| | | PROPOSED MERGER YOUR VOTE IS VERY IMPORTANT | | |  |

Douglas J. Swirsky | | | Mina Sooch |

President and CEO, Rexahn Pharmaceuticals, Inc. | | | President and CEO, Ocuphire Pharma, Inc. |

Delaware (State or other jurisdiction of incorporation or organization) | | | 2834 (Primary Standard Industrial Classification Code Number) | | | 11-3516358 (I.R.S. Employer Identification Number) |

Asher M. Rubin William I. Intner Hogan Lovells US LLP 100 International Drive, Suite 2000 Baltimore, MD 21202 (410) 659-2700 | | | Mina Sooch President & Chief Executive Officer Ocuphire Pharma, Inc. 37000 Grand River Ave, Suite 120 Farmington Hills, MI 48335 (248) 681-9815 | | | Phillip D. Torrence Jeffrey H. Kuras Emily J. Johns Honigman LLP 650 Trade Centre Way, Suite 200 Kalamazoo, MI 49002-0402 (269) 337-7700 |

Large accelerated filer | | | ☐ | | | | | Accelerated filer | | | ☐ | |

Non-accelerated filer | | | ☒ | | | | | Smaller reporting company | | | ☒ | |

| | | | | | | Emerging growth company | | | ☐ |

Title of Each Class of Security to be Registered | | | Amount to be Registered(1) | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price(2) | | | Amount of Registration Fee(3) |

Common stock, $0.0001 par value per share | | | 75,043,772 | | | N/A | | | $336.95 | | | $1.00 |

(1) | Represents the maximum number of shares of common stock, $0.0001 par value per share (“Rexahn common stock”), of Rexahn Pharmaceuticals, Inc., a Delaware corporation (“Rexahn”), issuable to holders of common stock, $0.0001 par value per share (“Ocuphire common stock”), and options of Ocuphire Pharma, Inc., a Delaware corporation (“Ocuphire”), in the proposed merger of Razor Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Rexahn (“Merger Sub”), with and into Ocuphire (the “merger”). The amount of Rexahn common stock to be registered is based on the estimated maximum number of shares of Rexahn common stock that are expected to be issued pursuant to the merger, after taking into account the expected issuance by Ocuphire immediately prior to the merger of an estimated 4,462,544 shares of Ocuphire common stock (3,346,908 of which will be held in escrow for the benefit of certain accredited investors) pursuant to an amended and restated securities purchase agreement, dated June 29, 2020, by and among Ocuphire, Rexahn and certain accredited investors, and assuming an exchange ratio calculated by assuming a minimum “Parent Valuation” of $12.0 million and “Parent Outstanding Shares” of 5,019,141 (which amount includes shares of Rexahn common stock that may be issued by Rexahn in exchange for warrants of Rexahn that are currently outstanding), conversion of Ocuphire convertible notes on November 14, 2020, and without giving effect to a reverse stock split of Rexahn common stock expected to be completed immediately prior to the merger. |

(2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(f)(2) of the Securities Act of 1933, as amended (the “Securities Act”). Ocuphire is a private company, no market exists for its securities, and Ocuphire has an accumulated capital deficit. Therefore, the proposed maximum aggregate offering price is one-third of the aggregate par value of the Ocuphire securities expected to be exchanged in the proposed merger. |

(3) | This fee has been calculated pursuant to Section 6(b) of the Securities Act and has been rounded up to $1.00. Rexahn previously paid this amount. |

| | | PROPOSED MERGER YOUR VOTE IS VERY IMPORTANT | | |  |

Douglas J. Swirsky | | | Mina Sooch |

President and CEO, Rexahn Pharmaceuticals, Inc. | | | President and CEO, Ocuphire Pharma, Inc. |

1. | to consider and vote upon a proposal to approve the issuance of shares of Rexahn common stock, $0.0001 par value per share (“Rexahn common stock”), to stockholders of Ocuphire pursuant to the terms of the Agreement and Plan of Merger and Reorganization, dated as of June 17, 2020, by and among Rexahn, Merger Sub and Ocuphire, as amended by the First Amendment to Agreement and Plan of Merger and Reorganization dated June 29, 2020, a copy of which is attached as Annex A to this proxy statement/prospectus/information statement (as amended, the “Merger Agreement”), and the change of control of Rexahn resulting from the merger under The Nasdaq Stock Market LLC rules; |

2. | to consider and vote upon an amendment to the amended and restated certificate of incorporation of Rexahn, as amended (the “Rexahn Certificate of Incorporation”), to effect a reverse stock split of Rexahn common stock, at a ratio within the range of 1-for-3 to 1-for-5, with such specific ratio to be approved by the Rexahn Board, in the form attached as Annex B to this proxy statement/prospectus/information statement; |

3. | to consider and vote upon an amendment to the Rexahn Certificate of Incorporation to change the corporate name of Rexahn from “Rexahn Pharmaceuticals, Inc.” to “Ocuphire Pharma, Inc.”, in the form attached as Annex C to this proxy statement/prospectus/information statement; |

4. | to consider and vote upon a proposal to approve the adoption of the Ocuphire Pharma, Inc. 2020 Equity Incentive Plan in the form attached as Annex D to this proxy statement/prospectus/information statement (the “Ocuphire 2020 Plan”); |

5. | to consider and vote upon a proposal to approve the issuance of: (i) shares of Rexahn common stock upon the exercise of the Investor Warrants to be issued in the Pre-Merger Financing, and (ii) additional shares of Rexahn common stock that may be issued following the closing of the Pre-Merger Financing, in each case pursuant to the Amended and Restated Securities Purchase Agreement, dated as of June 29, 2020, by and among Rexahn, Ocuphire and the investors party thereto, and as required by and in accordance with Nasdaq Listing Rule 5635; |

6. | to consider and vote upon an adjournment of the Rexahn special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal No. 1, 2, 3, 4 or 5; and |

7. | to transact such other business as may properly come before the Rexahn special meeting or any adjournment or postponement thereof. |

| | | By Order of the Rexahn Board, | |

| | | ||

| | | Douglas J. Swirsky President and Chief Executive Officer Rockville, Maryland , 2020 |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

Q: | What is the merger? |

A: | Rexahn, Merger Sub and Ocuphire entered into the Agreement and Plan of Merger and Reorganization on June 17, 2020 (the “Original Merger Agreement”). On June 29, 2020, the parties entered into the First Amendment to Agreement and Plan of Merger and Reorganization (the “Merger Agreement Amendment,” and together with the Original Merger Agreement, the “Merger Agreement”). The Merger Agreement contains the terms and conditions of the proposed business combination of Rexahn and Ocuphire. Under the Merger Agreement, Merger Sub will merge with and into Ocuphire, with Ocuphire surviving as a wholly owned subsidiary of Rexahn (the “merger”). |

Q: | What is the Pre-Merger Financing? |

A: | Concurrently with signing the Original Merger Agreement, Ocuphire and Rexahn entered into a securities purchase agreement with certain institutional healthcare investors, accredited investors and certain directors and officers of Ocuphire (the “Investors”). On June 29, 2020, concurrently with the execution of the Merger Agreement Amendment, Ocuphire and Rexahn entered into an amended and restated securities purchase agreement (as may be amended from time to time, the “Securities Purchase Agreement”) with the Investors, pursuant to which, among other things, (i) Ocuphire agreed to issue to the Investors shares of Ocuphire common stock (the “Initial Shares”) and to issue to an escrow account for the benefit of the Investors three times the number of Initial Shares of Ocuphire common stock (the “Additional Shares” and together with the Initial Shares, the “Pre-Merger Financing Shares”), in each case immediately prior to the merger to be exchanged for shares of Rexahn common stock at the closing of the merger, and (ii) Rexahn agreed to issue to the Investors warrants to purchase shares of Rexahn common stock on the tenth trading day following the consummation of the merger (the “warrant closing date”) (the “Investor Warrants”), and subject to certain conditions set forth in the Securities Purchase Agreement, to issue to the Investors all or a portion of the shares of Rexahn common stock from the escrow account, in a private placement transaction for an aggregate purchase price of approximately $21,150,000 (the “Pre-Merger Financing”). |

Q: | What will Ocuphire securityholders receive in the merger? |

A: | The Exchange Ratio at the closing of the merger (the “Closing”) would be approximately 4.3812, assuming (i) the Ocuphire convertible notes converted on September 10, 2020, (ii) the Parent Cash Amount is $1.9 million on the Anticipated Closing Date, (iii) there are 4,483,198 shares of Rexahn common stock outstanding as of the Closing (on a pre-Rexahn Reverse Stock Split basis) and (iv) there are 6,806,019 shares of Ocuphire common stock and options exercisable for Ocuphire common stock (each, an “Ocuphire Option,” each holder of an Ocuphire Option an “Ocuphire Optionholder” and, collectively with the Ocuphire Stockholders, “Ocuphire Securityholders”) outstanding as of the Closing (giving effect to the Initial Shares issued in the Pre-Merger Financing, and shares issuable upon the conversion of the Ocuphire convertible notes). |

Q: | What will Rexahn Securityholders receive in the merger? |

A: | At the Effective Time, Rexahn Stockholders will continue to own and hold their existing shares of Rexahn common stock. |

Q: | What will happen to Rexahn if, for any reason, the merger does not close? |

A: | If, for any reason, the merger does not close, the Rexahn Board may elect to, among other things, attempt to complete another strategic transaction like the merger, attempt to sell or otherwise dispose of the various assets of Rexahn, resume its research and development activities and continue to operate the business of Rexahn or dissolve and liquidate its assets. If Rexahn decides to dissolve and liquidate its assets, Rexahn would be required to pay all of its debts and contractual obligations, and to set aside certain reserves for potential future claims, and there can be no assurances as to the amount or timing of available cash left, if any, to distribute to stockholders after paying the debts and other obligations of Rexahn and setting aside funds for reserves. If Rexahn were to continue its business, it would need to raise a substantial amount of cash to fund ongoing operations and future development activities for its existing product candidates and any new product candidates that it acquires. |

