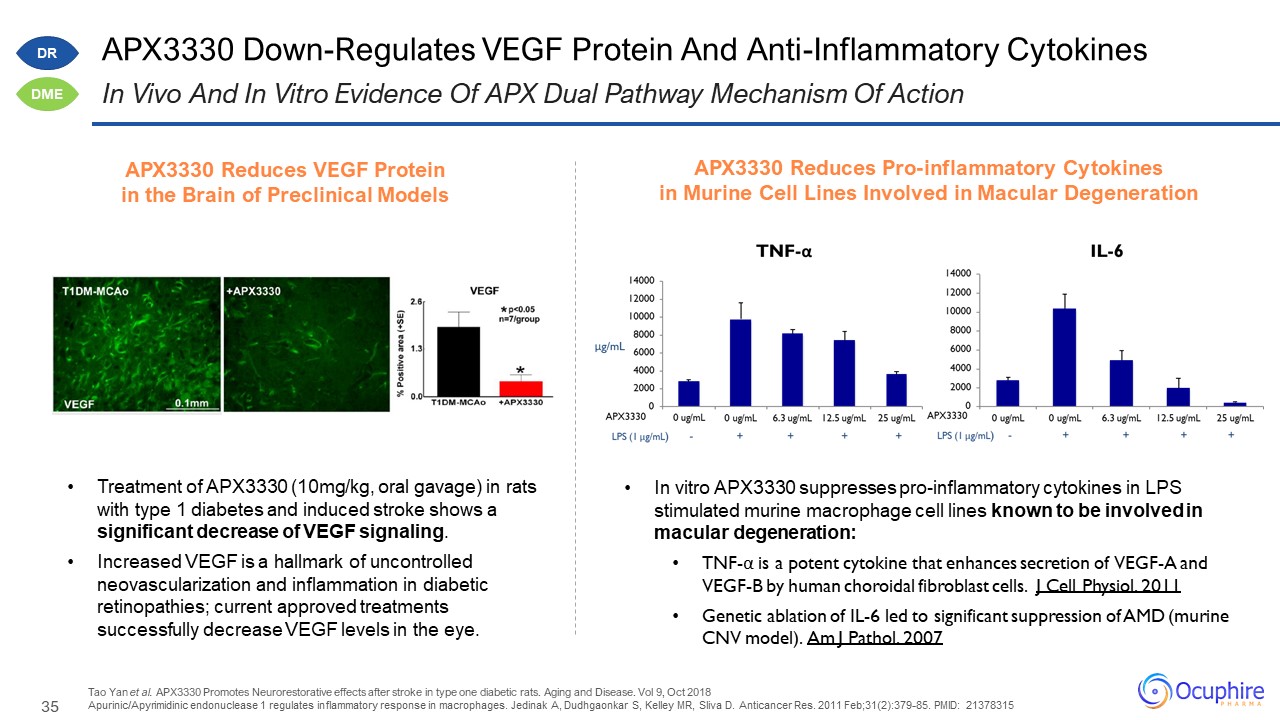

APX3330 Down-Regulates VEGF Protein And Anti-Inflammatory Cytokines Tao Yan et al. APX3330 Promotes

Neurorestorative effects after stroke in type one diabetic rats. Aging and Disease. Vol 9, Oct 2018Apurinic/Apyrimidinic endonuclease 1 regulates inflammatory response in macrophages. Jedinak A, Dudhgaonkar S, Kelley MR, Sliva D. Anticancer

Res. 2011 Feb;31(2):379-85. PMID: 21378315 In Vivo And In Vitro Evidence Of APX Dual Pathway Mechanism Of Action Treatment of APX3330 (10mg/kg, oral gavage) in rats with type 1 diabetes and induced stroke shows a significant decrease of VEGF

signaling. Increased VEGF is a hallmark of uncontrolled neovascularization and inflammation in diabetic retinopathies; current approved treatments successfully decrease VEGF levels in the eye. In vitro APX3330 suppresses pro-inflammatory

cytokines in LPS stimulated murine macrophage cell lines known to be involved in macular degeneration:TNF-α is a potent cytokine that enhances secretion of VEGF-A and VEGF-B by human choroidal fibroblast cells. J Cell Physiol. 2011Genetic

ablation of IL-6 led to significant suppression of AMD (murine CNV model). Am J Pathol. 2007 APX3330 Reduces VEGF Protein in the Brain of Preclinical Models APX3330 Reduces Pro-inflammatory Cytokines in Murine Cell Lines Involved in Macular

Degeneration DR DME

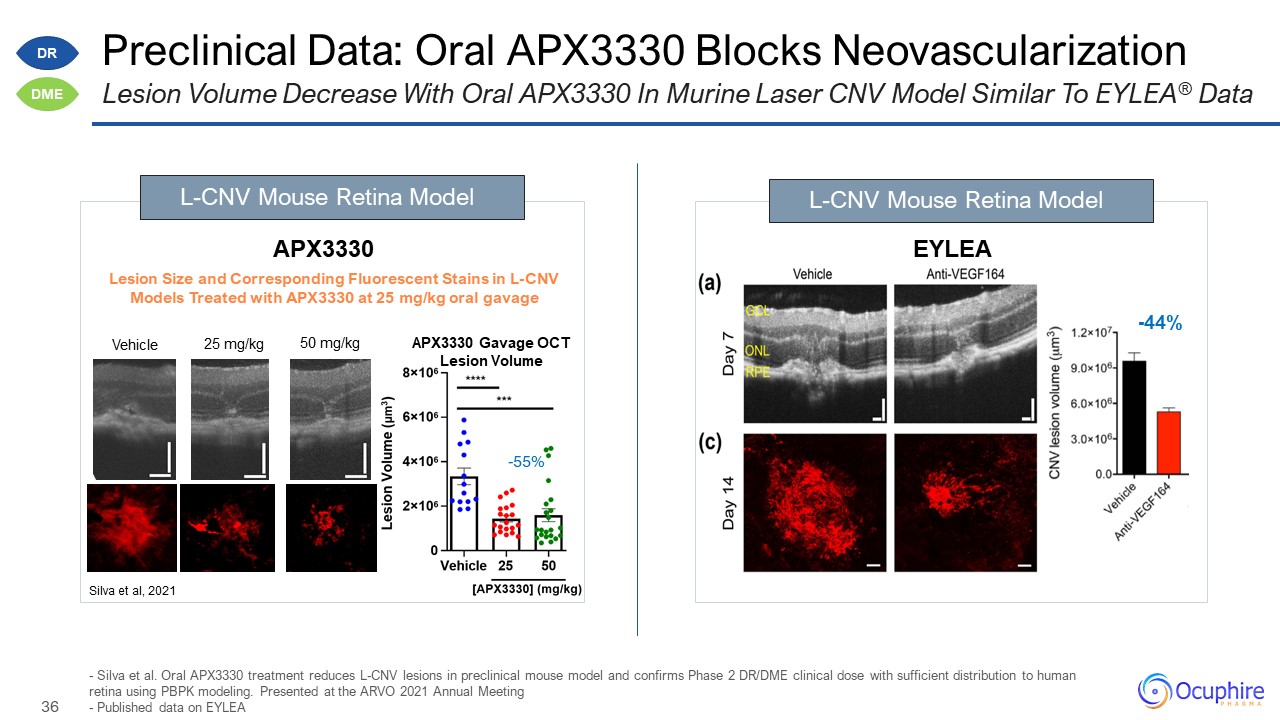

Preclinical Data: Oral APX3330 Blocks Neovascularization - Silva et al. Oral APX3330 treatment reduces

L-CNV lesions in preclinical mouse model and confirms Phase 2 DR/DME clinical dose with sufficient distribution to human retina using PBPK modeling. Presented at the ARVO 2021 Annual Meeting- Published data on EYLEA Lesion Volume Decrease With

Oral APX3330 In Murine Laser CNV Model Similar To EYLEA® Data -44% EYLEA Lesion Size and Corresponding Fluorescent Stains in L-CNV Models Treated with APX3330 at 25 mg/kg oral gavage -55% L-CNV Mouse Retina Model Silva et al,

2021 Vehicle 25 mg/kg 50 mg/kg APX3330 Gavage OCTLesion Volume L-CNV Mouse Retina Model APX3330 DR DME

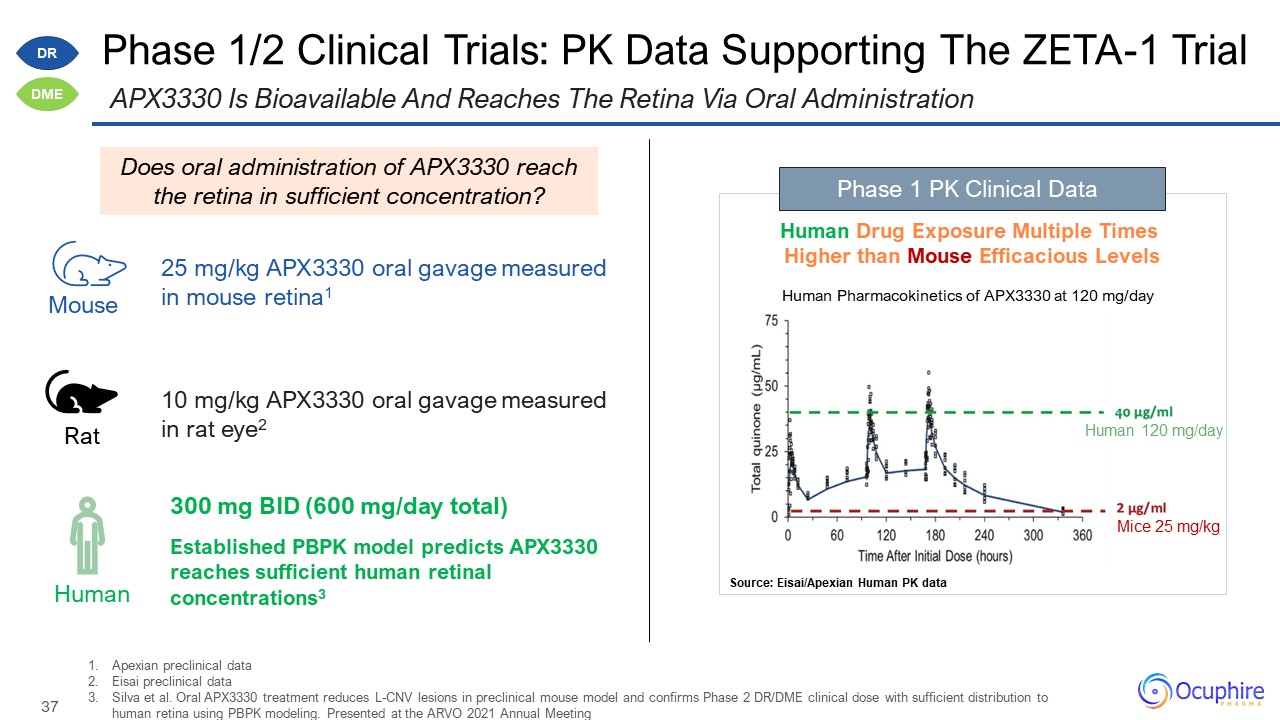

Phase 1/2 Clinical Trials: PK Data Supporting The ZETA-1 Trial Apexian preclinical dataEisai preclinical

dataSilva et al. Oral APX3330 treatment reduces L-CNV lesions in preclinical mouse model and confirms Phase 2 DR/DME clinical dose with sufficient distribution to human retina using PBPK modeling. Presented at the ARVO 2021 Annual