Q: | Why are the two companies proposing to merge? |

A: | Ocuphire and Rexahn believe that the merger will result in a clinical-stage ophthalmic biopharmaceutical company focused on developing and commercializing therapies for the treatment of eye disorders. For a discussion of Rexahn’s and Ocuphire’s reasons for the merger, please see the section entitled “The Merger—Rexahn Reasons for the Merger” and “The Merger—Ocuphire Reasons for the Merger” in this proxy statement/prospectus/information statement. |

Q: | Why am I receiving this proxy statement/prospectus/information statement? |

A: | You are receiving this proxy statement/prospectus/information statement because you have been identified as a Rexahn Stockholder or an Ocuphire Stockholder as of the applicable record date, and you are entitled, as applicable, to (i) notice of, and to vote at, the Rexahn special meeting or (ii) sign and return to Ocuphire the written consent. This document serves as: |

• | a proxy statement of Rexahn used to solicit proxies for the Rexahn special meeting; |

• | a prospectus of Rexahn used to offer shares of Rexahn common stock in exchange for shares of Ocuphire common stock in the merger and issuable upon exercise of Ocuphire Options; and |

• | an information statement of Ocuphire used to solicit the written consent of Ocuphire Stockholders for the adoption of the Merger Agreement and the approval of the merger and related transactions. |

Q: | What is required to consummate the merger? |

A: | To consummate the merger, Rexahn Stockholders must approve (i) the issuance of Rexahn common stock to Ocuphire Stockholders pursuant to the Merger Agreement and the change of control of Rexahn resulting from the merger under Nasdaq rules (Proposal No. 1) and (ii) the Rexahn Reverse Stock Split (Proposal No. 2). The merger may also not be consummated if Proposal Nos. 3 or 5 are not approved as approval of such proposals is also a condition to Closing under the Merger Agreement. Ocuphire Stockholders must adopt the Merger Agreement, thereby approving the merger and the related transactions. |

Q: | What stockholder votes are required to approve the proposals required in connection with the merger at the Rexahn special meeting? |

Q: | Who will be the directors of Rexahn following the merger? |

A: | Following the consummation of the merger, the size of the Rexahn Board is expected to be comprised of seven directors. Pursuant to the terms of the Merger Agreement, the Rexahn Board will be reconstituted such that six of the initial post-Closing directors will be designated by Ocuphire, and one initial post-Closing director will be designated by Rexahn. It is currently anticipated that, following the Closing, the Rexahn Board will be constituted as follows: |

Name | | | Current Principal Affiliation |

Mina Sooch | | | Ocuphire Pharma, Inc., President, Chief Executive Officer and Director |

Sean Ainsworth | | | Ocuphire Pharma, Inc., Director |

Alan R. Meyer | | | Ocuphire Pharma, Inc., Director |

James S. Manuso | | | Ocuphire Pharma, Inc., Director |

Cam Gallagher | | | Ocuphire Pharma, Inc., Director |

Richard J. Rodgers | | | Rexahn Pharmaceuticals, Inc., Director |

Susan K. Benton | | | Thea Pharma, Inc., General Manager and Head of the U.S. |

Q: | Who will be the executive officers of Rexahn immediately following the merger? |

A: | Immediately following the consummation of the merger, the executive management team of Rexahn is expected to be composed solely of the members of Ocuphire’s executive management team prior to the merger, as follows: |

Name | | | Title |

Mina Sooch, MBA | | | President, Chief Executive Officer & Treasurer |

Bernhard Hoffmann, MBA | | | VP of Corporate Development & Finance, Secretary |

Q: | What are the material U.S. federal income tax consequences of the merger? |

A: | In the opinion of Honigman LLP (“Honigman”), counsel to Ocuphire, and subject to the Tax Opinion Representations and Assumptions (as defined on page 158), the merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Subject to the limitations and qualifications described in the section entitled “The Merger—Material U.S. Federal Income Tax Consequences of the Merger,” a U.S. Holder (as defined on page 157) of Ocuphire common stock will not recognize any gain or loss for U.S. federal income tax purposes on the exchange of shares of Ocuphire common stock for shares of Rexahn common stock in the merger, except with respect to cash received by such U.S. Holder of Ocuphire common stock in lieu of a fractional share of Rexahn common stock. If any of the Tax Opinion Representations and Assumptions is incorrect, incomplete or inaccurate or is violated, the accuracy of the opinion described above may be affected and the U.S. federal income tax consequences of the merger could differ from those described in this proxy statement/prospectus/information statement. |

Q: | What are the material U.S. federal income tax consequences of the receipt of CVRs and the Rexahn Reverse Stock Split to Rexahn U.S. Holders? |

A: | In the opinion of Hogan Lovells US LLP, Rexahn’s legal counsel, based on the facts, representations and assumptions set forth herein, the issuance of the CVRs to Rexahn U.S. Holders (as defined on page 185) under the terms expressed in the form of the CVR Agreement included in Annex G to this proxy statement/prospectus/information statement is more likely than not to be treated as a distribution of property with respect to Rexahn common stock. Please review the information in the section entitled “Agreements Related to the Merger—Contingent Value Rights Agreement—Material U.S. Federal Income Tax Consequences of the Receipt of CVRs” for a more complete description of the material U.S. federal income tax consequences of the receipt of CVRs to Rexahn U.S. Holders, including possible alternative treatments. |

Q: | As a Rexahn Stockholder, how does the Rexahn Board recommend that I vote? |

A: | After careful consideration, the Rexahn Board recommends that Rexahn Stockholders vote “FOR” all of the proposals described in this proxy statement/prospectus/information statement. |

Q: | As an Ocuphire Stockholder, how does the Ocuphire Board recommend that I vote? |

A: | After careful consideration, the Ocuphire Board recommends that Ocuphire Stockholders execute the written consent to approve a certificate of amendment to Ocuphire’s certificate of incorporation, as amended (the “Ocuphire Certificate of Incorporation”) to increase the authorized shares of Ocuphire common stock, the merger, the Merger Agreement, and the transactions contemplated therein, substantially in accordance with the terms of the Merger Agreement and the other agreements contemplated by the Merger Agreement. |

Q: | What risks should I consider in deciding whether to vote in favor of the merger or to execute and return the written consent, as applicable? |

A: | You should carefully review the section entitled “Risk Factors” in this proxy statement/prospectus/information statement which sets forth certain risks and uncertainties related to the merger, risks and uncertainties to which the combined company’s business will be subject, and risks and uncertainties to which each of Rexahn and Ocuphire, as independent companies, are subject. |

Q: | Who can vote at the Rexahn special meeting? |

A: | Only Rexahn Stockholders of record at the close of business on the Record Date will be entitled to vote at the Rexahn special meeting. As of the Record Date, there were 4,483,198 shares of Rexahn common stock outstanding and entitled to vote. |

Q: | How many votes do I have? |

A: | On each matter to be voted upon, you have one vote for each share of Rexahn common stock you own as of the Record Date. |

Q: | What is the quorum requirement? |

A: | A quorum of Rexahn Stockholders is necessary to hold a valid meeting. A quorum will be present if Rexahn Stockholders holding at least 40% of the issued and outstanding shares of Rexahn common stock entitled to vote at the Rexahn special meeting are present in person or represented by proxy at the Rexahn special meeting. As of the Record Date, there were 4,483,198 shares of Rexahn common stock outstanding and entitled to vote. Accordingly, Rexahn expects that the holders of at least 1,793,280 shares of Rexahn common stock must be present at the Rexahn special meeting for a quorum to exist. Your shares of Rexahn common stock will be counted toward the quorum at the Rexahn special meeting only if you attend the Rexahn special meeting in person or are represented at the Rexahn special meeting by proxy. |

Q: | What are “broker non-votes?” |

A: | If you hold shares beneficially in street name and do not provide your broker or other agent with voting instructions, your shares may constitute “broker non-votes.” Broker non-votes occur on a matter when banks, brokers and other nominees are not permitted to vote on certain non-discretionary matters without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Proposal Nos. 1, 4 and 5 are anticipated to be non-routine matters, and Proposal Nos. 2, 3, and 6 are anticipated to be routine matters. Broker non-votes will have no effect on the outcome of Proposal Nos. 1, 4, and 5. |

Q: | When do you expect the merger to be consummated? |

A: | Rexahn and Ocuphire anticipate that the merger will occur sometime soon after the Rexahn special meeting to be held on Monday, November 2, 2020, but the companies cannot predict the exact timing. For more information, please see the section entitled “The Merger Agreement—Conditions to the Completion of the Merger” in this proxy statement/prospectus/information statement. |

Q: | What do I need to do now? |

A: | Rexahn and Ocuphire urge you to read this proxy statement/prospectus/information statement carefully, including its annexes, and to consider how the merger affects you. |

Q: | What happens if I do not return a proxy card or otherwise provide proxy instructions, as applicable? |

A: | If you are a Rexahn Stockholder of record, the failure to return your proxy card or otherwise provide proxy instructions will have the same effect as voting “AGAINST” Proposal Nos. 2 and 3. |