Meeting APX3330 Is Bioavailable And Reaches The Retina Via Oral Administration Human Pharmacokinetics of APX3330 at 120 mg/day Phase 1 PK Clinical Data Human Drug Exposure Multiple Times Higher than Mouse Efficacious Levels Human 120

mg/day Mice 25 mg/kg Source: Eisai/Apexian Human PK data Human Mouse Rat 10 mg/kg APX3330 oral gavage measured in rat eye2 Established PBPK model predicts APX3330 reaches sufficient human retinal concentrations3 300 mg BID (600 mg/day

total) 25 mg/kg APX3330 oral gavage measured in mouse retina1 Does oral administration of APX3330 reach the retina in sufficient concentration? DR DME

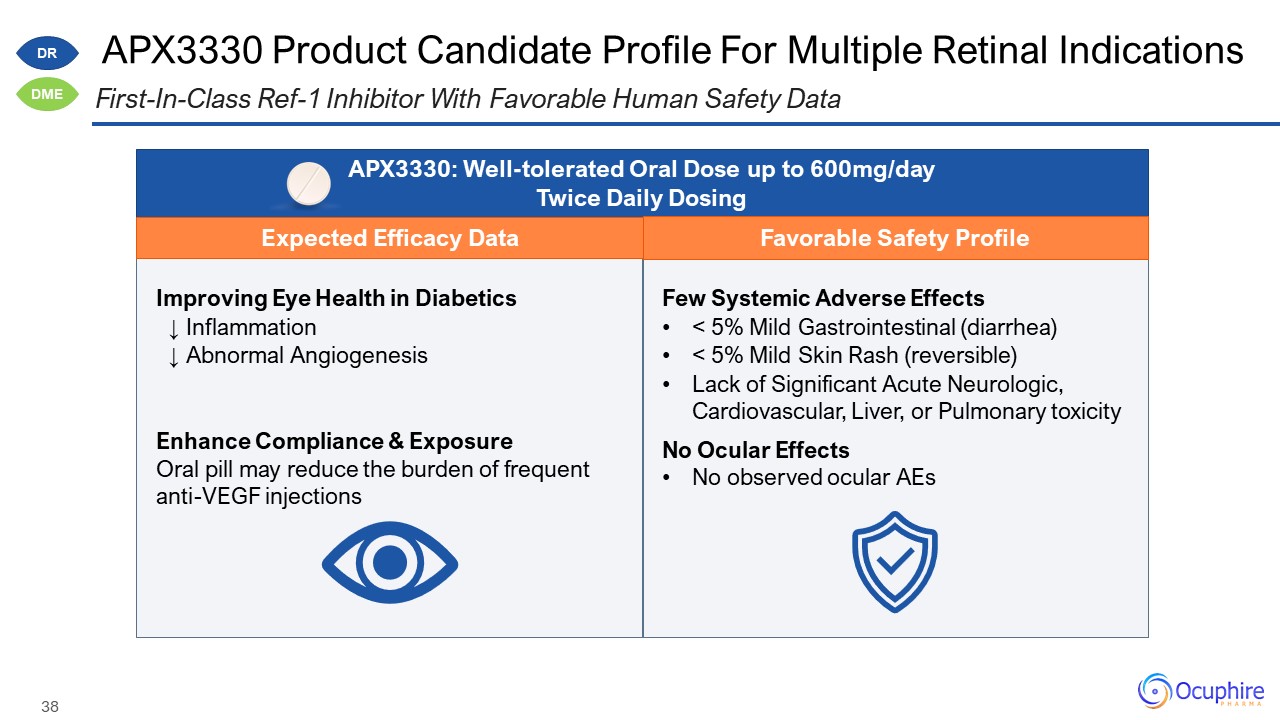

Improving Eye Health in Diabetics ↓ Inflammation ↓ Abnormal AngiogenesisEnhance Compliance &

ExposureOral pill may reduce the burden of frequent anti-VEGF injections Few Systemic Adverse Effects< 5% Mild Gastrointestinal (diarrhea)< 5% Mild Skin Rash (reversible)Lack of Significant Acute Neurologic, Cardiovascular, Liver, or

Pulmonary toxicityNo Ocular EffectsNo observed ocular AEs APX3330 Product Candidate Profile For Multiple Retinal Indications First-In-Class Ref-1 Inhibitor With Favorable Human Safety Data APX3330: Well-tolerated Oral Dose up to

600mg/dayTwice Daily Dosing DR DME Expected Efficacy Data Favorable Safety Profile