Q: | When and where is the Rexahn special meeting and may I vote in person? |

A: | The Rexahn special meeting will be held at Rexahn’s offices located at 15245 Shady Grove Road, Suite 455, Rockville, MD 20850, at 8:00 a.m., Eastern Time, on Monday, November 2, 2020. Subject to space availability, all Rexahn Stockholders as of the Record Date, or their duly appointed proxies, may attend the Rexahn special meeting. Since seating is limited, admission to the Rexahn special meeting will be on a first-come, first-served basis. Registration and seating will begin at 7:30 a.m., Eastern Time. If your shares of Rexahn common stock are registered directly in your name with Rexahn’s transfer agent, you are considered to be the stockholder of record with respect to those shares, and the proxy materials and proxy card are being sent directly to you by Rexahn. If you are a stockholder of record, you may attend the Rexahn special meeting and vote your shares in person. Even if you plan to attend the Rexahn special meeting in person, Rexahn requests that you sign and return the enclosed proxy to ensure that your shares will be represented at the Rexahn special meeting if you become unable to attend. If your shares of Rexahn common stock are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials are being forwarded to you by your broker or other nominee together with a voting instruction card. As the beneficial owner, you are also invited to attend the Rexahn special meeting. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Rexahn special meeting unless you obtain a proxy from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Rexahn special meeting. |

Q: | If my Rexahn shares are held in “street name” by my broker, will my broker vote my shares for me? |

A: | Unless your broker has discretionary authority to vote on certain matters, your broker will not be able to vote your shares of Rexahn common stock without instructions from you. Brokers are not expected to have discretionary authority to vote for any of the proposals other than Proposal Nos. 2, 3, and 6. To make sure that your vote is counted, you should instruct your broker to vote your shares, following the procedures provided by your broker. |

Q: | May I change my vote after I have submitted a proxy or provided proxy instructions? |

A: | Rexahn Stockholders of record may change their vote at any time before their proxy is voted at the Rexahn special meeting in one of three ways. First, a Rexahn Stockholder of record can send a written notice to the Secretary of Rexahn stating that it would like to revoke its proxy. Second, a Rexahn Stockholder of record can submit new proxy instructions either on a new proxy card or via telephone or the Internet. Third, a Rexahn Stockholder of record can attend the Rexahn special meeting and vote in person. Attendance alone will not revoke a proxy. If a Rexahn Stockholder who owns shares of Rexahn common stock in “street name” has instructed a broker to vote its shares of Rexahn common stock, the stockholder must follow directions received from its broker to change those instructions. |

Q: | Who is paying for this proxy solicitation? |

A: | Rexahn and Ocuphire will share equally the cost of printing and filing this proxy statement/prospectus/information statement and the proxy card. Arrangements will also be made with brokerage firms and other custodians, nominees and fiduciaries who are record holders of Rexahn common stock for the forwarding of solicitation materials to the beneficial owners of Rexahn common stock. Rexahn will reimburse these brokers, custodians, nominees and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding of solicitation materials. |

Q: | Who can help answer my questions? |

A: | If you are a Rexahn Stockholder and would like additional copies, without charge, of this proxy statement/prospectus/information statement or if you have questions about the merger, including the procedures for voting your shares, you should contact: |

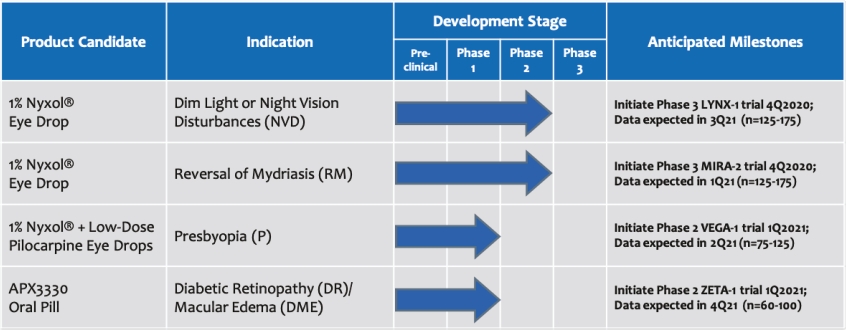

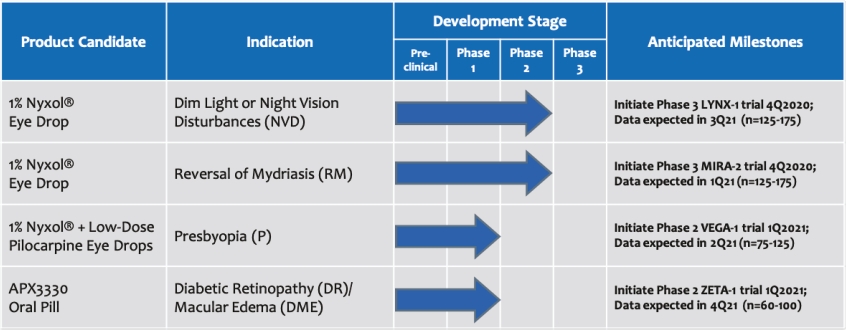

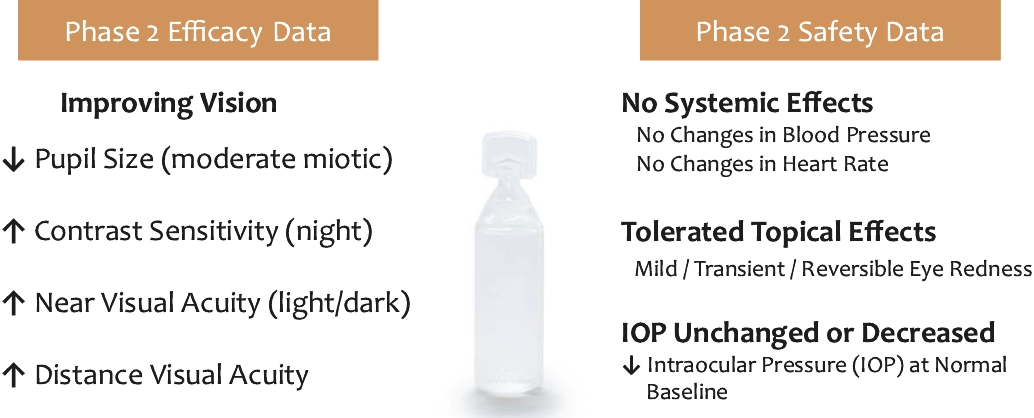

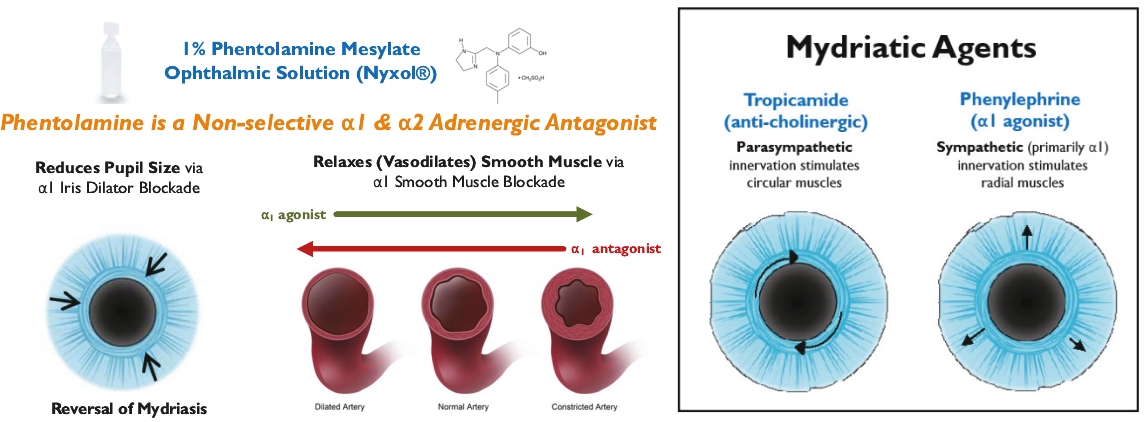

• | Lead Product Candidate Nyxol is Phase 3 Ready in Multiple Indications. Nyxol is being developed for the treatment of multiple indications, which Ocuphire management believes together represent a significant market opportunity. Ocuphire plans to begin Phase 3 trials for NVD and RM in the fourth quarter of 2020, and Phase 2 development for presbyopia in the first quarter of 2021. |

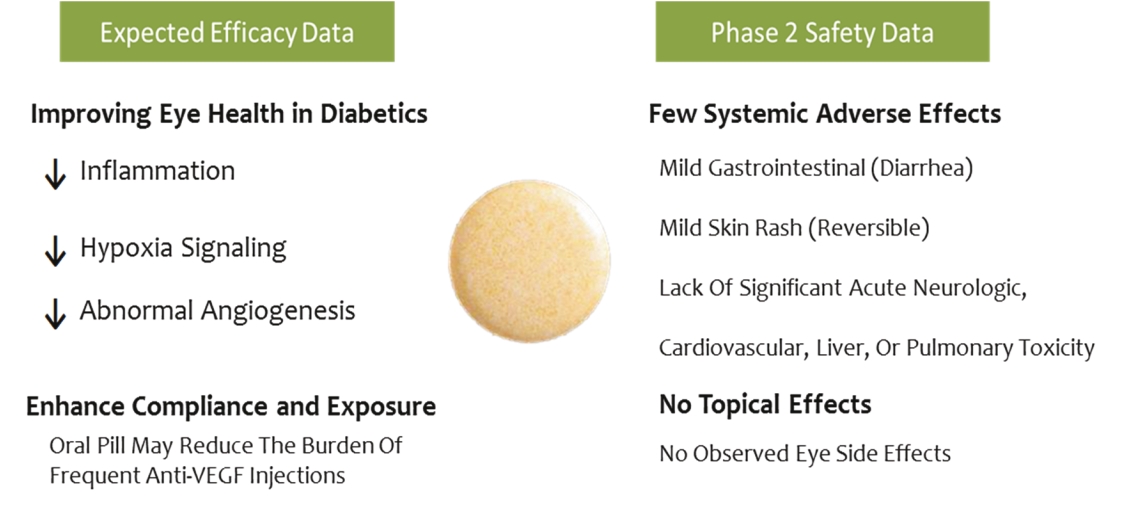

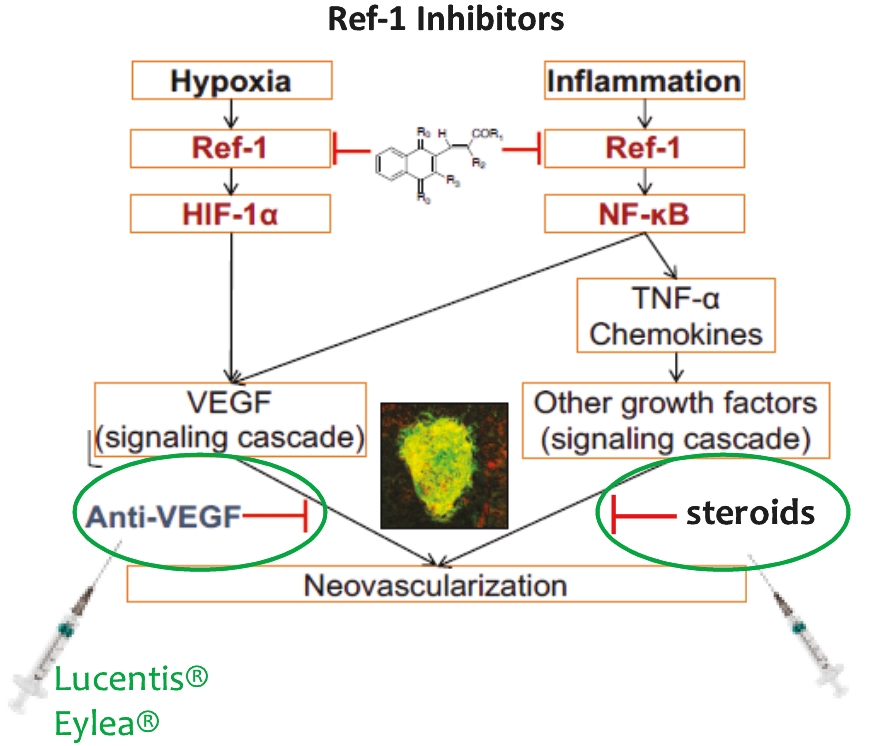

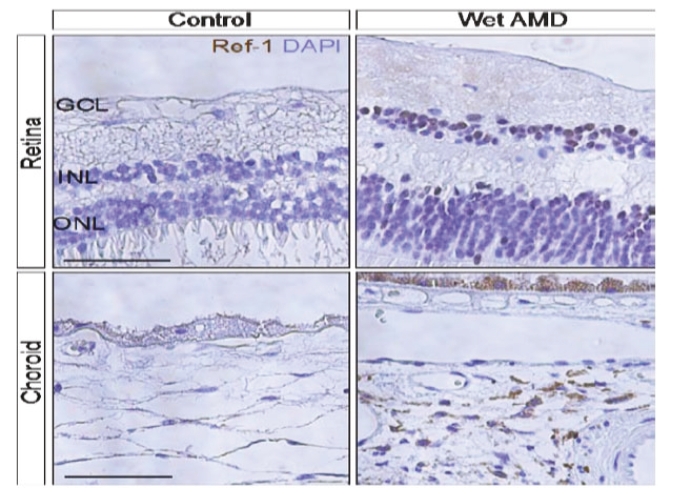

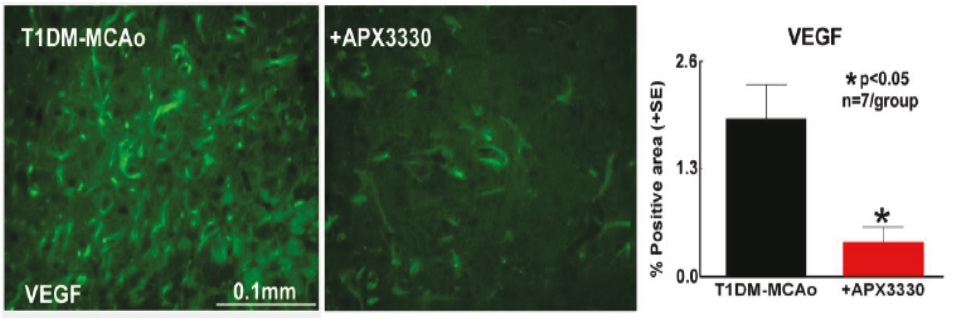

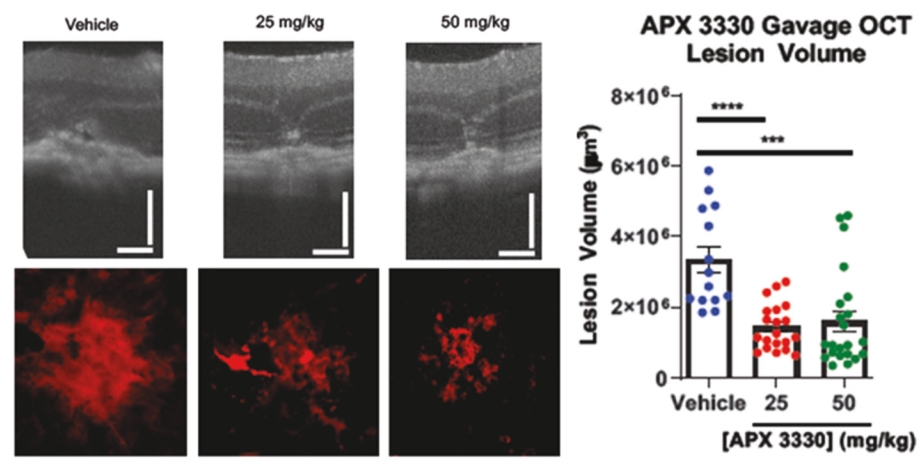

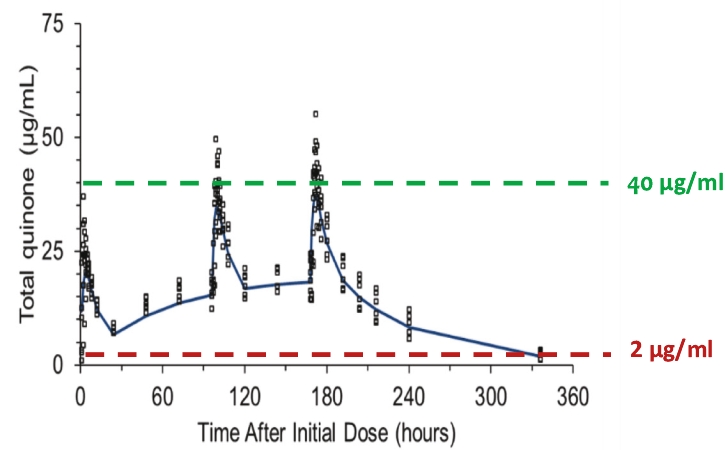

• | Secondary Product Candidate APX3330 to Initiate Phase 2 Clinical Development. APX3330 is being developed for DR and DME, which represents a significant, established market opportunity, with plans to begin its first ophthalmic Phase 2 trial in the first quarter of 2021. APX2009, a second generation preclinical product candidate analog of APX3330, is being investigated for use in wet age-related macular degeneration (“wAMD”). Wet age-related macular degeneration is a chronic and progressive disease where abnormal blood vessels grow underneath the retina and leak blood and fluid into the macula. |

• | Multiple Upcoming Late Clinical Stage Milestones. Ocuphire expects top-line results to read out as early as the first quarter of 2021 and throughout the remainder of 2021 for its four planned clinical trials. |

• | Experienced Management Team. It is expected that the combined organization will be led by the experienced senior management team from Ocuphire and a board of directors from Ocuphire with representation from Rexahn. |

• | Cash Resources. Following the Closing and taking into account proceeds received in the Pre-Merger Financing, the combined company is expected to have sufficient cash at the Closing for the combined company to sustain its operations through 2021. The combined company’s Nasdaq listing will provide it with access to the public market to raise additional funds in the future. |

• | the Rexahn Board’s belief that a go-it-alone scenario poses significant risk, including the risk of dilution to the Rexahn Stockholders, taking into account Rexahn’s business, operational and financial prospects, including its cash position, the limited value given by the marketplace to Rexahn’s product portfolio, uncertainty regarding the potential results from additional preclinical studies and clinical trials, uncertainty regarding the future costs and timeline to support a clinical program of Rexahn’s product candidates, the chances of success in conducting a clinical development program and obtaining regulatory approval, and the need to raise significant additional financing for future clinical and commercial development of Rexahn’s product candidates; |

• | the Rexahn Board’s belief, given the risks associated with clinical development, and based in part on the judgment, advice and analysis of Rexahn senior management with respect to the potential strategic, financial and operational benefits of the merger (which judgment was informed in part by the business, technical, financial and legal due diligence investigation performed by Rexahn with respect to Ocuphire) that Ocuphire’s Phase 3 ready, lead product candidate, Nyxol, for multiple front-of-the-eye (pupil/cornea) indications, as well as its product candidate, APX3330, for multiple back-of-the-eye (retina) conditions, along with the experience of its management and other personnel, and the granting of CVRs to Rexahn Stockholders to provide a potential financial benefit in the event that any of Rexahn’s existing intellectual property is sold or licensed during a future period or Rexahn receives any payments from BioSense or HaiChang, would create more value for Rexahn Stockholders in the long term than Rexahn could create as an independent stand-alone company; |