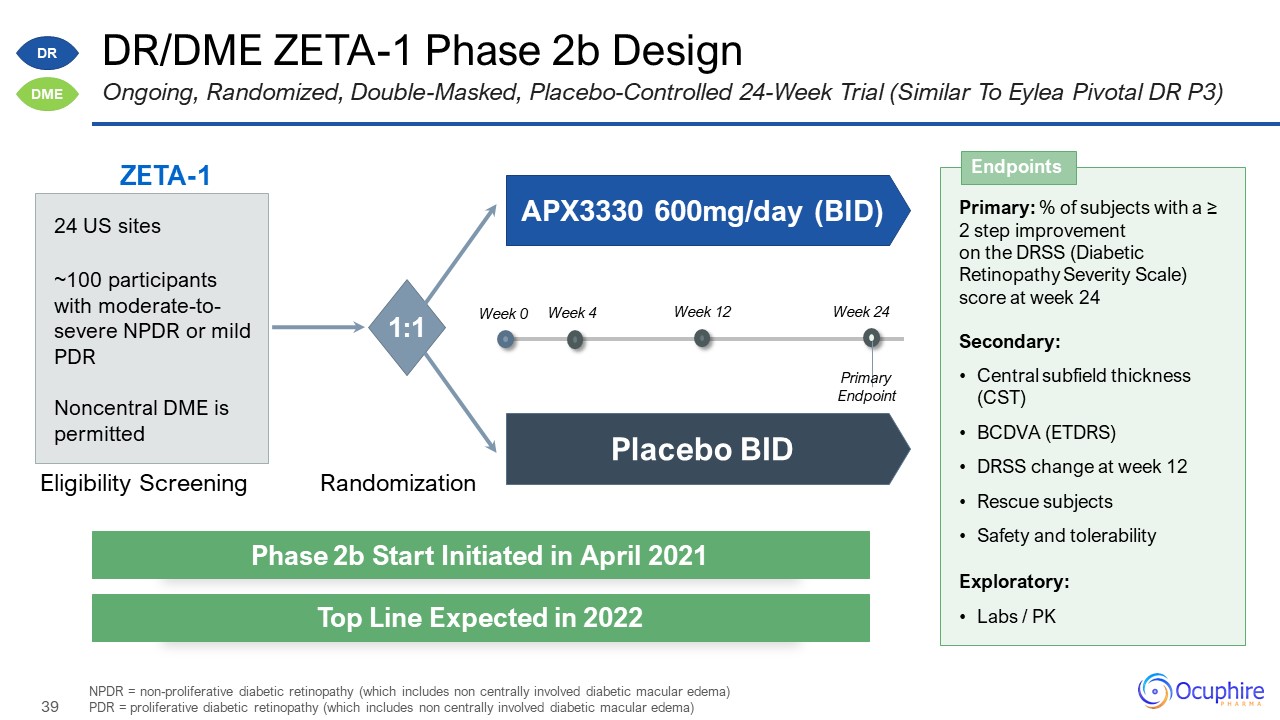

DR/DME ZETA-1 Phase 2b Design NPDR = non-proliferative diabetic retinopathy (which includes non

centrally involved diabetic macular edema)PDR = proliferative diabetic retinopathy (which includes non centrally involved diabetic macular edema) Ongoing, Randomized, Double-Masked, Placebo-Controlled 24-Week Trial (Similar To Eylea Pivotal DR

P3) Primary: % of subjects with a ≥ 2 step improvement on the DRSS (Diabetic Retinopathy Severity Scale) score at week 24Secondary:Central subfield thickness (CST)BCDVA (ETDRS)DRSS change at week 12Rescue subjectsSafety and

tolerabilityExploratory:Labs / PK Endpoints Phase 2b Start Initiated in April 2021 Top Line Expected in 2022 DR DME ZETA-1 Eligibility Screening Randomization APX3330 600mg/day (BID) Placebo BID 24 US sites~100 participants with

moderate-to-severe NPDR or mild PDRNoncentral DME is permitted 1:1 Week 0 Week 12 Week 24 Week 4 Primary Endpoint

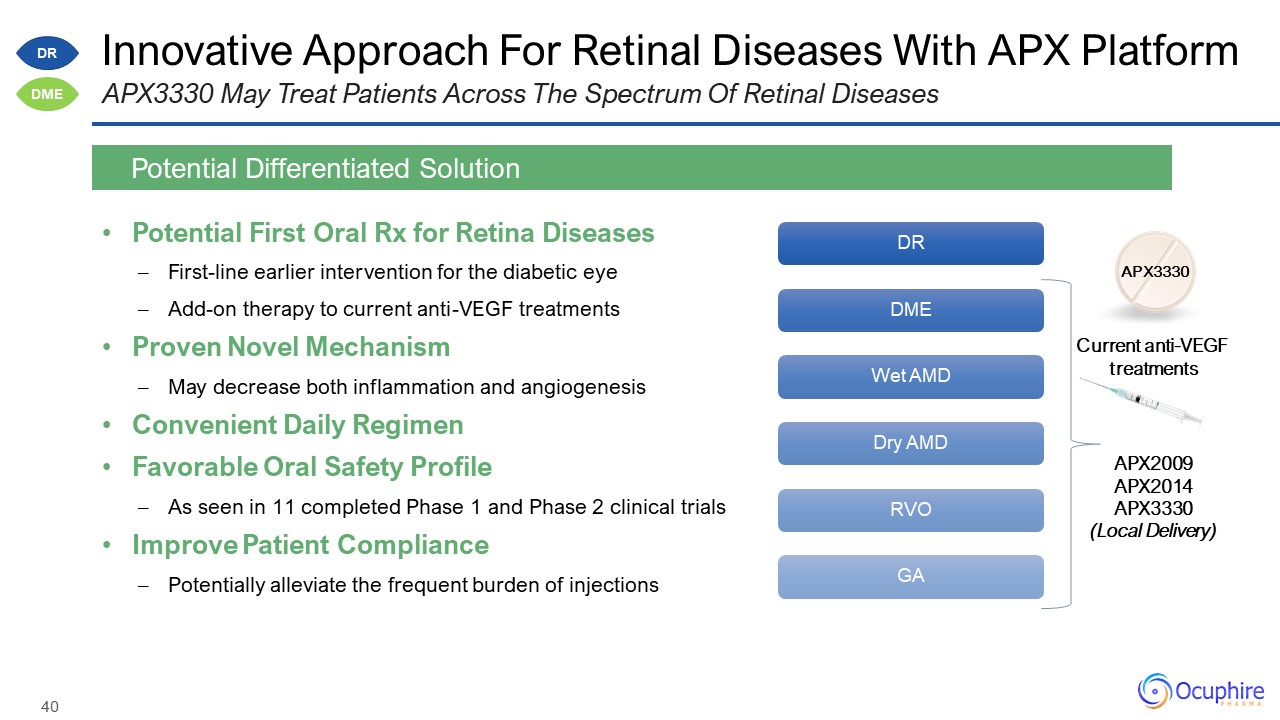

Innovative Approach For Retinal Diseases With APX Platform Potential First Oral Rx for Retina