• | the Rexahn Board’s review of the current development plans of Ocuphire to confirm the likelihood that the combined company would possess sufficient resources, or have access to sufficient resources, to allow Ocuphire senior management to focus on its plans for the continued development of Ocuphire’s product pipeline; |

• | the Rexahn Board’s consideration that the combined company should have sufficient cash at the Closing for the combined company to sustain its operations for the next 18 months at the time of the Rexahn Board’s consideration and the combined company’s public company structure will provide it with access to the public market to raise additional funds in the future; |

• | the Rexahn Board’s consideration of the results of its strategic review process, which included Oppenheimer’s outreach to 50 companies and the receipt of five inbound inquiries, resulting in the receipt of indications of interest from 19 companies. Further, the Rexahn Board’s consideration of the valuation and business prospects of all other strategic transaction candidates involved in its strategic review process, and its collective view that Ocuphire was the most attractive candidate for Rexahn due to, among other things, Ocuphire’s Phase 3 ready asset, Nyxol, as well as its APX3330 product candidate, Ocuphire’s strong financial position that includes backing from a syndicate of investors, the strength of Ocuphire’s management team, the potential market opportunity for Nyxol and APX3330, Ocuphire’s understanding of the potential value of Rexahn’s partnerships with BioSense and HaiChang, and that Ocuphire’s potential to achieve key milestones over the next several years could enable the combined company to access the public markets for additional financial resources; |

• | the Rexahn Board’s conclusion that the merger provides existing Rexahn Stockholders a significant opportunity to participate in the potential growth of the combined company following the merger, while potentially receiving certain cash payments from the grant, sale or transfer of rights to Rexahn’s existing intellectual property or pursuant to payments received by BioSense or HaiChang during a certain period following Closing on account of the CVR Agreement to be executed at the Effective Time; |

• | the Rexahn Board’s consideration that the combined company will be led by an experienced senior management team from Ocuphire and a board of directors with representation from each of the current boards of directors of Rexahn and Ocuphire; |

• | the Rexahn Board’s consideration of the financial analysis of Oppenheimer and the opinion of Oppenheimer delivered to the Rexahn Board on June 17, 2020, to the effect that, as of the date of such opinion, and based upon and subject to the various assumptions made, procedures followed, matters considered and limitations and qualifications on the scope of the review undertaken by Oppenheimer, as set forth in its written opinion, the Exchange Ratio was fair to Rexahn Stockholders, from a financial point of view, and that Oppenheimer’s opinion was based on an estimated Exchange Ratio of 4.3820, which assumed Rexahn would deliver an estimated Parent Cash Amount of $720,000 on the Anticipated Closing Date, resulting in Rexahn Stockholders owning approximately 11.9% of the combined company immediately following consummation of the merger on a fully diluted basis; |

• | Rexahn’s recent results of operations and financial condition; and |

• | the terms of the Merger Agreement, the CVR Agreement, the Pre-Merger Financing transaction documents and associated transactions. |

• | the fact that the Exchange Ratio will be adjusted downward to the extent the Parent Cash Amount is below $3.2 million on the Anticipated Closing Date, and Rexahn’s belief, based on current estimates, that it is reasonably likely to deliver significantly less than $3.2 million on the Anticipated Closing Date; |

• | the fact that the Parent Cash Amount will be reduced by an estimated warrant liability amount to be calculated approximately ten days prior to the Closing, with such estimated warrant liabilities being impacted by, among other things, the stock price of Rexahn common stock on such calculation date; and |

• | the fact that all Rexahn Stockholders may be further diluted based on the price reset provisions and Investor Warrants contemplated by the Pre-Merger Financing and the recognition that the fairness opinion from Oppenheimer did not address the potential additional dilution as a result of such price reset provisions and Investor Warrants. |

• | historical and current information concerning Ocuphire’s business, including its financial performance and condition, operations, management and pre-clinical and clinical data; |

• | the potential value of Nyxol and APX3330 and the ability of the combined company to advance the development of the Nyxol and APX3330 programs; |

• | Ocuphire’s prospects if it were to remain an independent company, including its need to obtain additional financing to continue its operations and the terms on which it would be able to obtain such financing, if at all; |

• | the belief of the Ocuphire Board that no alternatives to the merger were reasonably likely to create greater value for stockholders after reviewing the various strategic options to enhance stockholder value that were considered by the Ocuphire Board; |

• | the potential to provide Ocuphire’s current stockholders with greater liquidity by owning stock in the combined company, a public company; |

• | the expectation that the merger with Rexahn would be a more time- and cost-efficient means to access capital than other options considered by and available to Ocuphire, including private placements, venture debt financings and traditional methods of accessing the public markets through an initial public offering of Ocuphire’s securities; |

• | the anticipated cash resources of the combined company expected to be available at the Closing and the anticipated burn rate of the combined company; |

• | the broader range of investors potentially available to the combined company as a public company to support the development of Ocuphire’s product candidates, as compared with the investors to which Ocuphire could otherwise gain access if it continued to operate as a privately held company; |

• | the ability to improve Ocuphire’s balance sheet through the conversion of the Ocuphire convertible notes and accrued interest into common stock; |

• | the expectation that substantially all of Ocuphire’s employees, particularly its management, will serve in similar roles at the combined company; |

• | the expectation that the merger will be treated as a tax-free reorganization for U.S. federal income tax purposes, with the result that Ocuphire Stockholders will not recognize taxable gain or loss for U.S. federal income tax purposes upon the exchange of Ocuphire common stock for Rexahn common stock pursuant to the merger; |

• | the terms and conditions of the Merger Agreement, including, without limitation, the following: |

• | the expected relative percentage ownership of Rexahn Stockholders and Ocuphire Stockholders in the combined company at the Closing and the implied valuation of Ocuphire and Rexahn; |

• | the parties’ representations, warranties and covenants and the conditions to their respective obligations; and |

• | the limited number and nature of the conditions of the obligation of Rexahn to consummate the merger; and |

• | the likelihood that the merger will be consummated on a timely basis. |

• | solicit, initiate or knowingly encourage, induce or facilitate the communication, making, submission or announcement of, any “acquisition proposal” or “acquisition inquiry” (each as defined below) or take any action that could reasonably be expected to lead to an acquisition proposal or acquisition inquiry; |

• | furnish any non-public information with respect to it to any person in connection with or in response to an acquisition proposal or acquisition inquiry; |

• | engage in discussions or negotiations with any person with respect to any acquisition proposal or acquisition inquiry; |

• | approve, endorse or recommend an acquisition proposal; |

• | execute or enter into any letter of intent or similar document or any contract contemplating or otherwise relating to any “acquisition transaction” as defined below (other than a confidentiality agreement permitted by the Merger Agreement); or |

• | publicly propose to do any of the above. |

Name | | | Age | | | Position |

Executive Officers | | | | | ||

Mina Sooch | | | 52 | | | President, Chief Executive Officer, Treasurer, Director, Vice Chair |

Bernhard Hoffmann | | | 65 | | | VP of Corporate Development and Finance, Secretary |

| | | | | |||

Non-Employee Directors | | | | | ||

Sean Ainsworth | | | 52 | | | Director, Lead Independent Director |

James S. Manuso | | | 72 | | | Director |

Cam Gallagher | | | 51 | | | Director, Chair of the Board |

Alan R. Meyer | | | 67 | | | Director |

Richard J. Rodgers | | | 53 | | | Director |

Susan K. Benton | | | 56 | | | Director |

• | Rexahn and Ocuphire securityholders may not realize a benefit from the merger commensurate with the ownership dilution they will experience in connection with the merger and the Pre-Merger Financing. |

• | The Exchange Ratio set forth in the Merger Agreement is adjustable based on the Parent Cash Amount, so the relative ownership of the combined company as between current Rexahn Stockholders and current Ocuphire Securityholders may change based on, among other things, Rexahn’s interim cash burn prior to the Closing and the estimated warrant liabilities associated with the Rexahn Warrants. |

• | The market price of Rexahn common stock will impact the estimated warrant liability amount in the calculation of the Parent Cash Amount, and if the market price of Rexahn common stock continues to increase, Rexahn may not be able to satisfy the minimum Parent Cash Amount requirement in the Merger Agreement or, if Ocuphire waives the minimum Parent Cash Amount condition, Rexahn Stockholders may own significantly less of the combined company than currently estimated. |

• | Rexahn has issued and may issue additional shares of Rexahn common stock or other Rexahn securities before Closing in exchange for outstanding Rexahn warrants, which has diluted and would further dilute the ownership interests of current Rexahn Stockholders. |

• | The merger consideration at the Closing may have a greater or lesser value than at the time the Merger Agreement was signed. |

• | Failure to complete the merger may result in either Rexahn or Ocuphire paying a termination fee to the other party and could significantly harm the market price of Rexahn common stock and negatively affect the future business and operations of each company. |

• | The issuance of Rexahn common stock to Ocuphire Stockholders pursuant to the Merger Agreement and the resulting change in control from the merger must be approved by Rexahn Stockholders, and the Merger Agreement and transactions contemplated thereby must be approved by the Ocuphire Stockholders. Failure to obtain these approvals would prevent the Closing. |

• | The merger may be completed even though certain events occur prior to the Closing that materially and adversely affect Rexahn or Ocuphire. |

• | Some Rexahn and Ocuphire officers and directors have interests in the merger that are different from the respective stockholders of Rexahn and Ocuphire and that may influence them to support or approve the merger without regard to the interests of the respective stockholders of Rexahn and Ocuphire. |

• | The market price of Rexahn common stock following the merger may decline as a result of the merger. |