DiseasesFirst-line earlier intervention for the diabetic eye Add-on therapy to current anti-VEGF treatmentsProven Novel MechanismMay decrease both inflammation and angiogenesisConvenient Daily RegimenFavorable Oral Safety Profile As seen in 11

completed Phase 1 and Phase 2 clinical trialsImprove Patient Compliance Potentially alleviate the frequent burden of injections Potential Differentiated Solution APX3330 May Treat Patients Across The Spectrum Of Retinal

Diseases APX3330 Current anti-VEGF treatments APX2009APX2014APX3330(Local Delivery) DR DME

Team/Boards, Milestones, And Financial Data

Ocuphire Management Team Decades Of Biotech And Drug Development Experience Mina Sooch, MBAPresident

& CEO and Founder Drey ColemanVP, Clinical Operations Amy Rabourn, CPAVP, Finance Charlie Hoffmann, MBAVP Corporate Development and Operations Mitch Brigell, PhDHead, Clinical Development and Strategy Daniela Oniciu,

PhDGlobal Head, R&D, Chemistryand Product Development Ronil Patel, MSSenior Director BD and Market Strategy Chris ErnstGlobal Head, QAand Manufacturing Barbara Withers, PhDVP, Clinical and Regulatory Strategy

Ocuphire's World-Class Medical Advisory Board Fortunate For The Insights Of Leading KOLs & Drug

Candidate Co-Founders James Katz, MDUniversity of Illinois Jay Pepose, MD, PhDUCLA Thomas Samuelson, MDUniversity of Minnesota Paul Karpecki, ODIndiana University Eliot Lazar, MDGeorgetown University Marguerite McDonald, MDColumbia

University David Boyer, MDChicago Medical School Mark Kelley, PhDIndiana UniversityCo-Founder Apexian/APX3330 elCON Medical Michael Allingham, MD, PhDUniversity of North Carolina Peter Kaiser, MDHarvard Medical School Jeffrey Heier,

MDBoston University Y. Ralph Chu, MDNorthwestern University Douglas Devries, ODUniversity of Nevada David Brown, MDBaylor University Mitch Jackson, MDChicago Medical School Ed Holland, MDLoyola University Chicago Jack Holladay,

MDUniversity of Texas David Lally, MDVanderbilt University

Ocuphire Board of Directors Sean Ainsworth, MBALead Independent Director, Board

Director James Manuso, PhD/MBABoard Director Jay Pepose, MD, PhDBoard Director Richard Rodgers, MBABoard Director Susan Benton, MBABoard Director Cam Gallagher, MBAChair, Board Director Mina Sooch, MBAVice-Chair, Board

Director President & CEO Seasoned Directors With Decades Of Drug Development, M&A/Financings, And Ophthalmology