• | Rexahn Stockholders and Ocuphire Securityholders will have a reduced ownership and voting interest in, and will exercise less influence over the management of, the combined company following the Closing as compared to their current ownership and voting interest in the respective companies. |

• | The combined company will need to raise additional capital by issuing securities or debt or through licensing or other strategic arrangements, which may cause dilution to the combined company's stockholders or restrict the combined company's operations or impact its proprietary rights. |

• | During the pendency of the merger, Rexahn and Ocuphire may not be able to enter into a business combination with another party at a favorable price because of restrictions in the Merger Agreement, which could adversely affect their respective businesses. |

• | Certain provisions of the Merger Agreement may discourage third parties from submitting alternative takeover proposals, including proposals that may be superior to the arrangements contemplated by the Merger Agreement. |

• | Because the lack of a public market for Ocuphire common stock makes it difficult to evaluate the value of Ocuphire common stock, the Ocuphire Stockholders may receive shares of Rexahn common stock in the merger that have a value that is less than, or greater than, the fair market value of Ocuphire common stock. |

• | If the conditions to the merger are not met or waived, the merger will not occur. |

• | Rexahn and Ocuphire do not anticipate that the combined company will pay any cash dividends in the foreseeable future. |

• | Future sales of shares by existing stockholders could cause the combined company’s stock price to decline. |

• | The Pre-Merger Financing may not be satisfied. |

• | Litigation relating to the merger could require Rexahn or Ocuphire to incur significant costs and suffer management distraction, and could delay or enjoin the merger. |

• | The historical unaudited pro forma condensed combined financial information may not be representative of the combined company’s results after the merger. |

• | Ocuphire’s risk-adjusted projections, which Oppenheimer relied on for its fairness opinion delivered to the Rexahn Board, assume that Ocuphire’s product candidates receive FDA approval. Ocuphire’s failure to obtain such FDA approval would adversely impact the combined company’s potential to generate revenue, its business and its results of operations. |

• | The opinion received by the Rexahn Board from Oppenheimer is subject to a number of assumptions and it has not been, and is not expected to be, updated to reflect changes in circumstances that may have occurred since the date of the opinion. |

| | | For the Year Ended December 31, | | | Six Months Ended June 30, | ||||||||||||||||

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2020 (unaudited) | | | 2019 (unaudited) | |

Statement of Operations Data: | | | | | | | | | | | | | | | |||||||

Revenues | | | $— | | | $— | | | $— | | | $— | | | $— | | | $1,150,000 | | | $— |

Operating expenses: | | | | | | | | | | | | | | | |||||||

General and administrative | | | 5,738,227 | | | 7,428,615 | | | 6,639,421 | | | 6,324,236 | | | 6,115,210 | | | 3,372,898 | | | 3,035,538 |

Research and development | | | 5,476,776 | | | 13,109,058 | | | 10,715,296 | | | 10,089,149 | | | 12,148,226 | | | 688,397 | | | 3,890,631 |

Total operating expenses | | | 11,215,003 | | | 20,537,673 | | | 17,354,717 | | | 16,413,385 | | | 18,263,436 | | | 4,061,295 | | | 6,926,169 |

Loss from operations | | | (11,215,003) | | | (20,537,673) | | | (17,354,717) | | | (16,413,385) | | | (18,263,436) | | | (2,911,295) | | | (6,926,169) |

Other income (expense), net | | | | | | | | | | | | | | | |||||||

Interest income | | | 313,700 | | | 254,344 | | | 207,003 | | | 118,565 | | | 103,269 | | | 40,461 | | | 178,035 |

Mediation settlement | | | — | | | — | | | — | | | 1,770,658 | | | — | | | — | | | — |

Unrealized gain (loss) on fair value of warrants | | | 2,265,869 | | | 5,546,049 | | | (7,594,162) | | | 5,529,907 | | | 3,986,727 | | | (227,094) | | | 1,940,854 |

Other, net | | | — | | | 368,750 | | | (552,627) | | | (313,090) | | | (211,116) | | | — | | | — |

Total other income (expense), net | | | 2,579,569 | | | 6,169,143 | | | (7,939,786) | | | 7,106,040 | | | 3,878,880 | | | (186,633) | | | 2,118,889 |

Net loss | | | $(8,635,434) | | | $(14,368,530) | | | $(25,294,503) | | | $(9,307,345) | | | $(14,384,556) | | | $(3,097,928) | | | $(4,807,280) |

Net Loss per share, basic and diluted(1) | | | $(2.18) | | | $(5.25) | | | $(11.10) | | | $(5.15) | | | $(9.49) | | | $(0.77) | | | $(1.23) |

Weighted average shares outstanding, basic and diluted (1) | | | 3,960,163 | | | 2,738,506 | | | 2,278,105 | | | 1,807,628 | | | 1,515,465 | | | 4,019,141 | | | 3,900,208 |

| | | As of December 31, | | | As of June 30, | ||||||||||||||||

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2020 (unaudited) | | | 2019 (unaudited) | |

Balance Sheet Data: | | | | | | | | | | | | | | | |||||||

Cash, cash equivalents and marketable securities | | | $12,216,767 | | | $14,725,821 | | | $26,831,095 | | | $20,315,580 | | | $23,439,526 | | | $9,208,951 | | | $16,260,169 |

Total assets | | | $12,968,772 | | | $16,042,926 | | | $28,287,881 | | | $21,043,532 | | | $24,805,029 | | | $10,249,074 | | | $17,677,234 |

Total liabilities | | | $3,010,818 | | | $5,480,036 | | | $11,519,285 | | | $3,985,070 | | | $6,029,481 | | | $3,245,761 | | | $4,054,128 |

Accumulated deficit | | | $(163,322,676) | | | $(154,687,242) | | | $(140,318,712) | | | $(115,024,209) | | | $(105,716,864) | | | $(166,420,604) | | | $(159,494,522) |

Total Stockholders’ Equity | | | $9,957,954 | | | $10,562,890 | | | $16,768,596 | | | $17,058,462 | | | $18,775,548 | | | $7,003,313 | | | $13,623,106 |

(1) | Basic loss per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding for the period. Diluted loss per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding, plus the number of common share equivalents that would be dilutive. On May 5, 2017, Rexahn effected a one-for-ten reverse stock split of the outstanding shares of Rexahn common stock, together with a corresponding proportional reduction in the number of authorized shares of Rexahn capital stock. Each 10 shares of Rexahn common stock, par value $0.0001 per share, issued and outstanding at the effective time of the reverse stock split were reclassified and combined into one share of common stock par value $0.0001 per share. On April 12, 2019, Rexahn effected a 1-for-12 reverse stock split of the outstanding shares of Rexahn common stock. Each 12 shares of Rexahn common stock, par value $0.0001 per share, issued and outstanding at the effective time of the reverse stock split were reclassified and combined into one share of common stock par value $0.0001 per share. All share and per share amounts have been restated for all periods to give retroactive effect to the reverse stock splits. |

| | | Year Ended December 31, | | | Six Months Ended June 30, | |||||||

Statement of Operations Data: | | | 2019 | | | 2018 | | | 2020 (unaudited) | | | 2019 (unaudited) |

Operating expenses: | | | | | | | | | ||||

General and administrative | | | $1,820,477 | | | $743,279 | | | $942,471 | | | $777,189 |

Research and development | | | 2,372,502 | | | 555,951 | | | 928,561 | | | 828,450 |

Acquired in-process research and development | | | — | | | — | | | 2,126,253 | | | — |

Total operating expenses | | | 4,192,979 | | | 1,299,230 | | | 3,997,285 | | | 1,605,639 |

Loss from operations | | | (4,192,979) | | | (1,299,230) | | | (3,997,285) | | | (1,605,639) |

Interest expense | | | (1,409,096) | | | (196,506) | | | (1,242,624) | | | (319,869) |

Fair value change of premium conversion derivatives | | | (499,414) | | | (21,238) | | | (721,444) | | | (132,083) |

Gain on note extinguishment | | | — | | | — | | | 1,260,350 | | | — |

Other income, net | | | (67,471) | | | (109,897) | | | 8,505 | | | — |

Loss before income taxes | | | (6,168,960) | | | (1,626,871) | | | (4,692,498) | | | (2,057,591) |

Benefit (provision) for income taxes | | | — | | | — | | | — | | | — |

Net loss | | | (6,168,960) | | | (1,626,871) | | | (4,692,498) | | | (2,057,591) |

Other comprehensive loss, net of tax | | | — | | | — | | | — | | | — |

Comprehensive loss | | | $(6,168,960) | | | $(1,626,871) | | | $(4,692,498) | | | $(2,057,591) |

Net loss per share: | | | | | | | | | ||||

Basic and diluted(1) | | | $(2.29) | | | $(0.68) | | | $(1.36) | | | $(0.77) |

Number of shares used in per share calculations: | | | | | | | | | ||||

Basic and diluted(1) | | | 2,692,793 | | | 2,388,941 | | | 3,451,031 | | | 2,685,467 |

(1) | See Note 9 to Ocuphire’s financial statements appearing elsewhere in this proxy statement/prospectus/information statement for further details on the calculation of net loss per share, basic and diluted, attributable to common stockholders, and the weighted-average number of shares used in computation of the per share amounts. |

| | | As of December 31, | | | As of June 30, | |||||||

| | | 2019 | | | 2018 | | | 2020 (unaudited) | | | 2019 (unaudited) | |

Balance Sheet Data: | | | | | | | | | ||||

Cash and cash equivalents | | | $1,536,917 | | | $451,342 | | | $854,331 | | | $1,191,794 |