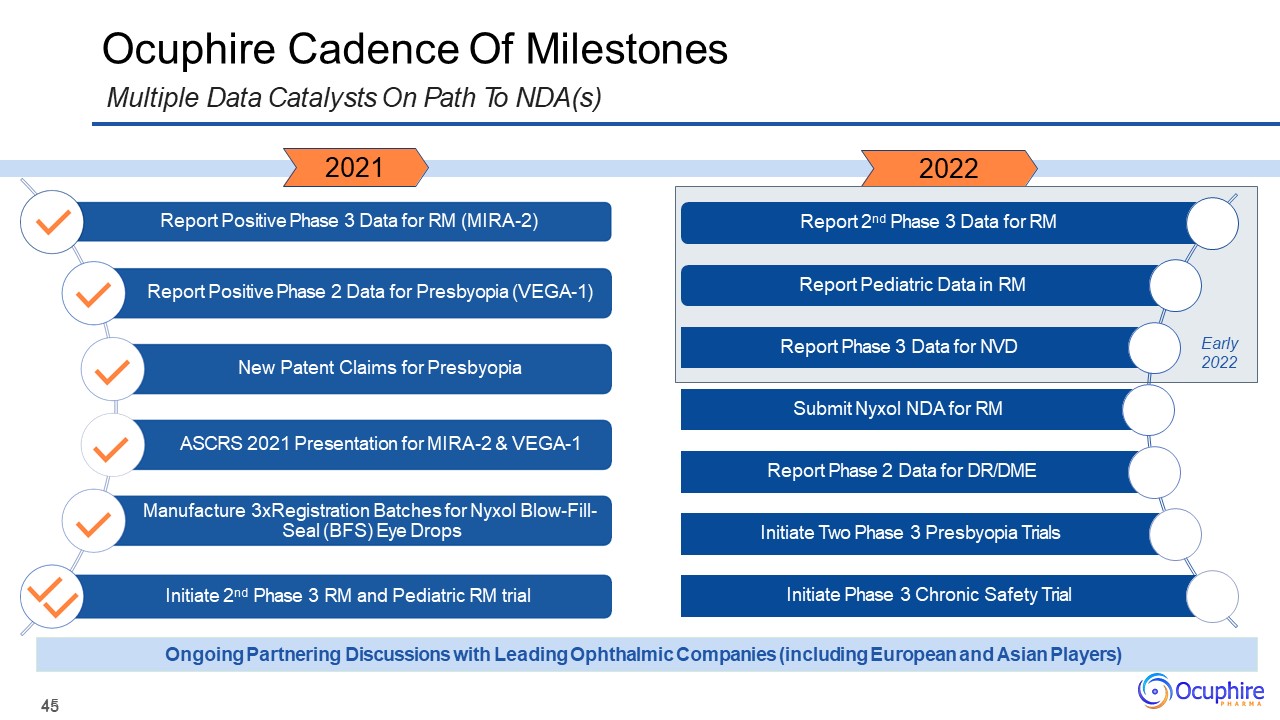

45 Ocuphire Cadence Of MilestonesMultiple Data Catalysts On Path To NDA(s) Ongoing Partnering

Discussions with Leading Ophthalmic Companies (including European and Asian Players) 2021 2022 Report 2nd Phase 3 Data for RM Report Pediatric Data in RM Report Phase 3 Data for NVD Submit Nyxol NDA for

RM Report Phase 2 Data for DR/DME Initiate Two Phase 3 Presbyopia Trials Report Positive Phase 3 Data for RM (MIRA-2) Report Positive Phase 2 Data for Presbyopia (VEGA-1) New Patent Claims for Presbyopia ASCRS 2021

Presentation for MIRA-2 & VEGA-1 Manufacture 3xRegistration Batches for Nyxol Blow-Fill- Seal (BFS) Eye Drops Initiate 2nd Phase 3 RM and Pediatric RM trial Initiate Phase 3 Chronic Safety Trial Early 2022

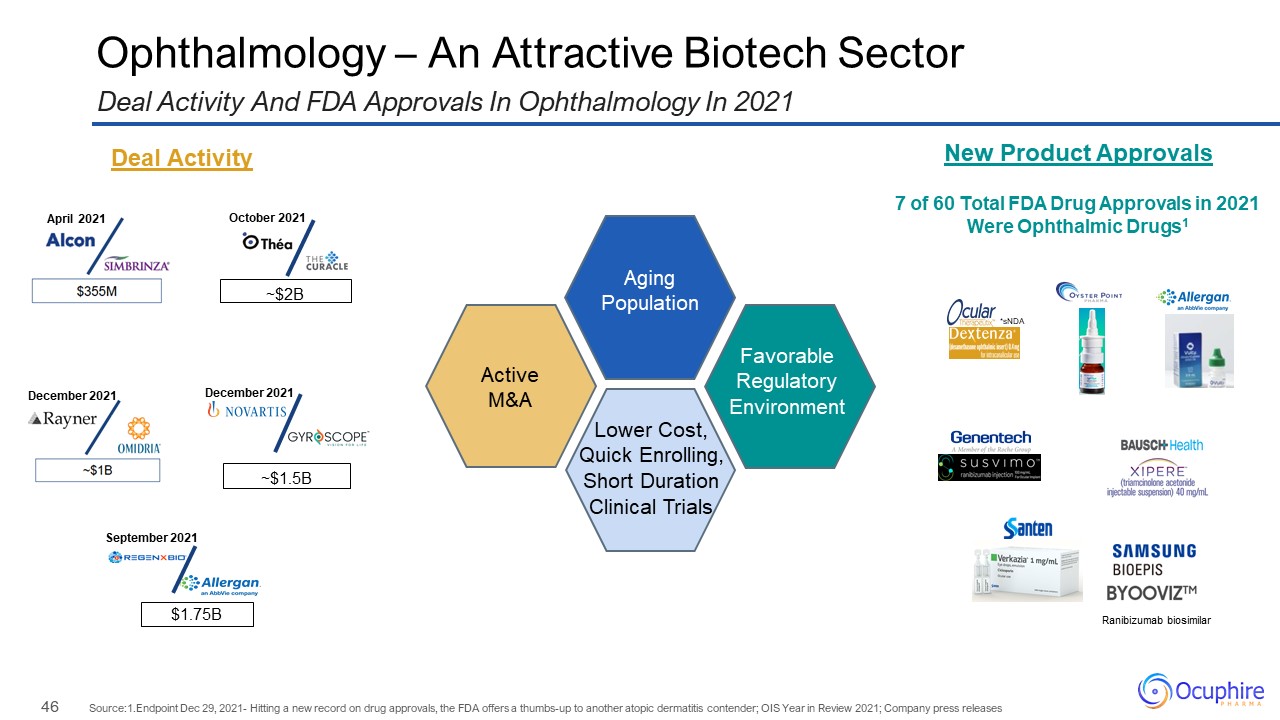

Ophthalmology – An Attractive Biotech Sector FavorableRegulatoryEnvironment Source:1.Endpoint Dec

29, 2021- Hitting a new record on drug approvals, the FDA offers a thumbs-up to another atopic dermatitis contender; OIS Year in Review 2021; Company press releases Deal Activity And FDA Approvals In Ophthalmology In 2021 New Product

Approvals *sNDA ~$2B ~$1.5B $1.75B 7 of 60 Total FDA Drug Approvals in 2021 Were Ophthalmic Drugs1 AgingPopulation Ranibizumab biosimilar ActiveM&A April 2021 October 2021 December 2021 December 2021 September

2021 Lower Cost,Quick Enrolling,Short Duration Clinical Trials Deal Activity

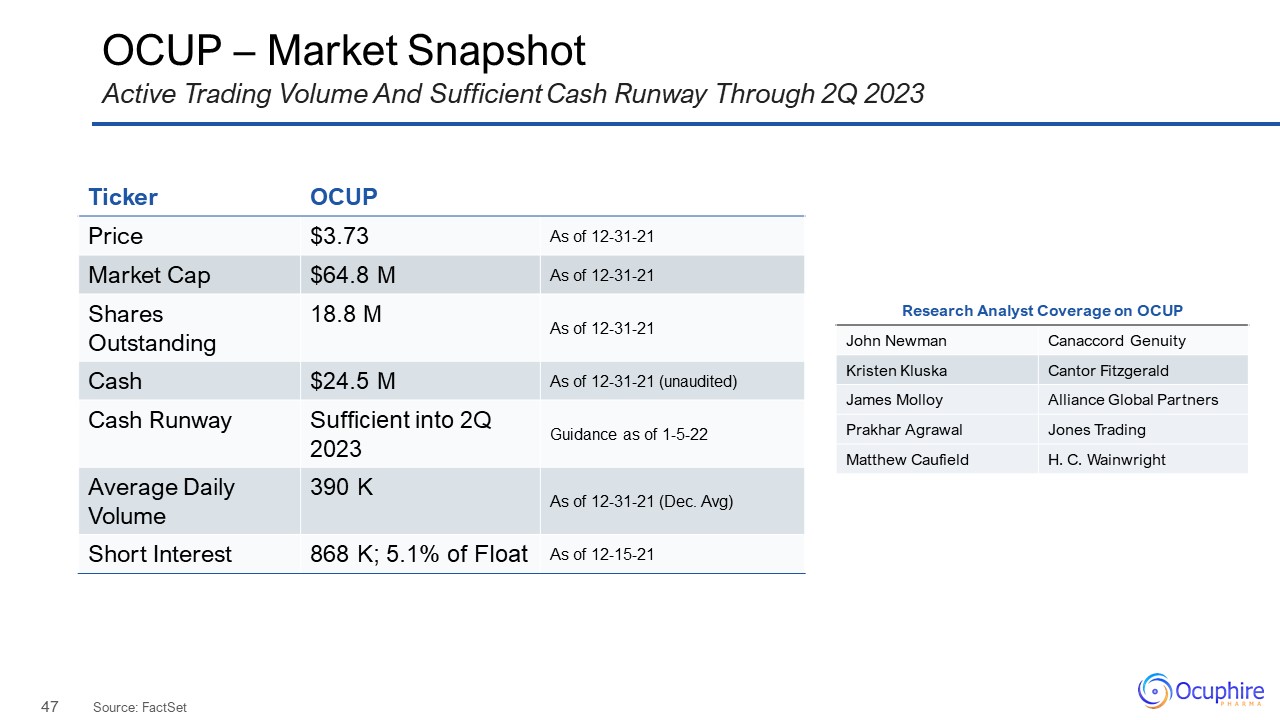

OCUP – Market Snapshot Source: FactSet Active Trading Volume And Sufficient Cash Runway Through 2Q

2023 Ticker OCUP Price $3.73 As of 12-31-21 Market Cap $64.8 M As of 12-31-21 Shares Outstanding 18.8 M As of 12-31-21 Cash $24.5 M As of 12-31-21 (unaudited) Cash Runway Sufficient into 2Q 2023 Guidance as of

1-5-22 Average Daily Volume 390 K As of 12-31-21 (Dec. Avg) Short Interest 868 K; 5.1% of Float As of 12-15-21 Research Analyst Coverage on OCUP John Newman Canaccord Genuity Kristen Kluska Cantor Fitzgerald James Molloy Alliance