Total assets | | | 1,784,279 | | | 533,073 | | | 3,499,908 | | | 2,996,731 |

Convertible notes (including premium conversion derivatives) | | | 8,380,498 | | | 1,643,146 | | | 10,300,593 | | | 5,848,940 |

Total liabilities | | | 9,343,803 | | | 2,231,747 | | | 12,277,261 | | | 6,596,510 |

Accumulated deficit | | | (8,054,703) | | | (1,885,743) | | | (12,747,201) | | | (3,943,334) |

Total shareholders’ deficit | | | (7,559,524) | | | (1,698,674) | | | (8,777,353) | | | (3,599,779) |

| | | For the Six Months Ended June 30, 2020 | | | For the Year Ended December 31, 2019 | |

Revenue | | | $1,150,000 | | | $— |

General and administrative expenses | | | 2,705,055 | | | 7,070,635 |

Research and development expenses | | | 1,616,958 | | | 7,849,278 |

Acquired in-process research and development expenses | | | 2,126,253 | | | — |

Loss from operations | | | (5,298,266) | | | (14,919,913) |

Net loss attributable to common stockholders | | | (5,476,394) | | | (12,407,815) |

Net loss per share, basic and diluted | | | (0.21) | | | (0.59) |

| | | As of June 30, 2020 | |

Cash and cash equivalents | | | $29,121,282 |

Working capital, net | | | 22,298,160 |

Total assets | | | 31,451,968 |

Accumulated deficit | | | (29,952,599) |

Total stockholders’ equity | | | 22,288,221 |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, 2019 | |

Historical Per Common Share Data: | | | | | ||

Basic and diluted net loss per share | | | $(0.77) | | | $(2.18) |

Book value per share | | | 1.74 | | | 2.48 |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, 2019 | |

Historical Per Common Share Data: | | | | | ||

Basic and diluted net loss per share | | | $(1.36) | | | $(2.29) |

Book value per share | | | (2.48) | | | (2.80) |

| | | Six Months Ended June 30, 2020 | | | Year Ended December 31, 2019 | |

Pro Forma Per Common Share Data: | | | | | ||

Basic and diluted net loss per share | | | $(0.21) | | | $(0.59) |

Book value per share | | | 0.85 | | | N/A |

• | general business, economic or political conditions affecting the industries in which Ocuphire or Rexahn, as applicable, operates; |

• | any natural disaster or any acts of war, armed hostilities or terrorism; |

• | changes in financial, banking or securities markets; |

• | with respect to Rexahn, any change in its stock price or trading volume excluding any underlying effect that may have caused such change, unless such effect is otherwise exempt from causing a material adverse effect under the Merger Agreement; |

• | any change in, or any compliance with or action taken for the purpose of complying with, applicable laws or U.S. GAAP, or interpretations thereof; |

• | continued losses from operations or decreases in cash balances of Rexahn; and |

• | the taking of any action, or failure to take action, by Rexahn or Ocuphire required to comply with the terms of the Merger Agreement. |

• | investors react negatively to the prospects of the combined company’s product candidates, business and financial condition following the merger; |

• | the effect of the merger on the combined company’s business and prospects is not consistent with the expectations of financial or industry analysts; or |

• | the combined company does not achieve the perceived benefits of the merger as rapidly or to the extent anticipated by financial or industry analysts. |

• | its ability to consummate the merger with Ocuphire; |

• | the level of development and commercialization efforts of BioSense and HaiChang and the receipt of milestone and other payments, if any, from such parties under their respective agreements with Rexahn; |

• | the scope, rate of progress and cost of its preclinical and clinical trials for any product candidate in its future pipeline and results of future clinical trials; |

• | the cost and timing of regulatory filings and approvals for any product candidates that successfully complete clinical trials; |

• | the timing and nature of any strategic transactions that Rexahn undertakes, including potential partnerships; |

• | the effect of competing technological and market developments; |

• | the cost incurred in responding to actions by activist stockholders; and |

• | the cost of filing, prosecuting, defending and enforcing its intellectual property rights. |

• | continued preclinical development and clinical trials for its product candidates; |

• | finding and maintaining suitable partnerships to help Rexahn research, develop and commercialize product candidates; |

• | efforts to seek regulatory approvals for its product candidates; |

• | implementing additional internal systems and infrastructure; and |

• | hiring additional personnel or entering into relationships with third parties to perform functions that Rexahn is unable to perform on its own. |

• | the attention of its remaining management and employees may be directed toward the completion of the merger and related matters and may be diverted from Rexahn’s day-to-day business operations; and |

• | third parties may seek to terminate or renegotiate their relationships with Rexahn as a result of the merger, whether pursuant to the terms of their existing agreements with Rexahn or otherwise. |

• | successfully conducting preclinical and clinical trials; |

• | obtaining regulatory approval; |

• | formulating and manufacturing products; and |

• | conducting sales and marketing activities. |

• | the cost of preclinical studies and clinical trials may be greater than Rexahn anticipates; |

• | delay or failure in reaching agreement with the FDA or a foreign regulatory authority on the design of a given trial, or in obtaining authorization to commence a trial, including due to a government shutdown, the COVID-19 pandemic, or future public health emergency; |

• | delay or failure in reaching agreement on acceptable terms with prospective contract research organizations (“CROs”) and clinical trial sites; |

• | delay or failure in obtaining approval of an institutional review board (“IRB”) to conduct a clinical trial at a given site; |

• | withdrawal of clinical trial sites from Rexahn’s clinical trials, including as a result of changing standards of care or the ineligibility of a site to participate, or due to COVID-19 pandemic; |

• | delay or failure in recruiting and enrolling study subjects, or the loss of study subjects, including due to the COVID-19 pandemic; |

• | delay or failure in having subjects complete a clinical trial or return for post-treatment follow up; |

• | clinical sites or investigators deviating from trial protocol, failing to conduct the trial in accordance with applicable regulatory requirements, or dropping out of a trial; |

• | inability to identify and maintain a sufficient number of trial sites; |

• | failure of third-party CROs to meet their contractual obligations or deadlines; |

• | the need to modify a study protocol; |

• | negative or inconclusive results during clinical trials, including the emergence of dosing issues, unforeseen safety issues or lack of effectiveness; |

• | changes in the standard of care of the indication being studied; |

• | reliance on third-party suppliers for the clinical trial supply of product candidates; |

• | inability to monitor patients adequately during or after treatment; |

• | lack of sufficient funding to finance the clinical trials; and |

• | changes in governmental regulations or administrative action. |

• | disagreement with the design or implementation of Rexahn’s clinical trials; |

• | failure to demonstrate to the authority’s satisfaction that the product candidate is safe and effective for the proposed indication; |

• | failure of clinical trial results to meet the level of statistical significance required for approval; |

• | failure to demonstrate that the product’s benefits outweigh its risks; |

• | disagreement with Rexahn’s interpretation of preclinical or clinical data; and |

• | inadequacies in the manufacturing facilities or processes of third-party manufacturers. |

• | Rexahn may suspend marketing of such product; |

• | regulatory authorities may withdraw their approvals of such product; |

• | regulatory authorities may require additional warnings on the label that could diminish the usage or otherwise limit the commercial success of such products; |

• | Rexahn may be required to develop a REMS for such product or, if a REMS is already in place, to incorporate additional requirements under the REMS, or to develop a similar strategy as required by a comparable foreign regulatory authority; |

• | Rexahn may be required to conduct post-market studies; |

• | Rexahn could be sued and held liable for harm caused to subjects or patients; and |

• | Rexahn’s reputation may suffer. |

• | awareness of a drug’s availability and benefits; |

• | perceptions by members of the health care community, including physicians, about the safety and effectiveness of Rexahn’s drugs; |

• | pharmacological benefit and cost-effectiveness of Rexahn’s products relative to competing products; |

• | availability of reimbursement for Rexahn’s products from government or other third-party payors; |

• | effectiveness of marketing and distribution efforts by Rexahn and Rexahn’s licensees and distributors, if any; and |

• | the price at which Rexahn sells its products. |

• | the federal Anti-Kickback Statute (the “Anti-Kickback Statute”) prohibits persons from, among other things, knowingly and willfully soliciting, offering, receiving or providing remuneration (interpreted to include anything of value), directly or indirectly, in cash or in kind, to induce or reward, or in return for, the referral of an individual for the furnishing or arranging for the furnishing, or the purchase, lease or order, or arranging for or recommending purchase, lease or order, any good or service for which payment may be made, in whole or in part, under a federal healthcare program such as Medicare and Medicaid; |

• | the federal civil False Claims Act (the “FCA”) imposes penalties, including through civil whistleblower or qui tam actions, against individuals or entities for, among other things, knowingly presenting, or causing to be presented, claims for payment of government funds that are false or fraudulent or making a false record or statement material to an obligation to pay money to the government or knowingly concealing or knowingly and improperly avoiding, decreasing, or concealing an obligation to pay money to the federal government; |

• | HIPAA imposes criminal liability for knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private third party payers, knowingly and willfully embezzling or stealing from a health care benefit program, willfully obstructing a criminal investigation of a health care offense, or knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statements or representations or making or using any false writing or document knowing the same to contain any materially false, fictitious or fraudulent statement or entry, in connection with the delivery of, or payment for, healthcare benefits, items or services. Similar to the Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation; |

• | HIPAA and its implementing regulations also impose obligations on certain covered entity health care providers, health plans and health care clearinghouses as well as their business associates that perform certain services involving the use or disclosure of individually identifiable health information, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information; |

• | the federal Physician Payment Sunshine Act (the “Physician Payment Sunshine Act”), being implemented as the Open Payments Program, which requires manufacturers of drugs, devices, biologics, and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to CMS information related to direct or indirect payments and other transfers of value to physicians and teaching hospitals (and certain other practitioners beginning in 2022), as well as ownership and investment interests held in the company by physicians and their immediate family members; and |