Global Partners Prakhar Agrawal Jones Trading Matthew Caufield H. C. Wainwright

[email protected] Ocuphire Pharma

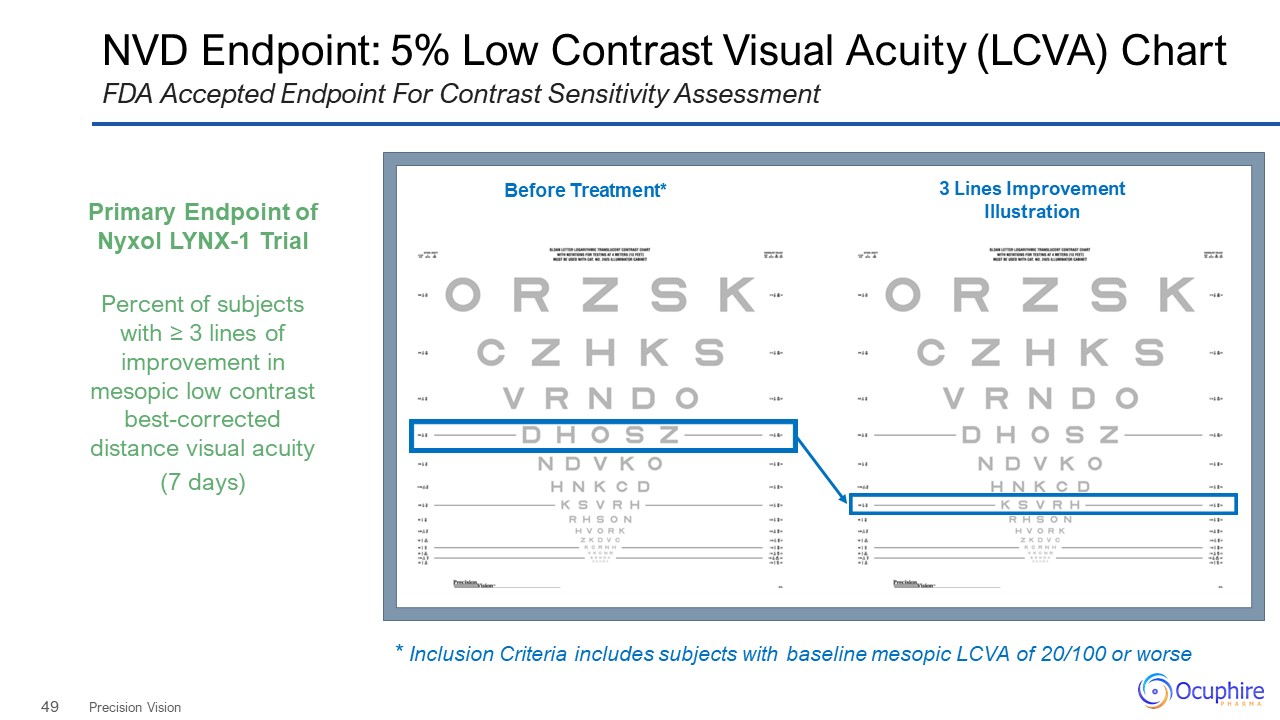

NVD Endpoint: 5% Low Contrast Visual Acuity (LCVA) Chart Precision Vision FDA Accepted Endpoint For

Contrast Sensitivity Assessment Before Treatment* 3 Lines Improvement Illustration Primary Endpoint of Nyxol LYNX-1 Trial Percent of subjects with ≥ 3 lines of improvement in mesopic low contrast best-corrected distance visual acuity (7

days) * Inclusion Criteria includes subjects with baseline mesopic LCVA of 20/100 or worse

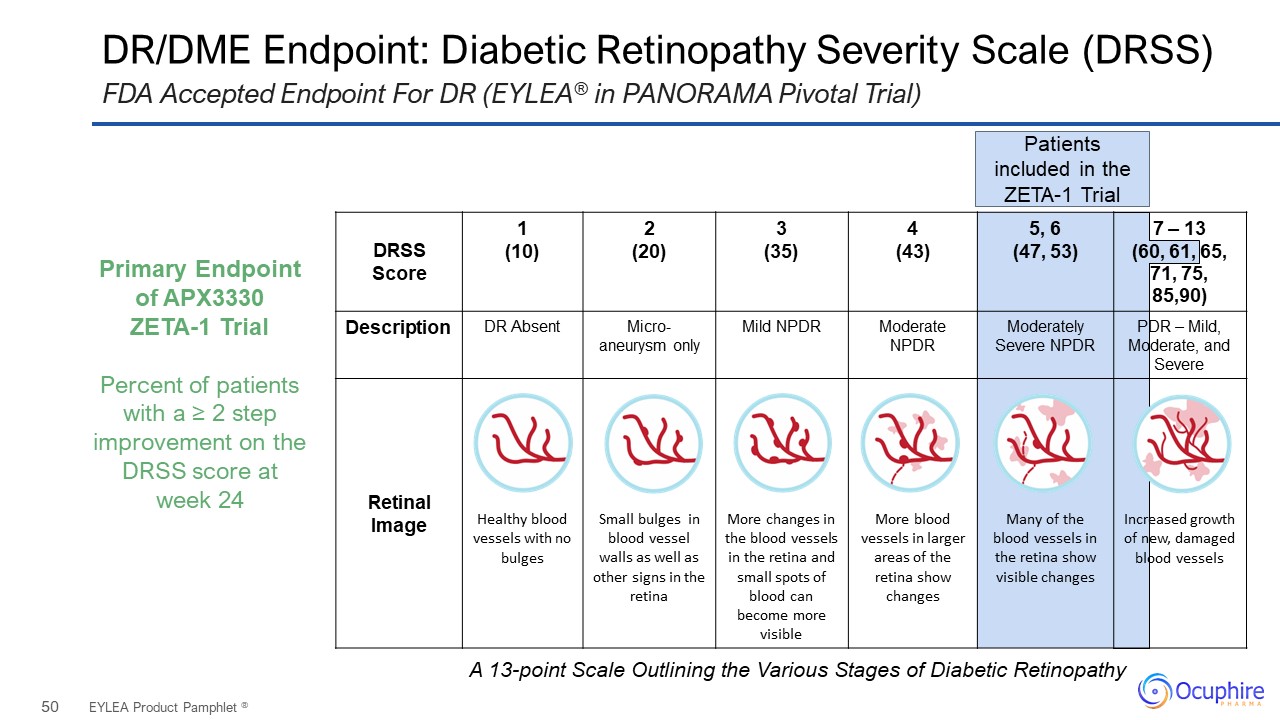

DR/DME Endpoint: Diabetic Retinopathy Severity Scale (DRSS) EYLEA

Product Pamphlet ® FDA Accepted Endpoint For DR (EYLEA® in PANORAMA Pivotal Trial) Patients included in the ZETA-1 Trial Primary Endpoint of APX3330 ZETA-1 Trial Percent of patients with a ≥ 2 step improvement on the DRSS score at week

24 A 13-point Scale Outlining the Various Stages of Diabetic Retinopathy DRSS Score 1 (10) 2 (20) 3 (35) 4 (43) 5, 6 (47, 53) 7 – 13 (60, 61, 65, 71, 75, 85,90) Description DR Absent Micro-aneurysm only Mild NPDR Moderate

NPDR Moderately Severe NPDR PDR – Mild, Moderate, and Severe Retinal Image Healthy blood vessels with no bulges Small bulges in blood vessel walls as well as other signs in the retina More changes in the blood vessels in

the retina and small spots of blood can become more visible More blood vessels in larger areas of the retina show changes Many of the blood vessels in the retina show visible changes Increased growth of new, damaged blood vessels