• | analogous state and foreign laws and regulations, such as state anti-kickback and false claims laws, which may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third-party payors, including private insurers; state and foreign laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to certain healthcare providers; state and foreign laws that require drug manufacturers to report information related to clinical trials, or information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures; and state and foreign laws that govern the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and often are not preempted by HIPAA, thus complicating compliance efforts. |

• | developing drugs; |

• | undertaking preclinical testing and human clinical trials; |

• | obtaining FDA and other regulatory approvals of drugs; |

• | formulating and manufacturing drugs; and |

• | launching, marketing and selling drugs. |

• | Rexahn may be unable to contract with third-party manufacturers on acceptable terms, or at all, because the number of potential manufacturers is limited. Potential manufacturers of any product candidate that is approved will be subject to FDA compliance inspections and any new manufacturer would have to be qualified to produce Rexahn’s products; |

• | Rexahn’s third-party manufacturers might be unable to formulate and manufacture Rexahn’s drugs in the volume and of the quality required to meet Rexahn’s clinical and commercial needs, if any; |

• | Rexahn’s third-party manufacturers may not perform as agreed or may not remain in the contract manufacturing business for the time required to supply Rexahn’s clinical trials through completion or to successfully produce, store and distribute Rexahn’s commercial products, if approved; |

• | Drug manufacturers are subject to ongoing periodic unannounced inspection by the FDA and other government agencies to ensure compliance with current good manufacturing practices (“cGMP”) and other government regulations and corresponding foreign standards. Rexahn does not have direct control over third-party manufacturers’ compliance with these regulations and standards, but Rexahn may ultimately be responsible for any of their failures; |

• | If any third-party manufacturer makes improvements in the manufacturing process for Rexahn’s products, Rexahn may not own, or may have to share, the intellectual property rights to such improvements; and |

• | A third-party manufacturer may gain knowledge from working with Rexahn that could be used to supply one of Rexahn’s competitors with a product that competes with Rexahn’s. |

• | the degree and range of protection any patents will afford Rexahn against competitors, including whether third parties find ways to invalidate or otherwise circumvent Rexahn’s licensed patents; |

• | if and when patents will issue in the United States or any other country; |

• | whether or not others will obtain patents claiming aspects similar to those covered by Rexahn’s licensed patents and patent applications; |

• | whether Rexahn will need to initiate litigation or administrative proceedings to protect Rexahn’s intellectual property rights, which may be costly whether Rexahn wins or loses; |

• | whether any of Rexahn’s patents will be challenged by Rexahn’s competitors alleging invalidity or unenforceability and, if opposed or litigated, the outcome of any administrative or court action as to patent validity, enforceability or scope; |

• | whether a competitor will develop a similar compound that is outside the scope of protection afforded by a patent or whether the patent scope is inherent in the claims modified due to interpretation of claim scope by a court; |

• | whether there were activities previously undertaken by a licensor that could limit the scope, validity or enforceability of licensed patents and intellectual property; or |

• | whether a competitor will assert infringement of its patents or intellectual property, whether or not meritorious, and what the outcome of any related litigation or challenge may be. |

• | obtain licenses, which may not be available on commercially reasonable terms, if at all; |

• | redesign its products or processes to avoid infringement; |

• | stop using the subject matter claimed in patents held by others, which could cause Rexahn to lose the use of one or more of Rexahn’s product candidates; |

• | pay damages; or |

• | defend litigation or administrative proceedings that may be costly whether Rexahn wins or loses and that could result in a substantial diversion of Rexahn’s management resources. |

• | Rexahn’s ability to consummate the transactions contemplated by the Merger Agreement, including the merger; |

• | the announcement of new products or product enhancements by Rexahn or its competitors; |

• | changes in Rexahn’s relationships with its licensors or other strategic partners; |

• | developments concerning intellectual property rights and regulatory approvals; |

• | variations in Rexahn’s and Rexahn’s competitors’ results of operations; |

• | changes in earnings estimates or recommendations by securities analysts; |

• | changes in the structure of healthcare payment systems; and |

• | developments and market conditions in the pharmaceutical and biotechnology industries, including due to the COVID-19 pandemic. |

• | the data collected from preclinical studies and clinical trials of Ocuphire’s product candidates may not be sufficient to support the submission of an NDA; |

• | Ocuphire may not be able to demonstrate to the satisfaction of the FDA that its product candidates are safe and effective for any indication; |

• | the results of clinical trials may not meet the level of statistical significance or clinical significance required by the FDA for approval; |

• | the FDA may disagree with the number, design, size, conduct, or implementation of Ocuphire’s clinical trials; |

• | the FDA may not find the data from preclinical studies and clinical trials sufficient to demonstrate that Ocuphire’s product candidates’ clinical and other benefits outweigh the safety risks; |

• | the FDA may disagree with Ocuphire’s interpretation of data from preclinical studies or clinical trials; |

• | the FDA may not accept data generated at Ocuphire’s clinical trial sites; |

• | the FDA may have difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee may recommend against approval of Ocuphire’s application or may recommend that the FDA require, as a condition of approval, additional preclinical studies or clinical trials, limitations on approved labeling or distribution and use restrictions; |

• | the FDA may require development of a Risk Evaluation and Mitigation Strategy (REMS) as a condition of approval; |

• | the FDA may identify deficiencies in the manufacturing processes or facilities of third party manufacturers with which Ocuphire enters into agreements for clinical and commercial supplies; or |

• | the FDA may change its approval policies or adopt new regulations. |

• | regulators or IRBs may not authorize Ocuphire or its investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | government or regulatory delays and changes in regulatory requirements, policy and guidelines may require Ocuphire to perform additional clinical trials or use substantial additional resources to obtain regulatory approval, including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | Ocuphire may have delays in reaching or fail to reach agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites, including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | clinical trials may produce negative or inconclusive results, and Ocuphire may decide, or regulators may require it, to conduct additional clinical trials or abandon product development programs, including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | the number of patients required for clinical trials may be larger, enrollment in these clinical trials may be slower or participants may drop out of these clinical trials at a higher rate than Ocuphire anticipates, including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | Ocuphire’s third-party contractors may fail to comply with regulatory requirements or meet their contractual obligations to Ocuphire in a timely manner, or at all; |

• | Ocuphire’s patients or medical investigators may be unwilling to follow its clinical trial protocols; |

• | Ocuphire might have to suspend or terminate clinical trials for various reasons, including a finding that the participants are being exposed to unacceptable health risks; |

• | the cost of clinical trials may be greater than Ocuphire anticipates, including due to the ongoing COVID-19 pandemic or other public health emergency; |

• | the supply or quality of any product candidate or other materials necessary to conduct clinical trials may be insufficient or inadequate; |

• | the product candidate may have undesirable side effects or other unexpected characteristics, causing Ocuphire or its investigators, regulators or IRBs to suspend or terminate the trials; |

• | clinical trials may be delayed or terminated because of the ongoing COVID-19 pandemic or another public health emergency; and |

• | federal agencies may, due to reduced manpower or diverted resources to the COVID-19 pandemic, require more time to review clinical trial protocols and INDs. |

• | severity of the disease under investigation; |

• | availability and efficacy of medications already approved for the disease under investigation; |

• | eligibility criteria for the trial in question; |

• | competition for eligible patients with other companies conducting clinical trials for product candidates seeking to treat the same indication or patient population; |

• | its payments for conducting clinical trials; |

• | perceived risks and benefits of the product candidate under study; |

• | efforts to facilitate timely enrollment in clinical trials; |

• | patient referral practices of physicians; |

• | the ability to monitor patients adequately during and after treatment; |

• | proximity and availability of clinical trial sites for prospective patients; |

• | the ability of patients to safely participate in clinical trials during the COVID-19 pandemic or other public health emergencies; and |

• | the ability to monitor patients adequately during periods in which social distancing is required or recommended due to the COVID-19 pandemic. |

• | regulatory authorities may withdraw their approval of the product; |

• | Ocuphire may be required to recall the product, change the way this product is administered, conduct additional clinical trials, or change the labeling or distribution of the product (including REMS); |

• | additional restrictions may be imposed on the marketing of, or the manufacturing processes for, the product; |

• | Ocuphire may be subject to fines, injunctions, or the imposition of civil or criminal penalties; |

• | Ocuphire could be sued and held liable for harm caused to patients; |

• | the product may be rendered less competitive and sales may decrease; or |

• | Ocuphire’s reputation may suffer generally both among clinicians and patients. |

• | obtain favorable results from and complete the clinical development of both Nyxol and APX3330 for their planned indications, including successful completion of the Phase 2 and Phase 3 trials for these indications; |

• | submit an application to regulatory authorities for both product candidates and receive marketing approval in the United States and foreign countries; |

• | contract for the manufacture of commercial quantities of its product candidates at acceptable cost levels; |

• | establish sales and marketing capabilities to effectively market and sell its product candidates in the United States or other markets, alone or with a pharmaceutical partner; and |

• | achieve market acceptance of its product candidates in the medical community and with third-party payors. |

• | the scope, size, rate of progress, results, and costs of researching and developing its product candidates, and initiating and completing its preclinical studies and clinical trials; |

• | the cost, timing and outcome of its efforts to obtain marketing approval for its product candidates in the United States and other countries, including to fund the preparation and filing of an NDA with the FDA for its product candidates and to satisfy related FDA requirements and regulatory requirements in other countries; |

• | the number and characteristics of any additional product candidates it develops or acquires, if any; |

• | Ocuphire’s ability to establish and maintain collaborations on favorable terms, if at all; |